Friday Apr 12 2024 11:45

5 min

European stock markets rallied early Friday, with the major indices posting gains of close to one per cent as we start to see a more mixed outlook for global central banks and the euro and pound touched multi-month lows against the dollar.

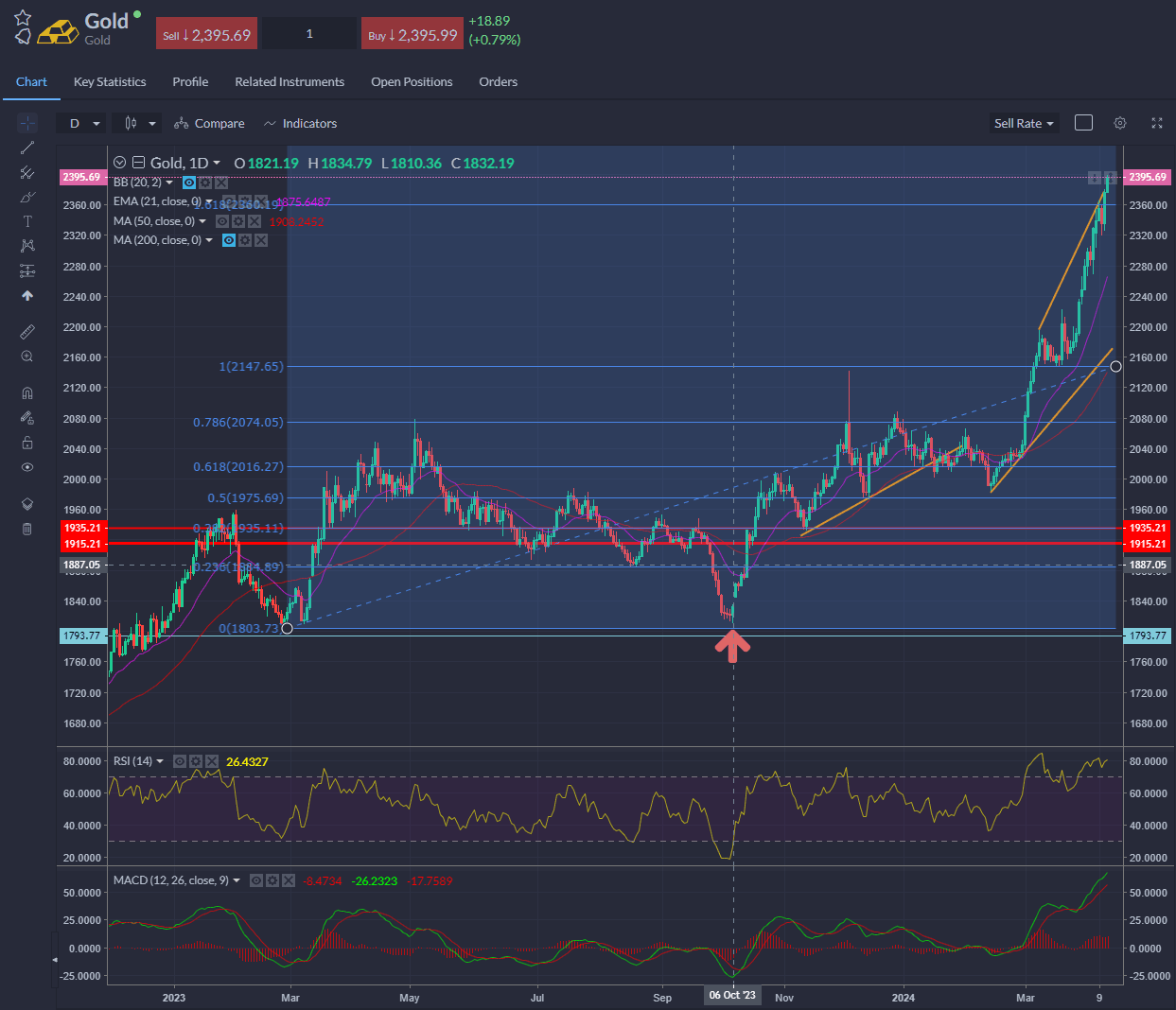

Gold prices kept pushing higher even as real yields have jumped – fears about an Iran strike on Israel, or maybe a U.S. plan to raise even more debt for Ukraine. Everything points to the argument I made a year ago:

“...we are about to go into a protracted economic (and maybe real) war, and it will require the mobilisation of the state and people – developed world central banks (Fed, ECB, BoE, BoC, RBA) will act together to orchestrate fiscal spending and suppress yields”.

Сalculate your hypothetical P/L (aggregated cost and charges) if you had opened a trade today.

Market

Instrument

Account Type

Direction

Quantity

Amount must be equal or higher than

Amount should be less than

Amount should be a multiple of the minimum lots increment

USD

EUR

GBP

CAD

AUD

CHF

ZAR

MXN

JPY

Value

Commission

Spread

Leverage

Conversion Fee

Required Margin

Overnight Swaps

Past performance is not a reliable indicator of future results.

All positions on instruments denominated in a currency that is different from your account currency, will be subject to a conversion fee at the position exit as well.

A big pop for technology giants led the Nasdaq Composite to a record level as Wall Street rebounded from its inflation shock.

Apple and Nvidia – the two stocks I mentioned only the other day as showing signs of distress – both rallied 4% to drive the tech sector higher and pull the S&P 500 index out of its funk. The FTSE 100 trades close to 8,000 again and within a whisker of its all-time high. Looking good for that now, I think.

Whilst traders have pared bets for the Fed and Bank of England to cut rates, the ECB yesterday stuck to its guns and predicted a quarter-point cut by June, with some even arguing for an immediate cut. Nevertheless, whilst the ECB says it’s not “Fed dependent”, traders did slightly pare bets for a June cut – down from 75% to 70%.

The market is not so convinced that the ECB can completely ignore US inflation. The chances of a Fed cut in June have come down from over 60% a month ago to just 24% today. However, that’s up from 16% in the wake of the US inflation data earlier this week – some over-excitement masked the fact that the Fed may not be as worried about inflation as the market, plus some softer-than-expected PPI inflation data out of the US pushed yields back down.

PPI rose 0.2% month-on-month in March, compared with +0.3% expected. Watch the UoM consumer inflation expectations later, whilst we hear from the Fed’s Bostic and Daly.

ECB communication yesterday was nuanced but definitely signalled a cut in June. Overall, if global central banks are starting to diverge from the Fed this can offer further support to the USD – however this may not fully materialise until we actually get some cuts.

The UK economy grew tepidly in February, with GDP expanding by 0.1%. Sterling remains under the cosh and GBP/USD has hit its lowest level since the Fed’s December pivot.

The euro sank to its weakest since mid-November in anticipation of policy divergence. Meanwhile, the Bernanke review of the Bank of England forecasting is anticipated today. Dot plot for the MPC?

The gold price has shrugged off everything – watch the geopolitics. Ever since Oct 7th there has been a decoupling from real yields as geopolitical risks rose, and the gold price is showing an inflation-debt-debasement premium as well – as talked about before.

The 10-year TIPS yield has jumped to 1.250%, the dollar index (DXY) is at 105 and its highest since mid-November. All the usual influences don’t seem to matter — is everyone hoarding?

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.

Asset List

View Full ListLatest

View all

Thursday, 3 April 2025

5 min

Wednesday, 2 April 2025

5 min

Wednesday, 2 April 2025

4 min