Wednesday Jan 8 2025 06:36

5 min

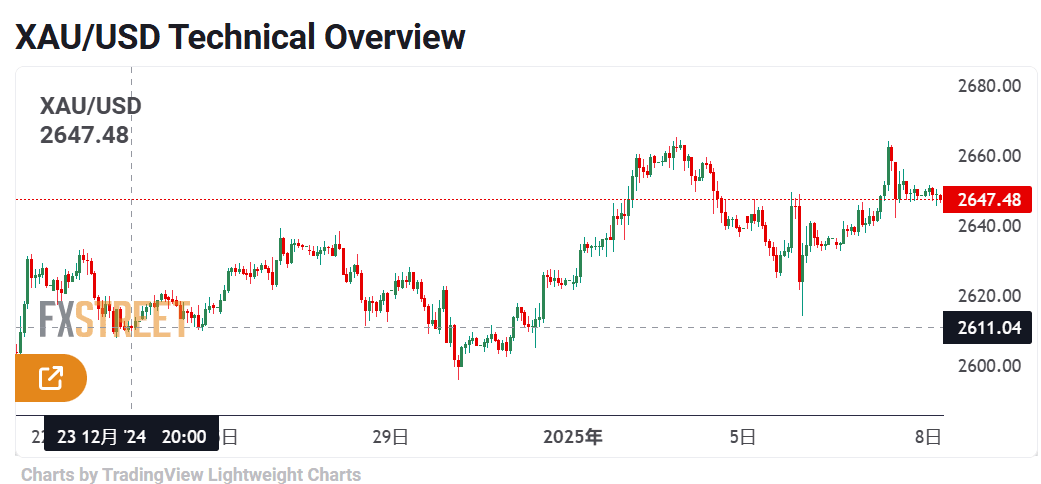

Gold price today, since the beginning of the new year, gold and silver prices have continuously risen, gold price today, currently, the US dollar spot price for 1 ounce of gold is $2,648.09 and in Canadian dollars C$3,799.66.

The U.S. job market shows continued resilience, with a high number of available positions. This robust labor environment is creating challenges for gold prices, according to analysts.

In November, job openings rose to 8.10 million, as reported by the Labor Department's monthly Job Openings and Labor Turnover Survey (JOLTS). This increase from 7.74 million openings in October surpassed expectations, as economists had predicted a stable figure of approximately 7.73 million.

Despite this positive labor market data, the gold market is struggling to hold onto its earlier gains. Spot gold was last priced at $2,648.60 per ounce, reflecting a 0.48% increase for the day. However, gold prices had surged nearly 1% before the report was released.

Analysts believe that a strong labor market could lead the Federal Reserve to shorten its monetary easing cycle this year. Last month, the central bank indicated it anticipates cutting interest rates only twice in 2025, down from an earlier projection of four cuts. This shift in expectations may contribute to the downward pressure on gold prices.

Gold and silver prices are up in midday U.S. trading on Tuesday, although they have retreated from earlier highs. The rise in metal prices was partly fueled by reports of renewed gold purchases by China’s central bank. However, a stronger U.S. dollar index today contributed to the decline from peak prices, while increasing U.S. Treasury yields also dampened buyer interest in these precious metals. As of now, February gold is up $18.60 at $2,665.90, and March silver has increased by $0.092 to $30.675.

Recent reports indicate that China’s central bank added 300,000 ounces to its gold reserves in December, bringing the total to 73.3 million ounces. This marks a renewed interest in gold following a six-month hiatus in purchases last year.

Bloomberg highlights a warning sign from fixed-income markets for equity investors, suggesting that stocks are nearing their most overvalued state against corporate credit and Treasuries in nearly two decades. This assessment is based on the earnings yield, which compares a company's profit generation relative to its stock price against bond yields.

Looking ahead, the critical economic data point this week is the employment situation report for December, scheduled for release on Friday. Analysts expect to see a non-payroll increase of 160,000, down from November's gain of 227,000.

In other key markets, the U.S. dollar index is higher, while Nymex crude oil futures are trading around $74.00 per barrel. The yield on the benchmark 10-year U.S. Treasury note is also climbing, currently at approximately 4.7%, marking the highest level since 2023.

source: fxstreet

Gold price stabilizes near $2,650 after the pullback from the $2,665 barrier as concerns about Trump's tariff plans and geopolitical risks support the safe-haven bullion. That said, diminishing odds for further Fed rate cuts and elevated US Treasury bond yields-led US Dollar strength weigh on Gold price ahead of Fed Minutes.

The daily chart for the XAU/USD pair shows its neutral-to-bullish. Technical indicators stand directionless at around their midlines, while the bright metal seesaws around a flat 20 Simple Moving Average (SMA). Meanwhile, the 100 SMA keeps heading north, providing dynamic support at around $2,626.30, while the 200 SMA also retains its upward slope, albeit roughly $200 below the current level.

In the near term, and according to the 4-hour chart, Gold’s rally seems to be losing steam. XAU/USD still holds above all its moving averages, with the 20 SMA aiming to cross above the 200 SMA after already surpassing the 100 SMA. Technical indicators, on the other hand, turned modestly lower, although the Relative Strength Index (RSI) indicator holds at around 58, limiting the bearish potential of the pair.

Support levels: 2,626.30 2,614.45 2,596.00

Resistance levels: 2,649.50 2,665.10 2,678.85

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.