Friday Mar 31 2023 04:53

3 min

European stocks rose tentatively in early trading on Thursday, trimming some of their losses for the month after a solid recovery for Wall Street underscored the more risk-on tone to this week. The FTSE 100 is about 1% higher for the week, whilst DAX and CAC trade up closer to 1.5%. The S&P 500 is 2% higher for the week after rising 1.42% yesterday to surmount the 4k level.

But the month of March has been tough – whilst the Nasdaq has rallied 2% as bond yields declined and tech caught a bid, the major indices are mainly lower. In Europe: Frankfurt –0.5%, Paris –1% and London is the outlier at –4% for March so far. The S&P 500 is down around half of one percent for March and the Dow is off 2%. In like a lion and out lion – just a lot of lambing in the middle.

The biggest decliners on the FTSE 100 for the month of March are financials, insurers and commercial property: Standard Chartered (-23%), Barclays (-18%), Beazley (-16%), British Land (-16%), Persimmon (-15%), Prudential (-14%), Land Securities (-13%). This reflects the wider and related fears about the health of banks and commercial real estate in the wake of the collapse of SVB and Signature, and the forced marriage of Credit Suisse to UBS. Big hitters like Shell (-9%) and BP (--7%) have also been a drag as oil prices retreated during the month. Endeavor Mining, Rentokil and BAE Systems are the top performers in March – a mixed bag.

Oil edged higher on Thursday despite a decline in the prior session. US crude oil inventories fell by 7.5 million barrels in the week to March 24th, the biggest draw since November, according to the EIA. Russian production is coming off more slowly than forecast but this was flagged. The weakness yesterday in the wake of the EIA numbers is indicative of a pattern of traders front-running the data and the API numbers. Later today in the US – final GDP numbers and weekly unemployment claims data, plus we hear from Treasury Sec Yellen.

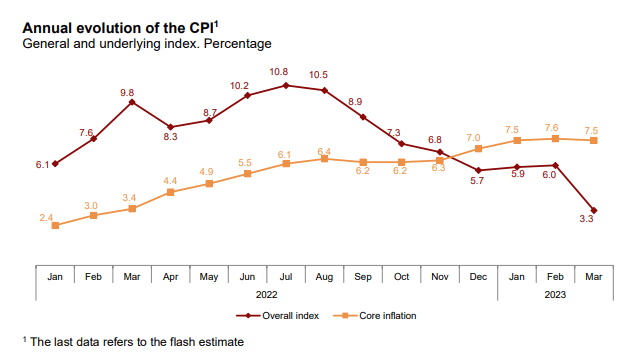

In Europe, inflation data comes out today. So far Spanish inflation declined to 3.3% vs 6% previously – is the dragon slayed? Well, not quite....we can see the headline rate collapsing due to the base effects of energy prices. It’s less optimistic when you look at the stickiness of core inflation – underlying inflation fell marginally to 7.5%. And the yellow line here shows a clear upward trend:

Asset List

View Full ListLatest

View all

Thursday, 20 February 2025

8 min

Thursday, 20 February 2025

5 min

Thursday, 20 February 2025

2 min