Thursday Jul 20 2023 09:34

8 min

European markets are diverging with the FTSE 100 extending yesterday’s bounce and the DAX shedding around a third of a percent in early trading. Yesterday the FTSE 100 rose 1.8% to close at 7,588.20 as housebuilders leapt on declining bond yields, a bit off the highs of the day but nevertheless a strong shift, while the FTSE 250 gained almost 3.8% to 19,322.52. The FTSE 100 trades half a percent higher this morning, clear of 7,600, extending a move above the 200-day line at 7,564, whilst the FTSE 250 is flat. Miners led the gains, with Anglo American surging 5% on its Q2 production update with copper output +42%.

Elsewhere in London, Premier Foods says prices won’t rise again this year as it reported a 21% jump in sales in the last quarter; Babcock profits plunged on a dispute with the MoD but shares rose 6%; EasyJet shares fell even as it said it expects record profits this summer as it booked a pre-tax profit of £203mn for the three months to the end of June from a loss of £114mn last year. Worth noting that the fall today of 1.6% is tiny vs the +47% return YTD – looks like profit taking as strikes create some near-term uncertainty.

After Wall Street touched fresh highs on Wednesday US futures have turned lower after soft earnings from key players Netflix and Tesla (combined market cap +$1tn). Apple got on the AI train and shares hit a fresh all-time high at $198.23, closing up 0.7%. Asia has been pretty choppy overnight; TSMC profits slipped 23% on falling chip demand but margins and net income was ahead of consensus forecasts.

The Dow finished up a third of a percent for an eighth straight day of gains, its best run since September 2019. US bank earnings are down but generally better than feared. GS net income plunged by two-thirds to $1.1bn from $2.8bn, but revenues exceeded expectations and shares added 1%. The banking crisis of earlier this year seems firmly behind us and the lower-yield, soft-landing narrative is persisting. The S&P 500 and Nasdaq were barely higher and futures indicate softness in the wake of the aforementioned Tesla and Netflix reports. Philly Fed, weekly unemployment claims and existing home sales are the main macro events later, whilst earnings come from JNJ and freight company CSX.

Netflix share price fell almost 9% in after-hours trading, giving up the entirety of its rally of the last week as Q2 revenue fell short of forecast. Guidance on revenue for this quarter was also short of expectations. On the plus side the company said it added nearly 6m subscribers with a crackdown on password sharing. And the Hollywood strike means way less content spend – free cash now seen up to $5bn from a previous estimate of $3.5bn...silver linings and all that. Profit rose 3% in the quarter from a year before to $1.5bn.

Given the rally YTD, some disappointment was clearly evident with Tesla’s report card. Quarterly revenue rose to an all-time high, which was expected given the record deliveries in the quarter, but operating margin dropped to 9.6%. Revenue from the core automotive business rose 46% year-over-year to $21.27bn, which was +6.5% sequentially. Shares slipped 4% after-hours during the analyst call as the company said factory downtime would lead to lower production and there could be further price reductions. Tesla stuck to 1.8m unit guidance but Musk has previously hinted at 2mn so maybe some disappointment there. EPS beat at $0.91 vs $0.82, with net income +20% on last year, though operating income declined 3%.

After rallying for much of yesterday’s session the dollar moved lower again overnight though didn’t test Wednesday’s lows. It looks like the move lower was down to China’s monetary authorities relaxing rules to allow companies to borrow more overseas by raising its macro prudential assessments to 1.5 from 1.25, seen as an effort to defend its weakening currency, which has lately slipped to its lowest level against the dollar since Nov ‘22.

Sterling rejected $1.28670 and is back above $1.2910 this morning after rising to as high as $1.2960 overnight on the dollar weakness. EURUSD holds the 1.12 handle for now, with Dixie just under the 100 mark.

Corn, wheat and soybeans rose Wednesday amid fears over drought in the US and the collapse of the Russia-Ukraine grain deal. Wheat futures leapt on Russia issuing a memo saying that all ships sailing to Ukrainian ports in the Black Sea would be "regarded as potential carriers of military cargo" from today, whilst Ukraine’s ports were hit by Russia for a third night.

A potentially strong El Nino has potential for further volatility in soft commodities. Earlier this year the National Oceanic and Atmospheric Administration announced the arrival of El Nino, which could strengthen over the winter, increasing the risk of heavy rainfall and droughts in certain parts of the world – especially if it’s classed as a strong one as in 2015/16.

