Tuesday May 5 2020 08:54

1 min

Disney is a three-part business now – theme parks, films and streaming. Whilst streaming is going very well – thanks in no small part to lockdown – the other units are not performing so well.

DIS was downgraded to neutral from buy by MoffettNathanson ahead of the company’s earnings to be released after the market close on Tuesday (May 5th).

“There are a number of risks that could lead this unprecedented event to have a longer impact, with earnings revisions massively skewed to the downside,” 5-star analyst Michael Nathanson wrote in the update.

“Our Disney downgrade is also an admission that we believe the economic impact on the company will be longer than most anticipate, especially given the risks of a second wave of infections after reopening.”

MoffettNathanson expects the theme parks unit revenues to fall 33% from $26.2 billion to $17.7 billion this fiscal year, which ends in September. Revenues are seen down 1% next year as the drag from Covid-19 lingers before bouncing back 22% in 2022. In films, the analyst sees earnings down 20% this year to $2.7bn on a 23% drop in revenues.

Asset List

View Full ListLatest

View all

Sunday, 20 April 2025

6 min

Saturday, 19 April 2025

5 min

Thursday, 17 April 2025

7 min

Tuesday, 22 April 2025

Indices

Commodity market today: Crude Oil Fluctuates as OPEC+ Modifies Production Goals

Tuesday, 22 April 2025

Indices

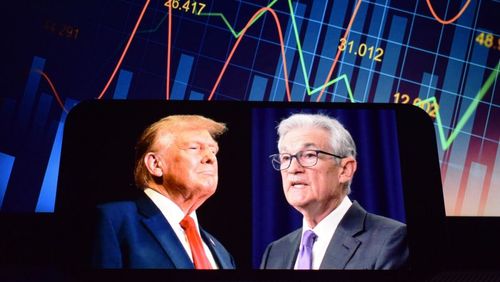

Morning Note: Trump Calms Fed Fears; Tesla Disappoints; UK Trade Talks Begin