Monday Mar 20 2023 10:30

5 min

UBS chief executive Ralph Hamers tells staff this morning to continue treating Credit Suisse as a competitor. Hardly the warm embrace of banking brothers: you have to think that the schadenfreude that UBS must be feeling will be tempered greatly by angst about what they have bought into. Shares in the extant Swiss lender fell sharply. CS will still pay bonuses...some things never change, eh?

UBS taking over Credit Suisse is the only story this morning and it’s not being greeted terribly favourably by the markets. European indices dunked and US futures fell sharply as they reopened for trade after a tumultuous weekend in Switzerland.

Shareholders in Credit Suisse have been left nursing very heavy losses (-63% this morning) after UBS agreed was dragooned into buying CS for CHF3bn with the SNB providing a CHF100bn "liquidity assistance loan" backed up by a guarantee of CHF9bn from the Swiss Government. It creates a whopping great bank right at the heart of European finance – larger and potentially riskier. UBS has secured considerable concessions as a price for playing ball – rightly so if you were a UBS shareholder – but we are yet to see whether it works out.

But the biggest surprise is the treatment of some CS debt that appears to have investors worried. Swiss regulators demanded Credit Suisse Additional Tier 1 (AT1) debt be written down to zero as part of the deal: "The extraordinary government support will trigger a complete write-down of the nominal value of all AT1 shares of Credit Suisse in the amount of around CHF 16 billion, and thus an increase in core capital".

These are ‘contingent convertible’ bonds that are riskier than other debt instruments and designed to get wiped out in a crisis – or converted to equity. Usually this would be the same thing – like when Banco Popular got gobbled up by its national rival Santander in 2017 – the only precedent for the CS takeout. However, shareholders in CS are getting something, even if it’s not much. Blatantly upending the hierarchy of debt will have ramifications and I think this is why we are seeing such a negative reaction in bank shares this morning.

Shareholders in Credit Suisse got a skinhead, bond holders took a bath, but it’s the haircut for UBS shares that matters about the future – and they are down 13% or so in early trading on Monday. French banks were also hard hit with BNP and SocGen –7% and Credit Agricole –4%. Deutsche Bank and Barclays fell more than 7% as financials took a serious hit, dragging the major indices sharply lower for the session. Major US bank shares in Frankfurt fell too. Everyone saying bank shares were oversold last week were ignoring the reality of a crisis – but on a fundamental basis they may be right – markets tend to overreact on the way down just as much as they do on the way up when the bubble is forming. Risk desks with be forcing portfolio managers to sell bank bonds and equities and anything else that might be tainted.

Shares in London and Frankfurt with the FTSE 100 making a new YTD low at 7,204, its weakest since November, whilst the DAX fell to 14,459, its lowest since the start of Jan. Govt bond yields fell as investors sought shelter – US 10yr Treasury yields declined to 3.30% from 3.50% and the US 2yr yields declined to 3.620% from 4.0%, whilst the German 2yr declined to 2.10% from 2.40%.

This is not the kind of reaction that regulators or central banks would have been hoping for. This reflects Worries about CoCo bonds everywhere after CS AT1s got zapped.Which banks own CS bonds (though this is secondary to the impact of them getting wiped out on the whole €250bn sector in Europe) The inevitable ‘who's next?’ question for European banks and US regionals – a confidence crisis can lead to liquidity and funding problems that can spiral into solvency trouble Considerations for a doom loop as banks rein in lending and slash origination, tightening financial conditions and hobbling economic growth

Dollar swap lines now open daily instead of weekly, designed to shore up liquidity in the global financial system. CBs are effectively easing – Fed faces a tough call this week but on the basis that the ECB went ahead with 50bps, it seems highly likely the US central bank will go with at least 25bps. But the market is very volatile and situation fluid.

As I said about CS last week – my view is that once it comes to the central bank saying it will provide liquidity the game is effectively up. And last night we had multiple central banks coordinating on a Sunday night – hardly the sign of calm that investors would like. In addition to the Fed this week, the odds are roughly evens for the Bank of England to raise rates by a quarter point. But the OBR saying inflation is likely to come down to 2.9% this year, combined with a small amount of market turmoil, may well stay its hand. Data last week showed UK inflation expectations eased to a 16-month low.

