CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Friday Mar 7 2025 09:08

4 min

The U.S. non-farm payrolls for January recorded an increase of 143,000 jobs, while the forecast for February stands at 150,000. This data is set to be released at 13:30 GMT. This expected uptick is likely driven by continued labour market resilience, seasonal hiring patterns, and potential revisions to prior data. Moreover, while inflation and interest rates still pose a threat, steady economic activity, coupled with ongoing business expansion, may contribute to moderate employment growth.

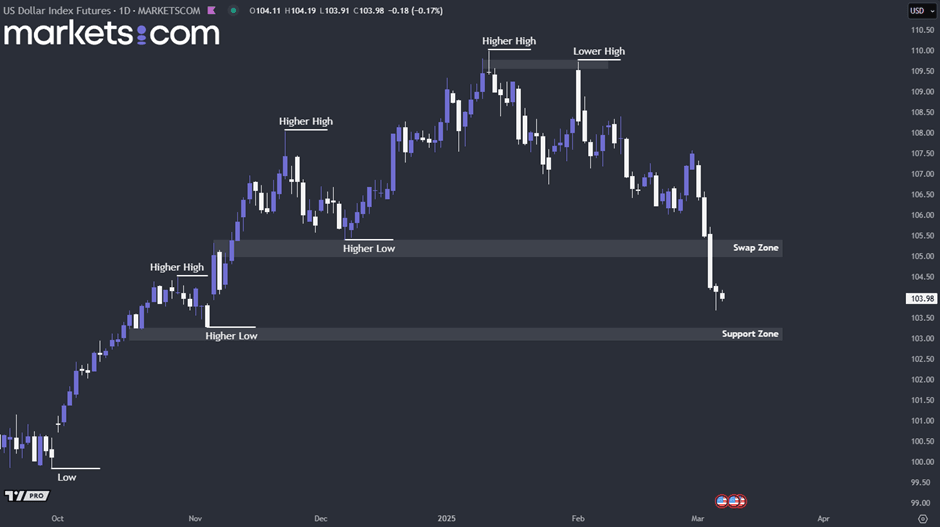

(U.S Dollar Index Daily Chart, Source: Trading View)

From a technical analysis perspective, the overall trend of the U.S. Dollar Index has been bullish since the end of September 2024, as indicated by the formation of higher highs and higher lows. However, the index began to decline in early February 2025, marked by a significant double-top candlestick pattern.

Recently, the consecutive bearish candlesticks with strong bearish momentum have pushed the price downward, signalling a valid trend reversal from bullish to bearish. Therefore, it is highly likely that the index will continue declining without a significant pullback, retesting the support zone at 103.00 – 103.30.

U.S. President Donald Trump issued an executive order on Thursday that startled the world by declaring a reserve for Bitcoin that will be funded with seized Bitcoin. This shift came just a day before Trump met with cryptocurrency executives at the White House. Furthermore, those in attendance at the crypto summit expect that this event will act as a springboard that allows Trump to announce his plans for a strategic reserve consisting of Bitcoin and four other cryptocurrencies.

