Wednesday Oct 23 2024 20:19

6 min

The euro cracked, and inflation had its neck broken. Christine Lagarde declared victory over inflation with brutal imagery after announcing the European Central Bank’s third rate cut of the year, which amounted to a step-up in the easing cycle.

“Have we broken the neck of inflation? Not yet.

Are we in the process of breaking that neck? Yes.”

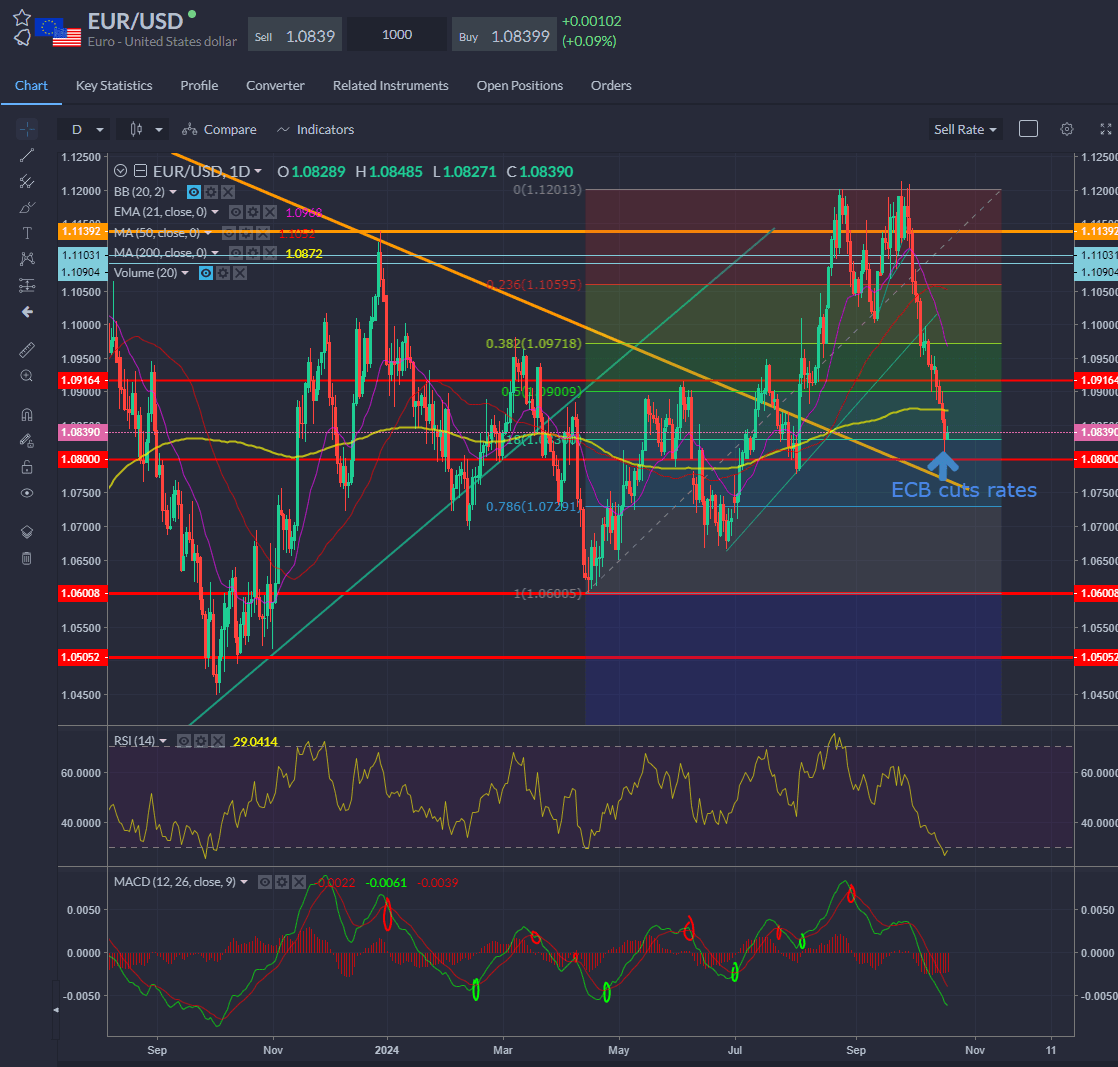

She noted more downside risk ahead but would not be drawn on a pre-committed path. Clearly, the door for another cut in December is well and truly open, but they are sticking to the meeting-by-meeting schtick. US data, meanwhile, was strong, with retail sales defying expectations – pushing EURUSD even further into the soup just as Lagarde was about to speak.

A big part of the moves is simple yield spread dynamics—US-German spreads on the 10-year have widened from about 150bps a month ago to about 190bps today. That explains a lot of the movement in the EURUSD cross. It’s not a dissimilar picture for the sterling, which has rallied to its best against the euro since April, as UK-German spreads rose from around 160bps a month ago to around the 190 mark today.

Worries about a trade war with Washington—the Trump Trade—are another factor, but chiefly, it’s about the market realising that the ECB needs to cut a lot from here.

EURUSD – holding at the 61% retracement

Gold’s not budging for the Dollar steamroller

It’s not just the euro feeling the pressure. For a large part of the year, the dollar was on a one-way ride downwards; lately, it’s completely reversed and steamrolled everything in its way.

The yen has lost about 7% against the dollar in a month. Japan’s top currency official, Atsushi Mimura, said recent currency moves were “somewhat one-sided and rapid”. USDJPY is flirting with 150 again this morning as data showed Japan’s inflation slowed in September, with consumer prices excluding fresh food rose 2.4% vs 2.8% last time.

Sterling rallied as the rally in gilts stalled on better-than-expected UK retail sales. GBPUSD pushed up to $1.3070 after sinking to a two-month low of around $1.2970 yesterday. At the same time, a record number of British businesses are flagging ‘significant’ financial distress. The BoE is cutting next and likely at each of the next few meetings.

European stocks rose in the wake of the ECB move but are more mixed this morning. The FTSE 100 slipped about 0.4% in early trade, with the DAX and CAC around the flatline. Chinese equities rallied, with Hong Kong up more than 3%. Data showing China's GDP rose 4.6% annually in Q3, slightly ahead of the forecast 4.5%; industrial output grew 5.4% in September yoy vs. f/c 4.5%; and retail sales rose 3.2% in September vs. f/c 2.5%.

US stocks notched fresh highs—the S&P 500 hit an intraday record but fell a touch at the close, and the Dow Jones secured a record close. Nvidia rose to a record after Taiwan Semiconductor delivered strong Q3 results. Netflix shares rose 4.8% in after-hours trading after delivering its most profitable quarter ever, adding 5 million new subscribers.

Gold rallied to a record high and traded above $2,700 this morning—there is no stopping it despite the rally in the dollar and real yields in the last month—the 10yr TIPS yield has risen from around 1.53% to 1.80% in the previous month.

Gold: geopolitical premium but also central bank buying, and the ever-expanding deficit trade. And rate cuts, even if we see short-term retracements in relative yields.

UK equities: Potential breakout for the FTSE 100? Price action has driven out of the top of the Bollinger band, and we see some positive moves on the MACD, but what is the catalyst here? Weak sterling cannot be the only driver – we need to see a reappreciation of UK plc, and that will be down to the Budget.

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.