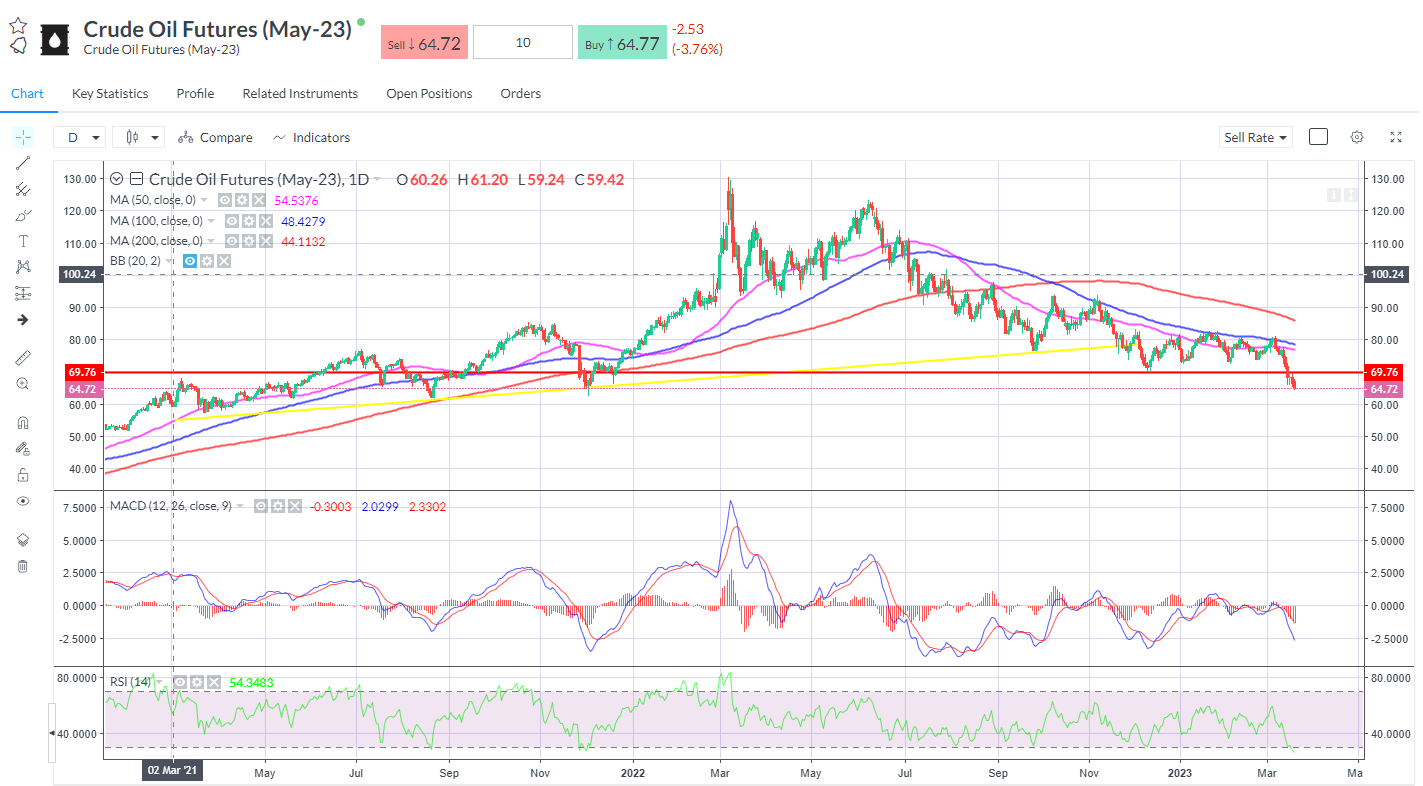

Oil lower with risk well and truly off, with WTI (May) testing the Dec ‘21 lows around $64.30.