The last strong El Nino occurred in the winter of 2015/16 and between the end of August 2015 and end of September 2016 sugar prices doubled, led mainly by a big drop in Indian production. Already this year sugar prices are at their highest since 2011 – though in part that is to do with a rally in the Brazilian real, as well as droughts in Brazil and floods in India. El Nino can also impact output of wheat and rice – India consumes all the wheat it produces and so a bad crop can raise demand for imports. But El Nino can boost production of items such as corn and soybeans in Brazil and the US.

Wheat – big move but seen in context nothing like as tight as we have been

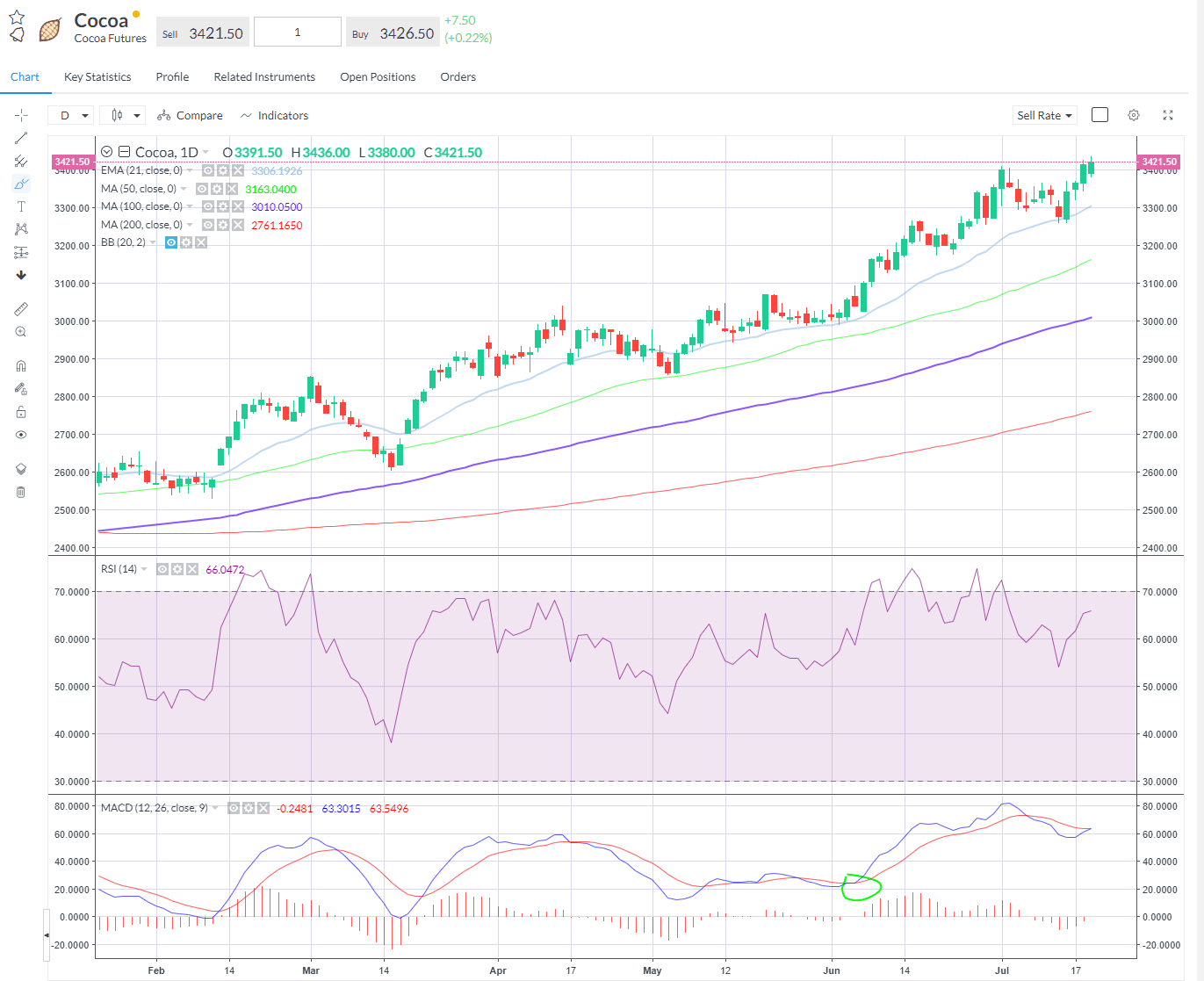

Cocoa hit a 12-year high in NY, whilst prices in London also rallied having recently hit a 46-year high. Extreme wet weather and black pod disease in West Africa is hammering the crop. We're not quite at the same kind of £240 premium we saw between the July and September contracts in London in June trading, but the backwardation does still point to tight supplies/heavy demand for cocoa.

