Tuesday Mar 7 2023 09:09

4 min

Stocks across Europe were a touch softer after a sluggish start to trading on Tuesday, taking the cue from a pretty nothingburger of a session on Wall Street, but started to show some more positive momentum in the second half hour of the session with the major indices flipping into green – but not a huge conviction trade here. The Dow and S&P 500 rose by whiskers on Monday, closing near the lows of the day, whilst the Nasdaq fell 0.11% having been up 1.2% at one stage. Oil pushed up to its highest in weeks – seemingly unperturbed by the China growth target story as market participants focused on declining spare capacity in the market. Attention will be on Fed chair Jay Powell’s testimony in Congress, which begins today. Until then I think we’re feeding on scraps.

Australia’s dollar slipped to its weakest against its US counterpart since at least early January after the country’s central bank signalled it’s almost done with rate hikes. The Reserve Bank of Australia hiked for a 10th straight time, raising the cash rate by 25bps to 3.6%, the highest it’s been since 2012. But it was dovish on the outlook. After governor Lowe said in February that the RBA “expects that further increases in interest rates will be needed over the months ahead to ensure that inflation returns to target”, there was a less hawkish tone to the comments after today’s hike. Crucially the RBA dropped the reference to multiple rises, saying: “The Board expects that further tightening of monetary policy will be needed to ensure that inflation returns to target and that this period of high inflation is only temporary.”

China trade data showed exports and imports continued to decline in the first two months of this year - exports fell 6.8% in Jan and Feb yoy vs f/c -9%, imports contracted 10.2% vs f/c -7.5%. Meanwhile, Beijing said it will increase military spending by 7.2% this year, China's new foreign minister has some strong words for the White House. Qin Gang said "If the U.S. does not hit the brake but continue to speed down the wrong path, no amount of guardrails can prevent derailing and there will surely be conflict and confrontation.”

Tesla shares down 2% yesterday after the automaker cut prices for the second time this year... Teslemmings still saying that price cuts are sign of strength, but I don’t buy it...how do bulls like Dan Ives or Gary Black justify improving margins when the company is cutting selling prices and inventory is up?

