Thursday Apr 11 2024 11:40

7 min

"We don't really know if this is a bump on the road or something more. We'll to have to find out", Federal Reserve Chair Jay Powell said yesterday, after the US CPI report showed inflation accelerating year-on-year in March and exceeding most analysts’ estimates.

Stock markets declined in the wake of hotter-than-anticipated US inflation data. On Wall Street, both the Dow Jones industrial average and S&P 500 index shed about 1%; Asian shares followed suit. The FTSE 100 finished about 40 points off its high of the day which saw it kiss 8,000.

European stock markets are steadier this morning ahead of the European Central Bank decision; one which may tee up a rate cut in June that could start to see some of that multi-speed exits from the top of the mountain, more commonly known as policy divergence, that could spur more volatility in financial markets – particularly in FX.

US CPI inflation came in hotter than expected at +0.4% month-on-month, sending traders to the exit bets on a June rate cut. Year-on-year rose to 3.5% from 3.2%, ahead of the 3.4% expected. Core was up 0.4% on the month, +3.8% YoY. The headline 3-month annualised rate jumped to 4.6% (prior to 4.0%), with the 6-month at 3.2%. Core 3-month annualised rose to 4.5% from 4.2%, with the 6-month steady at 3.9%.

Supercore was +0.7%, or 5% YoY. Fundamentally, it’s as expected on the longer time frame – expectations and the reality are both totally unanchored and have been since the Fed said it would let US inflation run hot in August 2020. It’s still trying to put the genie back in the bottle and markets are starting to question whether the next move may actually be to hike – the labour is still quite strong.

The data sparked sharp repricing in rates markets – the Treasury market had it worst day since the Kamikwaze Budget sparked turmoil in gilts. The 2yr jumped about 20bps, the most since the regional banking crisis a year ago.

The 10-year yield has also risen more than 20bps since the data was released and traders have now priced out a June rate cut – just 16% implied probability vs. 60% only a couple of weeks ago. That is a big shift from the start of the year – the last mile is proving the hardest.

The boulder in the pond is creating ripples elsewhere. Market bets on the first 25bps rate cut from the Bank of England were pushed back from August to September.

Three months of surprisingly strong inflation is starting to look more like a sustained trend than a bump in the road. Question: what is the reaction function of the Fed in the face of this data? Everyone is talking like the data slams shut the door to a June cut — but what does the Fed think?

Remember they revised up their core PCE forecast this year whilst sticking to 3 cuts... Where do they think is neutral? We had always thought disinflation would be lumpy and 3% is the new 2%, but the question is whether this matters to the Fed. Does it still think that it’s about 300bps above neutral? Financial conditions have remained very easy since at least December, but mortgage rates are up again.

It’s a head-scratcher for the White House too. Joe Biden said he still expects the Fed to cut rates, but the data “may delay it a month or so”. I’m not quite sure what communication channels he has with the Fed, but I do think that the central bank is being leaned on to cut.

I think they were way too early to declare victory in December – the Powell Pivot (the Arthur Burns moment). But the question is whether they are now tacitly accepting higher US inflation – I believe they are, albeit the timing of a cut is one for those with a crystal ball.

The debt burden is not going down unless they cut, and I think the Treasury is in charge. Us infDoes the Treasury prefer a rate cut or lower inflation? There will be additional upward pressure from base effects in the second half of the year.

Minutes from the last Fed meeting released last night showed policymakers were already starting to fret about stubborn inflation. “Participants generally noted their uncertainty about the persistence of high inflation and expressed the view that recent data had not increased their confidence that inflation was moving sustainably down to 2 per cent,” the minutes said.

The Bank of Canada remained on hold and said it’s waiting for a more sustained slowing of inflation before it cuts rates. Raising its growth outlook, the BoC warned that inflation, at 2.8 per cent in February, is “still too high and risks remain”.

Now it’s over to the European Central Bank decision today. Data since the March meeting has been mixed, but generally we see more slowing in inflation and growth than in the US, teeing up a possible divergence that FX traders were quick to jump on as EUR/USD dipped and the DXY index hit its best since November.

EZ core CPI inflation is annualizing at about 2% vs 4% in the US. I think they can confidently signal they are going to cut in June.

