Wednesday May 10 2023 09:20

5 min

Lacklustre start to trading in Europe ahead of key inflation data from the US, follows a nervy session on Wall Street that left the S&P 500 down by half a percent amid ongoing concerns about the debt ceiling. The FTSE 100 slipped a quarter of one percent to test the 7,740 area, with only real gains for Melrose, which said it will continue as a pureplay aerospace company and Compass, which raised FY guidance; whilst the DAX was down almost half a percent. Oil was softer after US stockpiles rose, gold steady with benchmark US 10yr yields a little above 3.5%. In FX markets the dollar was firmer for a second day after DXY futs made a big rejection of the 101.30 area yesterday. Cable was holding gains above 1.26 ahead of tomorrow’s expected rate hike by the Bank of England.

US inflation data is the main game in town – expected at +5.0% year-on-year, +0.4% monthly; core +0.3% monthly. The trading this week so far has been clear enough – people are waiting on the CPI data for a signal as to what the Fed does in June. Markets have bet hard on a pause; Powell left the door open to another hike and since the hot payrolls figure Fed funds futures indicate a 20% of another 25bps increase next month. Markets are slowly waking up to the fact that the data is not cool enough and the Fed has made it clear it’s open to do more. The Fed’s Williams said "we haven't said we are done raising rates".

With the Fed in data dependent more the core monthly inflation level here is key. CPI for March fell to 5% year-on-year, down from 6% in February. However, core hit 5.6%, up 0.4% on the month, suggesting that sticky inflation will continue to dog the Fed. This inflation release is really big – it will be key to the determining the pivot timing. GS reckons +0.47% on the core month-over-month.

JPM says 50% chance of 5.0%-5.2% for the headline reading, which it reckons would see the S&P 500 rally between a half and three-quarters of a percent. But the spread here is huge – almost 30% chance of a higher reading that would see a move of +1% to the downside, and a 20% chance of slower inflation seeing at least +1% to the upside. Trade this at your peril.

Talks going nowhere so far...default looms by June...it won’t actually default, will it? It’s the extreme tail risk but until it’s fixed it will be a weight for risk appetite in general...confidence being eaten away – small business optimism down to a 10-year low. That is about inflation as much as anything else...but for now the consumer is holding up well. It’s also about the elephant in the room – you need to cut spending and entitlements a lot to get the ship righted. “All this focus on the debt ceiling instead of the future fiscal issue is like sitting on the beach at Santa Monica worrying about whether a 30-foot wave will damage the pier when you know there’s a 200-foot tsunami 10 miles out.” - Stanley Druckenmiller. You either cut now or later…but whether it’s the govt or a central bank it’s always easier to kick the can down the road so we know what will happen.

JPM also cuts European stocks to underweight. “We believe that the time has come to close the trade of overweight Eurozone vs the US,” the bank said Tuesday. European equities on a broad level have rallied twice as much as the S&P 500 since September.

Airbnb – good but not good enough it seems; shares -10% after-hours on weak second quarter guidance despite profitable quarter. Earnings easily beat expectations but the company sounded a little cautious on the outlook for this summer. Probably an overreaction – the guidance was broadly in line with analyst expectations, ($2.35bn-$2.45bn vs fc consensus $2.42bn).

Twilio – garbage tech…$260m marketing spend – a quarter of revenues – for -2% sequential growth. Shares -14% after-hours…targets GAAP profitability by…2027! LOL.

Oil – spot WTI retreated from a one-week high at $73.70 to test the $73.0 support this morning, having yesterday suffered a sharp correction lower to $71.30 on bearish stockpiles data. API said crude inventories rose by 3.6mn barrels last week.

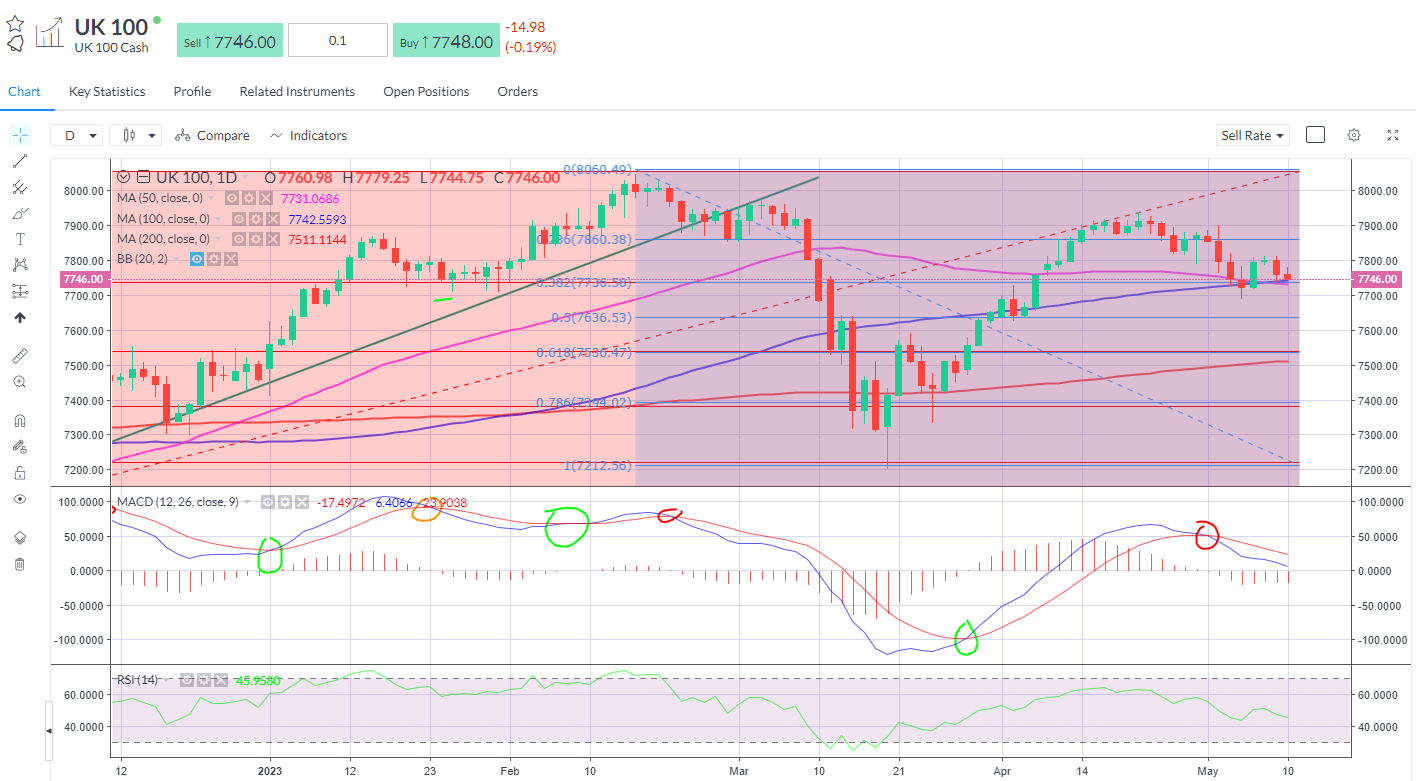

FTSE – testing some support levels around SMAs and Fib levels