Rabu Apr 23 2025 07:38

5 min.

On Tuesday, President Donald Trump retracted his earlier threats to dismiss Federal Reserve Chair Jerome Powell, following several days of escalating criticism over the Fed's reluctance to cut interest rates. "I have no intention of firing him," Trump told reporters in the Oval Office. However, he reiterated his desire for Powell to adopt a more proactive stance on monetary easing, stating, "I would like to see him be a little more active in terms of his idea to lower interest rates."

Despite softening his stance on Powell’s job security, Trump continued to sharply criticise the Fed’s current rate policy. He emphasised the administration’s view that now is an ideal time for a rate cut, saying, "We think that it's a perfect time to lower the rate, and we'd like to see our chairman be early or on time, as opposed to late." The president’s earlier threats had unsettled financial markets, which considered the Fed’s independence essential to maintaining its credibility and sustaining global financial stability.

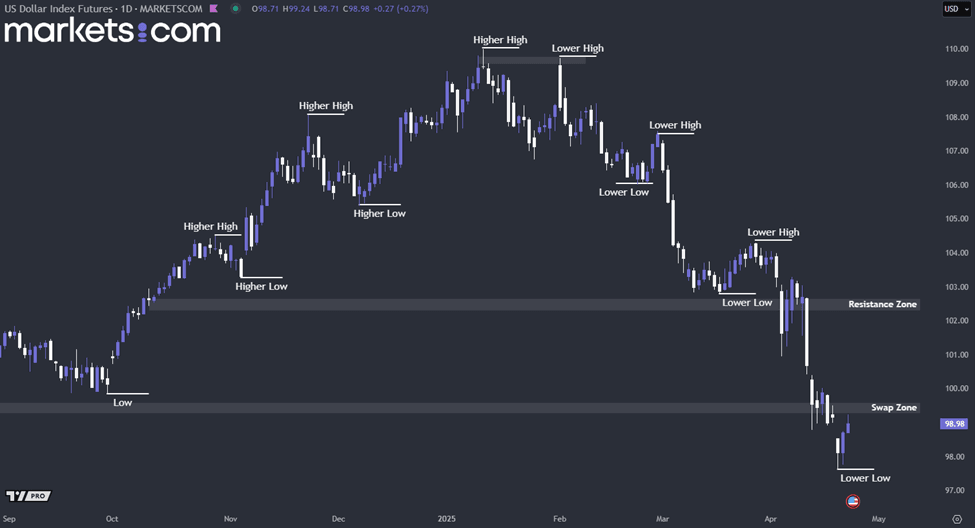

(U.S. Dollar Index Daily Chart, Source: Trading View)

From a technical analysis perspective, the U.S. dollar index has been moving in a bearish trend since the beginning of February 2025, as indicated by the lower highs and lower lows. Currently, it is approaching the swap zone of 99.30 – 99.60. If it can break above the swap zone, it might surge upwards to retest the resistance zone of 102.30 – 102.60. Conversely, if the bearish force rejected it from breaking above the swap zone, it might continue to drop lower.

Tesla (TSLA) reported its first-quarter earnings on Tuesday, after the market closed, revealing a sharp decline in profit and revenue. Adjusted earnings dropped to $0.27 per share from $0.45 a year earlier, missing the consensus estimate of $0.41. Revenue also fell 9% year-over-year to $19.34 billion, well below Wall Street’s expectation of $21.27 billion. The earnings shortfall underscores growing concerns around Tesla’s performance, as the company struggles with declining demand for its ageing lineup of electric vehicles.

In response to increasing investor pressure, Tesla CEO Elon Musk announced he will scale back his role as a special adviser to President Donald Trump to just one or two days per week starting next month. His 130-day term as a special government employee is expected to expire in late May. Musk’s political involvement and aggressive cost-cutting measures have triggered public criticism and contributed to Tesla’s stock plunging nearly 50% from its December high. Amid the turmoil, many shareholders have called for Musk to reduce his outside commitments and focus more intently on stabilising Tesla’s core business.

