Tuesday Feb 20 2024 12:47

5 min

The PBOC’s 25-basis point cut to the five-year loan prime rate was the biggest since the benchmark was introduced in 2019 and it shows Beijing is concerned. Equities in mainland China and Hong Kong fell at first before rallying towards the end of the Asian session.

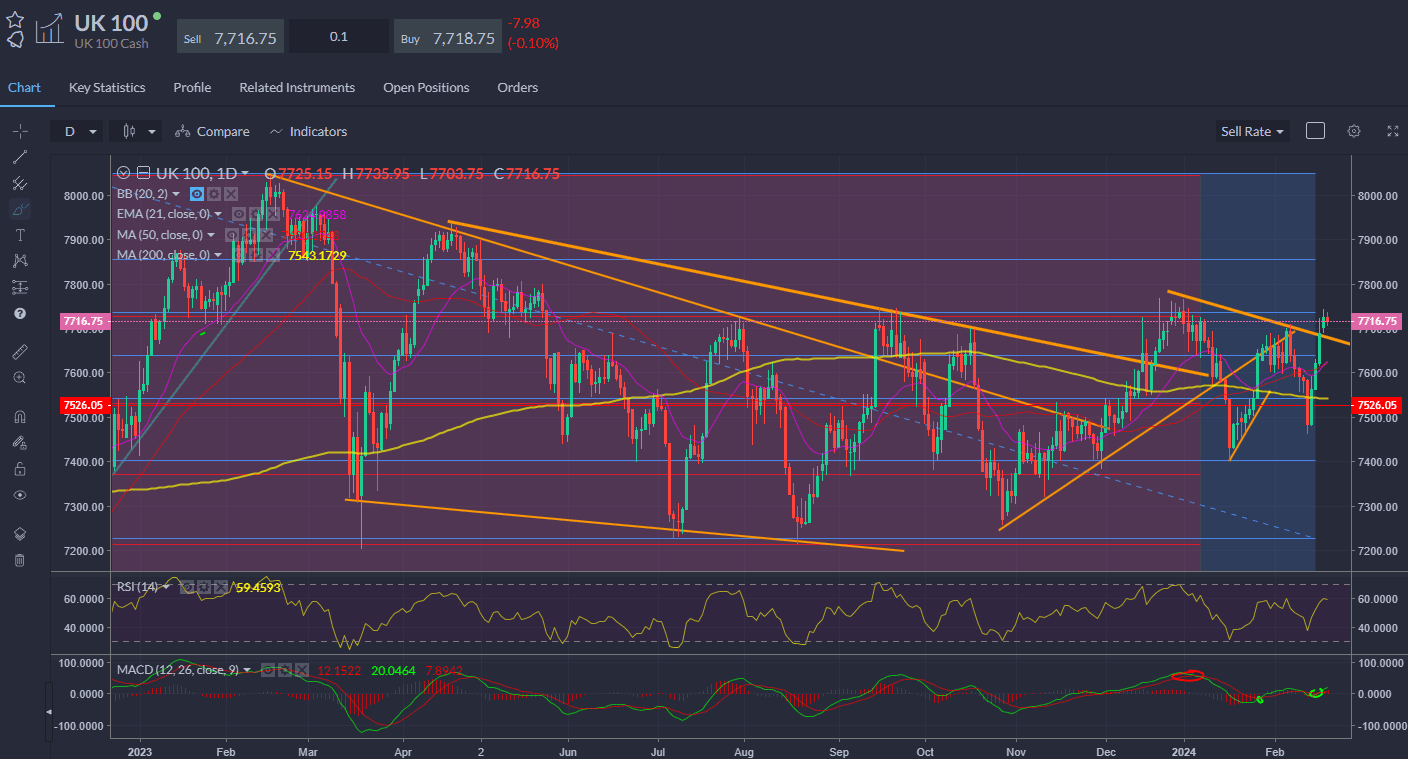

Stocks advanced a bit on Monday in London but retreated a bit on Tuesday as metal prices declined following the reopening of markets in China. Iron ore futures skidded lower amid demand worries as China delivered the largest-ever cut to its benchmark mortgage rate.

European stock markets were mainly a tad lower in early trade on Tuesday but lacking meaningful direction, though both Paris and Frankfurt are trading close to all-time highs struck earlier in the month. The FTSE 100 index held onto the 7,700 handle.

The US reopens after a holiday with the S&P 500 a little below the 5k mark. Here’s the latest from J.P. Morgan:

"Our central case remains that equity upside is limited from here, constrained by the fact that investors’ equity allocation globally is approaching the post-Lehman high seen in early 2015.”

Retailers Walmart and Home Depot provide some steer for the broader market in terms of the US consumer. Data is otherwise quite light again.

Сalculate your hypothetical P/L (aggregated cost and charges) if you had opened a trade today.

Market

Instrument

Account Type

Direction

Quantity

Amount must be equal or higher than

Amount should be less than

Amount should be a multiple of the minimum lots increment

USD

EUR

GBP

CAD

AUD

CHF

ZAR

MXN

JPY

Value

Commission

Spread

Leverage

Conversion Fee

Required Margin

Overnight Swaps

Past performance is not a reliable indicator of future results.

All positions on instruments denominated in a currency that is different from your account currency, will be subject to a conversion fee at the position exit as well.

Barclays shares rallied 6% on a positive market reaction to its strategy overhaul. Profits were down 6% in line with forecasts. It took almost a £1bn restructuring hit and bad loans rose to £1.9bn from £1.2bn.

But investors cheered plans to return £10bn to shareholders over the next three years via buybacks and dividends. When you trade at such a discount to book value, this makes sense. The plan places a lot of emphasis on cost-cutting with management aiming to reduce expenses to 63% from 67% on a cost-to-income basis.

It wants to drive this down to the high 50s by 2026, when it expects its return on tangible equity to have risen to more than 12% from 10% today. It seems to be that people think this is a good plan, but the question is one of execution, given the reliance on growth.

Barclays shares traded 5.8% up on the LSE at 157.62p at the time of writing on Tuesday morning. The bank’s stock is up 2.5% so far this year — although the past 12 months have seen it fall by 8.05%.

With the move clear on the FTSE 100 bulls look to take out the Dec peak at 7,768, which was the highest since May 2023. This area may offer yet more resistance, however.

Sterling continues to trade the range and cable (the GBP to USD rate) retreated wards the 200-day SMA after turning back at the 21-day EMA as traders dial back expectations for a May rate cut by the Bank of England (BoE) to around 18%... now looks like June at the soonest. BoE governor Andrew Bailey is due to speak to MPs today.

When considering shares, indices, bonds, foreign exchange (forex), and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.

Asset List

View Full ListLatest

View all

Tuesday, 15 April 2025

6 min

Tuesday, 15 April 2025

6 min

Monday, 14 April 2025

5 min