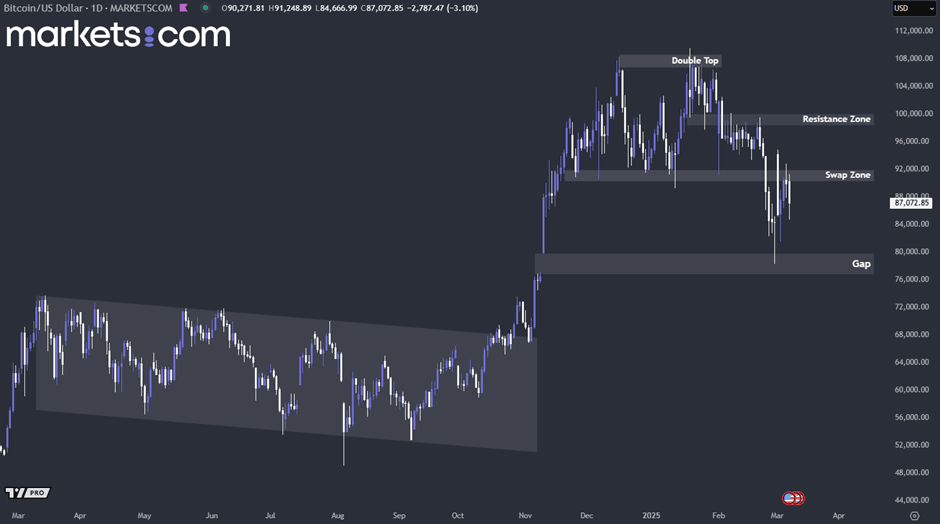

(Bitcoin Daily Price Chart, Source: Trading View)

From a technical analysis perspective, Bitcoin has been in a bullish trend since breaking above the descending channel at the beginning of November 2024. However, it faced rejection from bearish pressure accompanied by a double-top candlestick pattern at the beginning of February 2025.

Recently, the price retested the swap zone at the 90,200 – 91,800 level but was rejected. If the price fails to close within or above this swap zone in the near term, the overall structure could shift to bearish, pushing the price further downward to retest the gap area of 76,700 – 80,000 once again.

Canada's unemployment rate stood at 6.6% in January, with February's figure expected to remain unchanged at the same level. This data is set to be released at 13:30 GMT. This stability suggests a balanced labour market, where job creation is offset by labour force growth. Factors such as steady economic conditions, cautious hiring amid economic uncertainties, and the impact of monetary

policy may be contributing to the unchanged rate. Additionally, businesses might be maintaining current employment levels while assessing future economic trends.

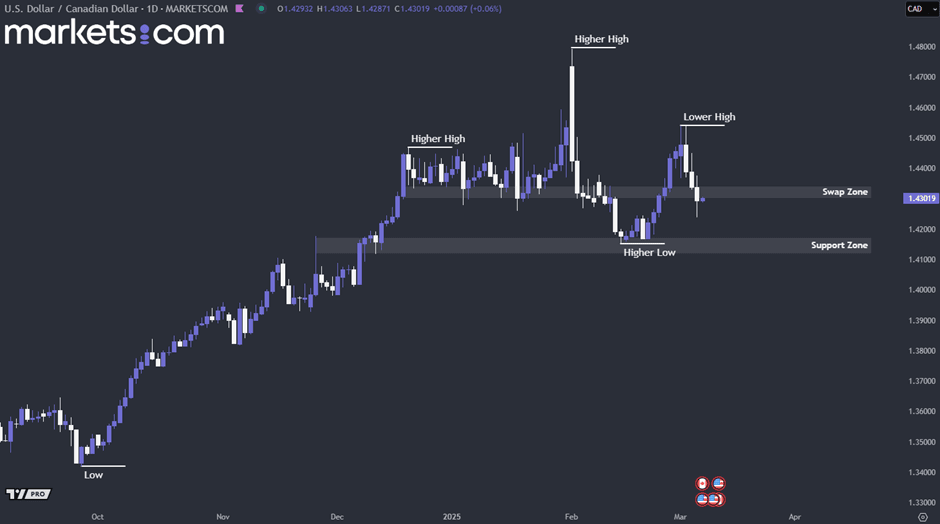

(USD/CAD Daily Price Chart, Source: Trading View)

From a technical analysis perspective, the overall trend of the USD/CAD currency pair has been bullish since the beginning of October 2024, as indicated by the formation of higher highs and higher lows. However, strong bearish momentum pushed the price downward at the start of February 2025, and the candlestick pattern has begun to shift to a bearish structure, as evidenced by the lower high pattern formed in March 2025.

Recently, the price action broke below the swap zone of 1.4300 – 1.4340 and is currently retesting it. If it fails to close within or above the swap zone in the near term, the bearish momentum could drive the price further downward to retest the support zone between 1.4120 and 1.4170.

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.