Thursday Jun 6 2024 09:25

7 min

Fresh record highs on Wall Street either shout “secular bull market alive and well” or “run for cover”. It just depends on your outlook. Nvidia stock rallied 5% to top $3 trillion in market cap. BofA upgraded its NVDA price target to $1,500. Three stocks – Nvidia, Apple and Microsoft now make up 20% of the S&P 500 index and NVDA accounts for about 45% of the SPX’s gains this year. Breadth is so narrow it’s borderline alarming – what happens if they topple?

The Nasdaq’s record high was marked by fewer stocks hitting 52-week highs than 52-week lows – this does not happen often; it’s not a good signal usually. Still the bulls are content – Vix below 13, SPX record high, Goldman Sachs says a “wall of money” will come into the market in the second half from passive equity allocation. The first 15 days of July is usually the best for equities. Is it a bubble? Not yet, according to analysts at BofA:

“[...] the lack of a material rise in tech volatility suggests we are not there yet. Return dispersion (how much stocks diverge) also shows few bubble signs as do valuations compared to the late ‘90s.”

US regulators are clearing the way for antitrust (monopoly) investigations into the big AI players – Nvidia, Microsoft, and OpenAI.

Сalculate your hypothetical P/L (aggregated cost and charges) if you had opened a trade today.

Market

Instrument

Account Type

Direction

Quantity

Amount must be equal or higher than

Amount should be less than

Amount should be a multiple of the minimum lots increment

USD

EUR

GBP

CAD

AUD

CHF

ZAR

MXN

JPY

Value

Commission

Spread

Leverage

Conversion Fee

Required Margin

Overnight Swaps

Past performance is not a reliable indicator of future results.

All positions on instruments denominated in a currency that is different from your account currency, will be subject to a conversion fee at the position exit as well.

Imagine if the European Central Bank doesn’t cut rates today. Inflation in the Eurozone has picked up with headline CPI up from +2.4% to +2.6% and core CPI up from +2.7% to +2.9%. Growth has fewer downside risks than in March. China trade data is better, German data is likely bottoming and the composite Eurozone PMI hit a one-year high of 52.3. No rush to cut rates in this scenario.

ECB officials, however, have pretty well signed in blood that they will cut today. Eurozone inflation is pretty close to target and come down a lot. The risks to growth remain balanced. Wage growth has not been as strong as they thought it would be. Cutting from 4% to 3.75% would still leave rates restrictive. A hawkish cut removing that top layer of restriction is on the cards.

I noted the divergence story morphing into one of reconvergence yesterday – the US/German 10-year spread has already narrowed a lot so this is starting to look priced but could have a little further to run if the ECB stays hawkish – currently just under three cuts priced this year (65bps). This could come into 2 (50bps) and push up EUR if the ECB declines to offer much in the way of guidance in terms of future cuts.

But with EU elections taking place, the upside for EUR may be capped in the near-term until there is some post-election unclenching — that is a big “if”, though, with the right expected to do very well and possibly even better than expected.

The Bank of Canada became the next G10 central bank to cut rates and left the door open to another in July. "With continued evidence that underlying inflation is easing, ... monetary policy no longer needs to be as restrictive,” said the BoC. "Recent data has increased our confidence that inflation will continue to move towards the 2% target."

Meanwhile US data seems to be suggesting that the case for the Fed to cut is building. ADP payrolls came in light at 152k vs 175k expected, underscoring the run of soft eco data this week that has sent the odds of a cut in September up to 70%.

European stock markets were firmer in early trade, with the DAX up 1% to lead the way. The FTSE 100 was up a more modest 0.2% even as oil prices recovered. Spot WTI rallied off the $72.50 zone to $74.60 this morning. Gold has started to move up again as US yields fell again with the 10yr Treasury under 4.3% for the first time in some weeks.

In an interview with Fox Business published on June 3, Neel Kashkari, the president of the Federal Reserve Bank of Minneapolis, said one of the things he has learned in the past few years is that consumers would rather experience a recession than continue to suffer the pain of soaring prices. The comment that apparently stuck with him the most was from a labor leader who represented low-income service workers:

“She said to me, ‘Inflation is worse than a recession’. That is contrary to conventional economic thinking. And I said, 'I don't understand that. How can inflation be worse than a recession? In a recession, you lose your job. Inflation is paying higher prices, [but] you still have a job’.”

His comments are insensitive, to put it mildly — and betray wealth and privilege. Inflation hits the poorest the hardest and leaves them feeling like they cannot get on – they work and still can’t afford things. That’s worse than not working at all.

Ahead of Friday's payroll data, it’s worth noting that what investors fear more than the Fed staying restrictive is a full-blown recession. It’s in recessions that you get the kind of 20-30% drawdowns in the S&P 500.