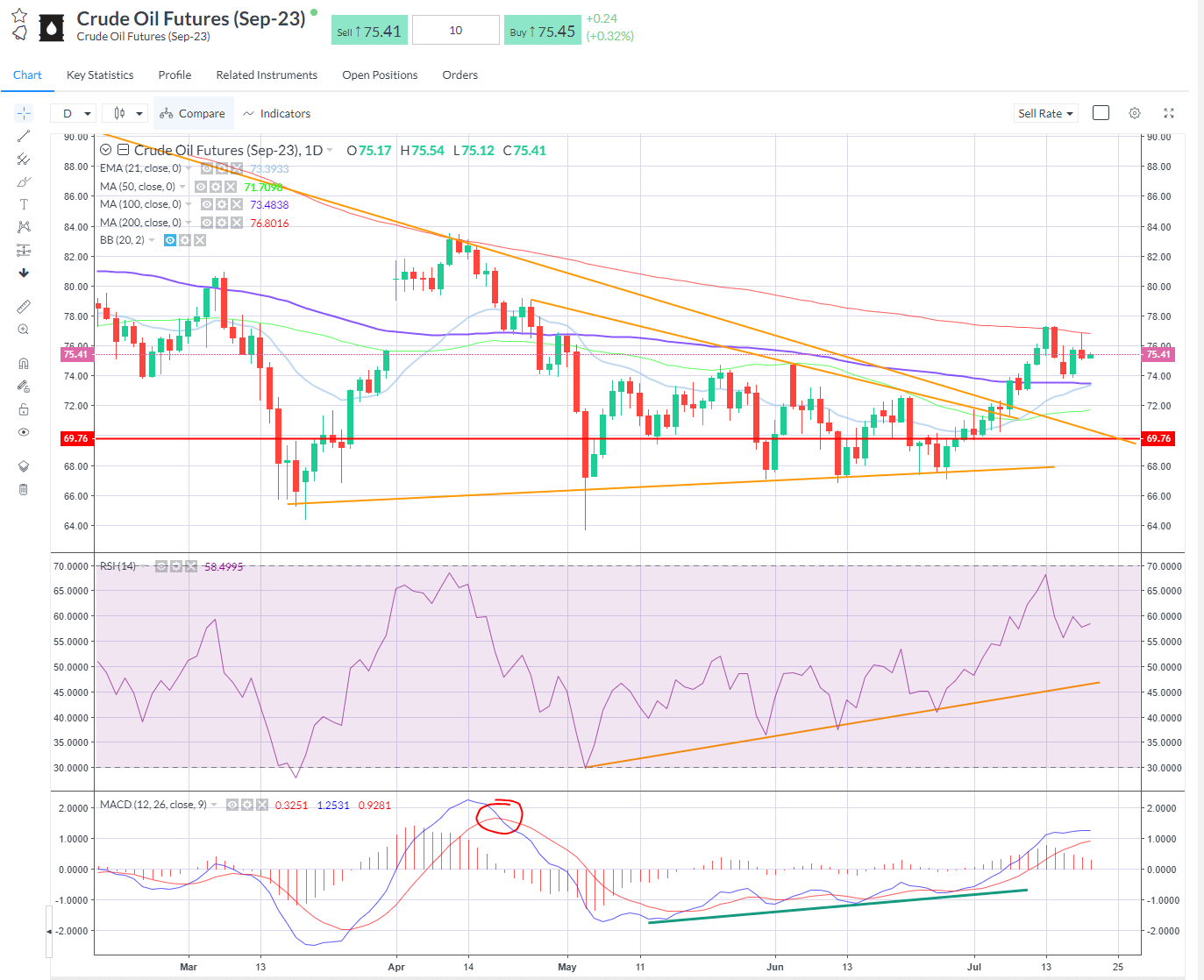

Crude oil – WTI (Sep) again failing to breach the 200-day line, consolidating here

Ahead – Japan national core CPI inflation – more pressure on the BoJ, or will the June report indicate disinflation? USDJPY backing gently off the 140 round number, 50% retracement area as recent decline consolidates around 139.