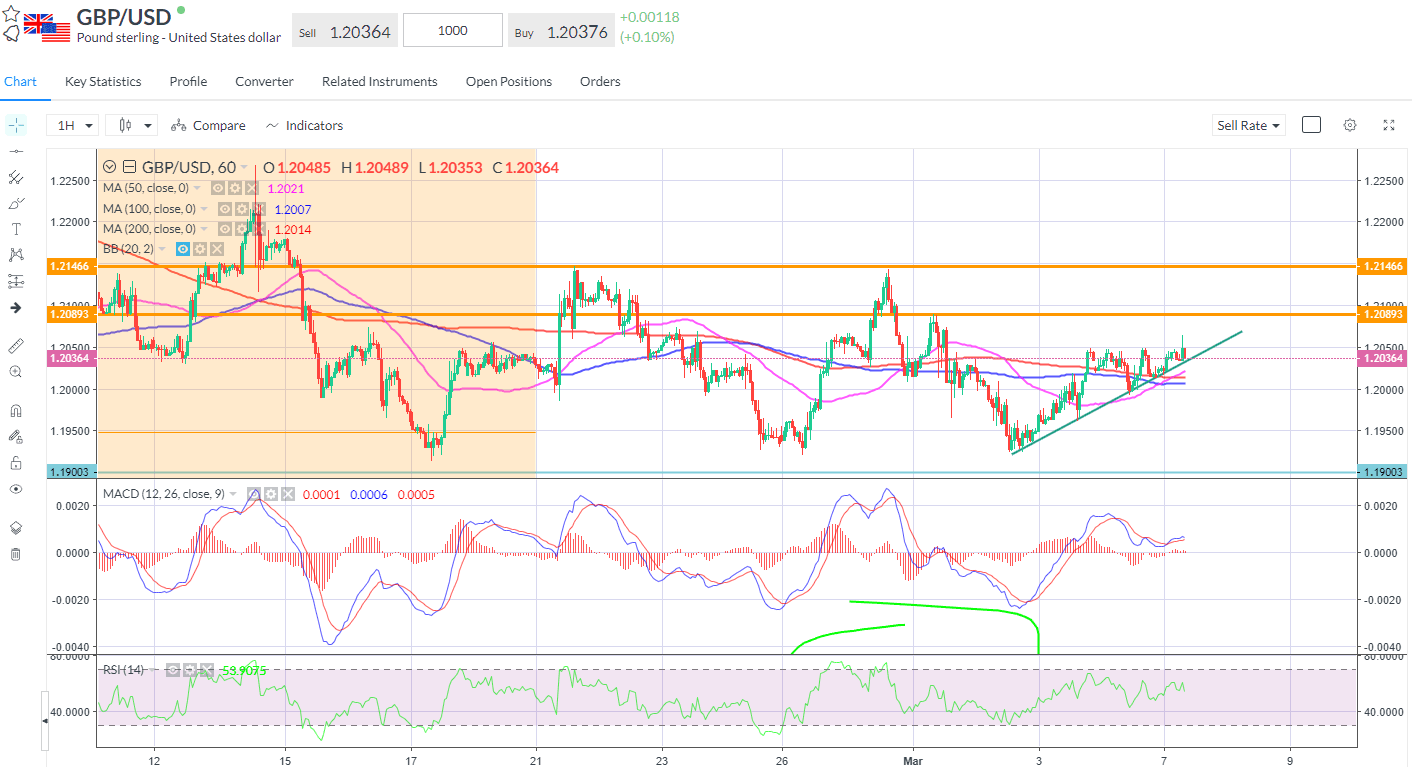

Sterling trades firm this morning after UK retail sales held up. Cable rose to its best in a week as data showed UK retail sales for February rose 5.2% from a year before vs a 4.2% rise in January. But with inflation running at +10% or so this rise masks a sizeable fall in volumes. GBPUSD hugging the rising trend line, looks to recapture the late Feb swing high around 1.2090, with the double top around 1.2150 next. Support strong at the triple bottom around the 1.1920 area.

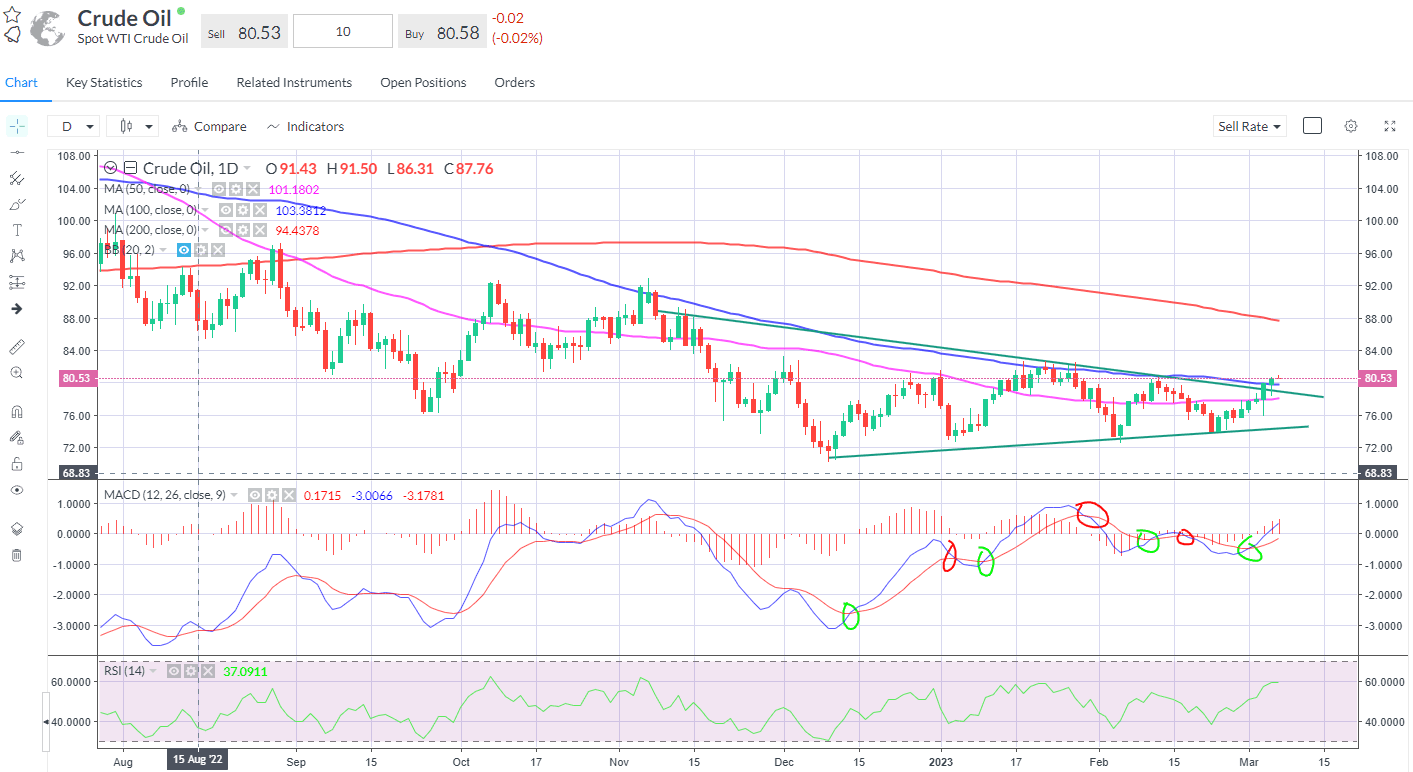

Crude oil – breakout time?