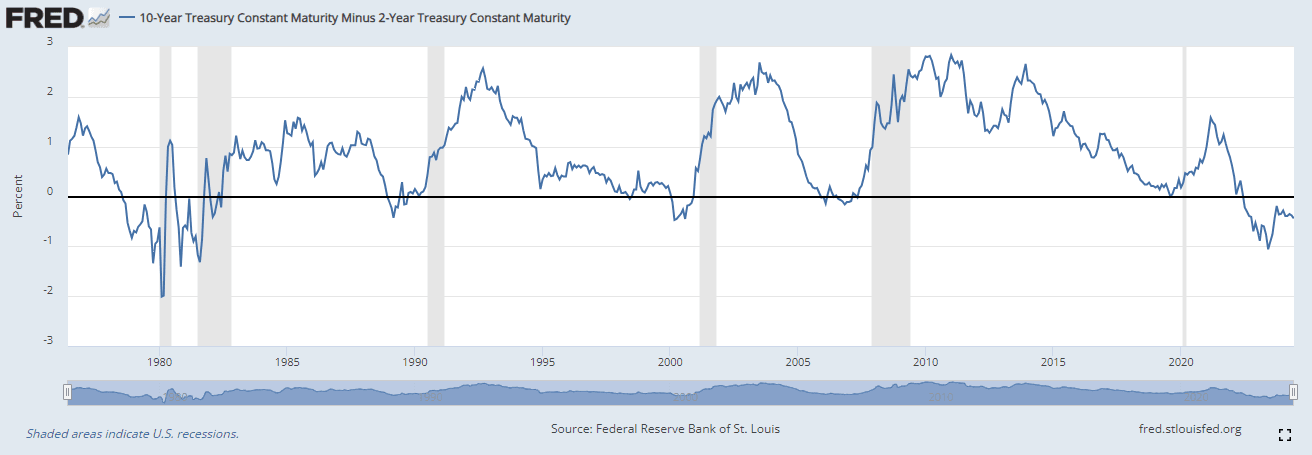

Where is the recession? Inversion of the yield curve has not led to a recession in nominal terms at least, even if people feel poorer. A recent Guardian/Harris poll found that 56% of respondents said they believe the US is in a recession – blame inflation for that. The point is that the exit from Covid is not part of a normal business cycle.

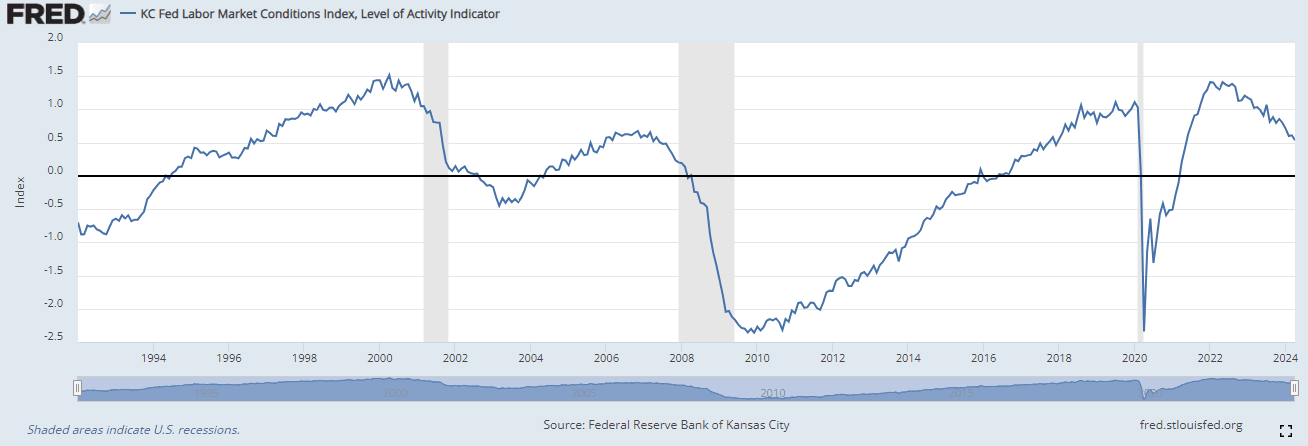

Tomorrow’s jobs data could shake things up. Here is the Kansas City Fed Labor Market Conditions Index:

It’s worth noting that the market is already well set-up for a bad showing from the NFP. The soft JOLTS figures and generally soft eco data has sent yields lower already and been a great help to equities – recession fears resurfacing rather than soft-landing.

Meanwhile Bloomberg Economics estimates that 2023 monthly nonfarm payrolls has overstated job gains by over 730,000, with “hiring maybe even falling below zero in October”.

Anyway, to this week’s NFP. BofA says “a healthy but better-balanced" labour market, forecast nonfarm payrolls to rise by 200k in May.

The copper price dropped below 50-day SMA for first time in about three months.

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.

Asset List

View Full ListLatest

View all

Tuesday, 8 April 2025

4 min

Monday, 7 April 2025

6 min

Monday, 7 April 2025

4 min