Tuesday Jan 7 2025 08:26

5 min

Forex market update, EUR/USD Price Analysis, EUR/USD ascends over 0.78%, buoyed by potential US tariff implications and a weak Dollar environment.

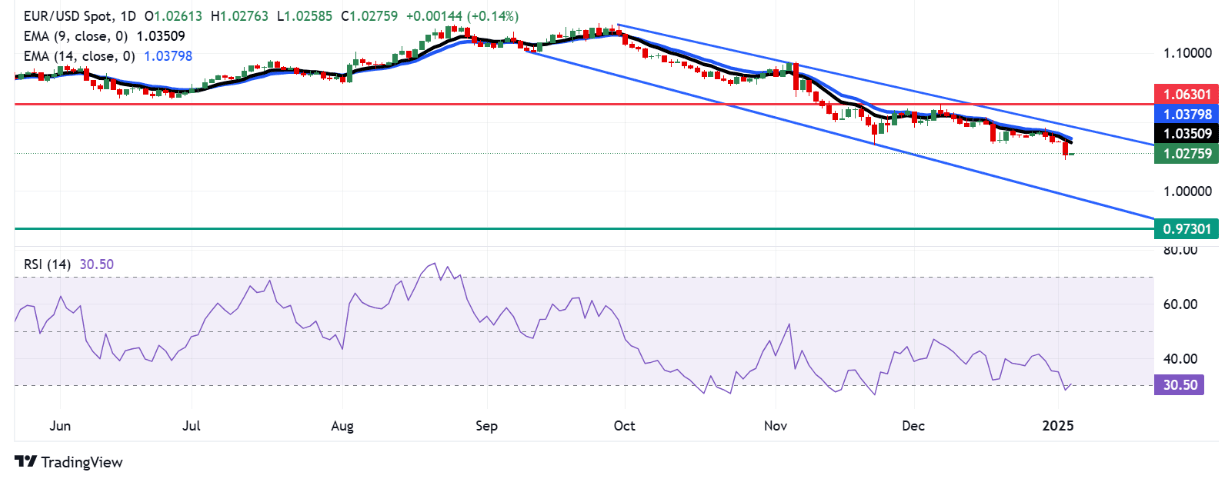

The EUR/USD pair has paused its four-day losing streak, trading around 1.0270 during the Asian session on Friday. An analysis of the daily chart reveals a consistent bearish trend, with the pair moving within a descending channel.

The 14-day Relative Strength Index (RSI), a key momentum indicator, is currently near the 30 mark, suggesting an oversold condition and the potential for a short-term upward correction. However, the nine-day Exponential Moving Average (EMA) remains below the 14-day EMA, indicating weaker short-term momentum and reinforcing the overall bearish sentiment.

Resistance for the EUR/USD pair is primarily found at the nine-day EMA around 1.0350, followed by the 14-day EMA at 1.0379. If the pair manages to break above these resistance levels, it could target the upper boundary of the descending channel at 1.0470, with further gains potentially reaching the seven-week high of 1.0630.

On the downside, the EUR/USD pair may encounter support near the psychological level of 1.0000, followed by the lower boundary of the descending channel at 0.9970. A decisive break below 0.9970 could enhance the bearish outlook, potentially pushing the pair further down to test 0.9730, marking the lowest level since November 2022.

source: tradingview

The EUR/USD currency pair experienced a notable increase of over 0.78%, reflecting a shift in market sentiment during the latest trading session. This upward movement comes after a period of consolidation and highlights a potential reversal in the prevailing bearish trend.

Several factors contributed to this rise. First, improved economic data from the Eurozone has bolstered investor confidence in the euro. Recent reports indicating stronger-than-expected manufacturing output and consumer sentiment have fueled optimism about the region's economic recovery. As a result, traders are increasingly looking to the euro as a more attractive investment option against the U.S. dollar.

Additionally, shifts in monetary policy expectations have played a role. The European Central Bank (ECB) has signaled its commitment to combat inflation, which may lead to tighter monetary policy in the near term. This contrasts with the Federal Reserve's stance, which has suggested a more cautious approach to interest rate hikes. Such divergence in monetary policy outlooks tends to support the euro's strength relative to the dollar.

From a technical perspective, the EUR/USD pair is currently testing important resistance levels. Recent price action indicates that it has broken above the nine-day Exponential Moving Average (EMA), which is situated around 1.0350. This is a significant development, as maintaining momentum above this level could pave the way for further upward movement.

If the pair can sustain its gains and close above the nine-day EMA, it may target the upper boundary of the descending channel at 1.0470. This boundary has been a key resistance point and breaking through it could signal a more robust bullish trend.

Additionally, the 14-day Relative Strength Index (RSI) is approaching overbought territory, suggesting heightened buying pressure. However, traders should remain cautious, as overbought conditions can precede pullbacks.

While the recent break above the nine-day EMA is a positive sign, the EUR/USD pair must maintain its momentum to capitalize on potential gains. Key resistance at 1.0470 will be closely monitored, as a successful breach could indicate a shift in the prevailing bearish trend and open the door for further upside potential.

Despite the positive movement, market sentiment remains cautious. Traders are closely monitoring geopolitical developments and economic indicators that could influence future price action. The 14-day Relative Strength Index (RSI) indicates an approaching overbought condition, suggesting that a pullback could occur if buying pressure wanes.

In summary, the recent 0.78% increase in the EUR/USD pair reflects positive economic signals from the Eurozone and changing monetary policy expectations. As traders assess key resistance levels and market sentiment, the pair's trajectory will be closely watched in the coming sessions.

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.