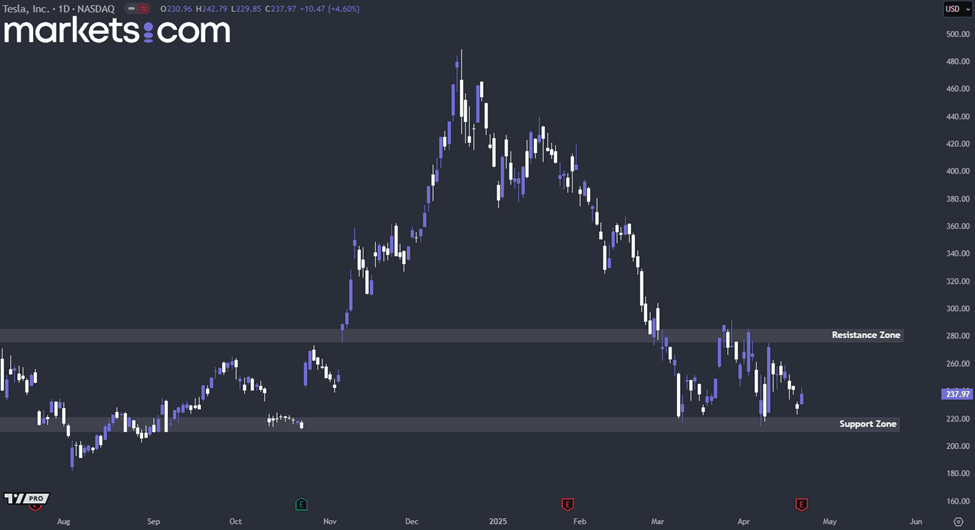

(Tesla Share Price Daily Chart, Source: Trading View)

From a technical analysis perspective, Tesla's share price has been in a bearish trend since mid-December 2024, as indicated by a series of lower highs and lower lows. Since mid-March 2025, the price has entered a consolidation phase, moving within an oscillation channel between the support zone of 210 – 220 and the resistance zone of 275 – 285. A decisive breakout in either direction could potentially lead the stock’s next major trend in that direction.

The United States is reportedly seeking a reduction in Britain's automotive tariffs from 10% to 2.5%, according to The Wall Street Journal, which cited sources familiar with a draft proposal circulated by the Trump administration. British Finance Minister Rachel Reeves is expected to meet U.S. Treasury Secretary Scott Bessent this week to advocate for a bilateral trade agreement that could ease or eliminate tariffs imposed under former President Donald Trump. Those tariffs include a 10% levy on most UK imports and a 25% duty on key sectors such as automobiles and steel.

However, whether Washington will agree to lower the 10% tariff without significant concessions from London remains uncertain. The U.S. is currently formulating its trade negotiation strategy, reportedly aiming for the UK to reduce tariff and non-tariff barriers on a wide range of goods. The Trump administration is also expected to push for more lenient rules on U.S. agricultural exports, particularly beef, as part of any potential trade deal.

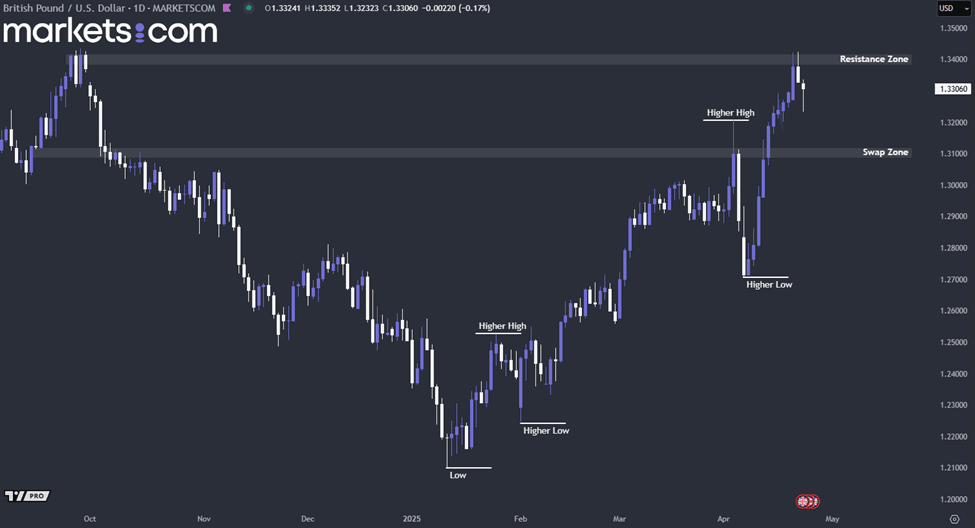

(GBP/USD Daily Chart, Source: Trading View)

From a technical analysis perspective, the GBP/USD currency pair has been in a bullish trend since mid-January 2025, as indicated by a pattern of higher highs and higher lows. Recently, it was rejected from the resistance zone between 1.3380 and 1.3420, causing the pair to move lower. Currently, it might be heading toward a retest of the swap zone of 1.3090 – 1.2130 as part of a bullish correction before determining its next move. Alternatively, if strong bullish momentum drives a breakout above the resistance zone without a retest, the pair could surge even higher, further confirming the strength of the bullish trend.

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.