Elsewhere, China inflation decelerated with CPI YoY at 0.1% vs 0.4% expected and 0.7% prior and PPI at -2.8% vs -2.8% exp and -2.7% prior. John and I talk about China in the latest edition of the podcast.

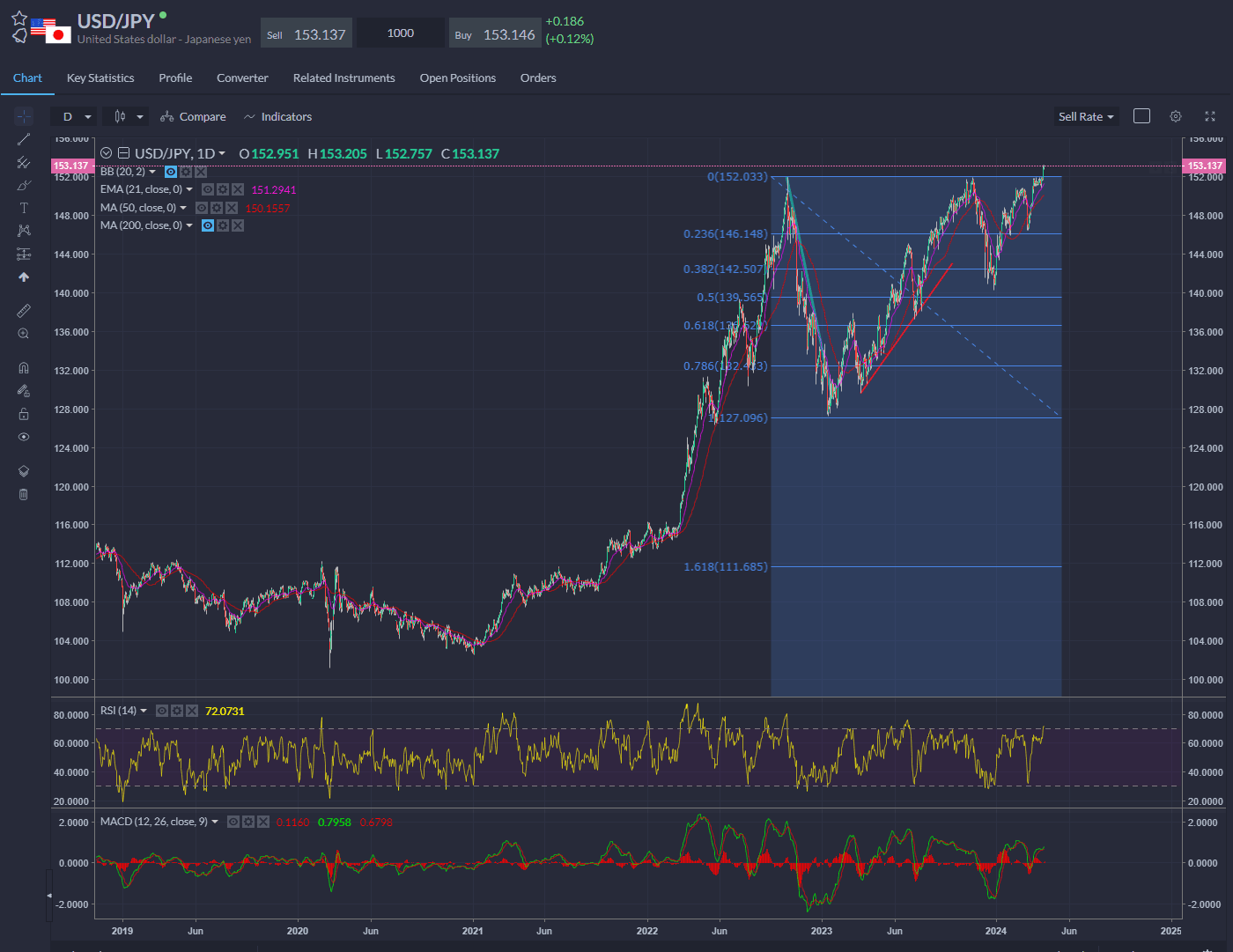

Japan is on currency intervention watch after the USDJPY broke above 153 in the wake of the US inflation data. I’d be very surprised if we don’t see something out of Tokyo soon.

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.