Friday Jan 10 2025 08:33

4 min

Employment in the Canadian economy to be released on Friday is likely to grow by 25,000 jobs,slightly less than half of what was added in November. Meanwhile, the unemployment rate isprojected to climb slightly to 6.9% from 6.8% in November. Weakness in labour demand willreinforce expectations with the Bank of Canada easing an already loose monetary policy by slashinginterest rates by an unusually high 50 basis points.

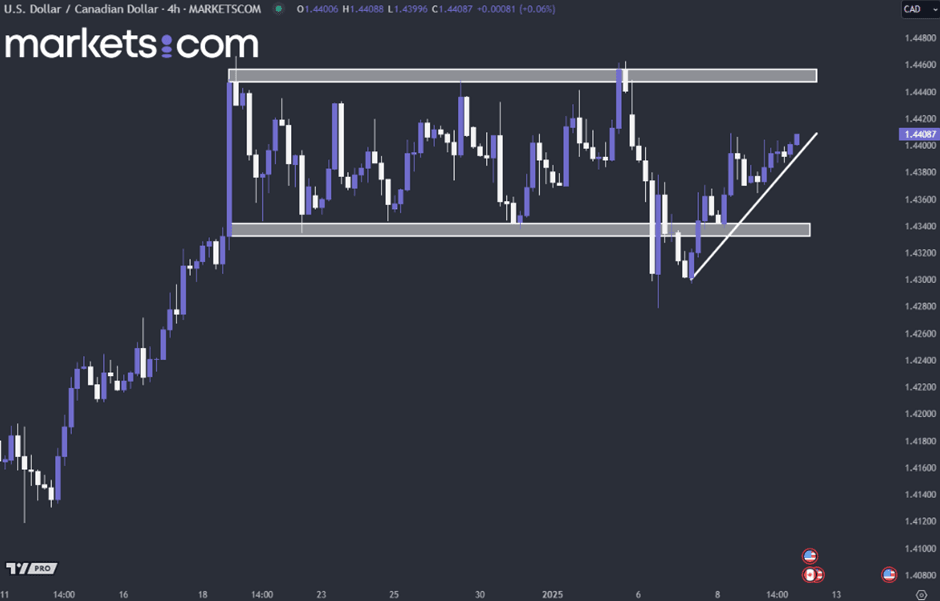

(USD/CAD 4H Price Chart, Source: Markets.com)

From the technical analysis perspective, the USD/CAD currency pair is currently trending upwards, as indicated by the higher highs and higher lows. However, there is a crucial resistance zone above, which has rejected the price from breaking through upwards multiple times. A decisive break above this zone will solidify the bullish continuation, driving the price further upwards.

The non-farm employment change is expected to increase at a slower pace, declining from 227,000 jobs in November to 164,000 jobs in December. Meanwhile, the unemployment rate is expected to remain constant at 4.2%. Additionally, the Federal Reserve’s hawkish signal that it would slow the pace of rate cut in 2025, continues to provide support for the U.S dollar.

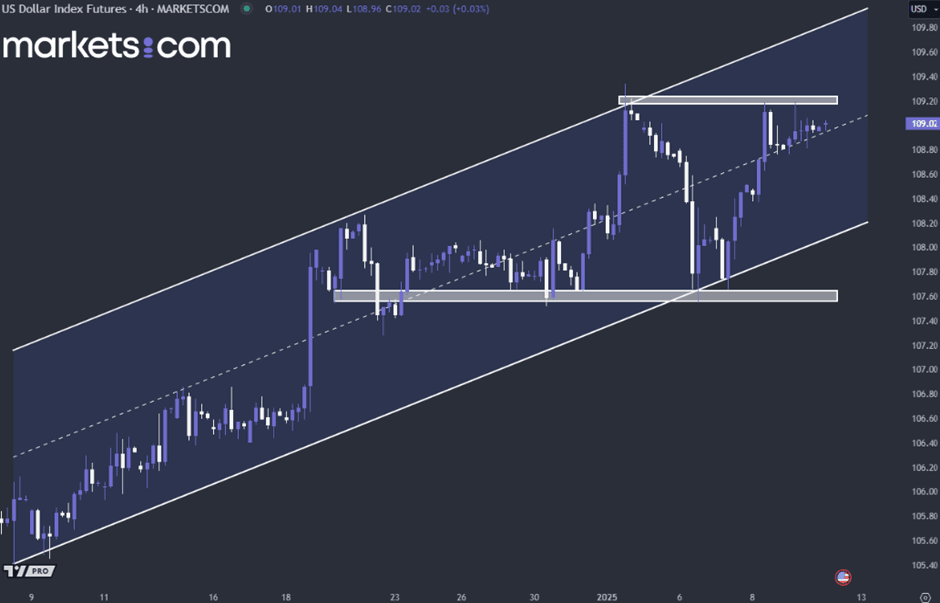

(U.S Dollar 4H Price Chart, Source: Markets.com)

From the technical analysis perspective, the overall movement of the U.S. dollar remains upwards, as indicated by the higher highs and higher lows. The price has retested the support zone at 107.60 multiple times and rebounded but eventually lost its bullish momentum, currently hovering at the resistance zone. However, a decisive break above this zone will solidify the bullish continuation, driving the price further upwards.

MicroStrategy's shares fell by nearly 10% after Bitcoin dropped by 9.5%, reflecting their high correlation. With a market capitalization of $82 billion, investors are now effectively paying a hefty premium for MicroStrategy's Bitcoin holdings. The revenues from the company's software business are likely to remain below $500 million in 2025, leading analysts to conclude that MicroStrategy's share price would, in fact, be driven by the Bitcoin strategy. A fall in Bitcoin's price would cause steep losses in MicroStrategy's stocks.

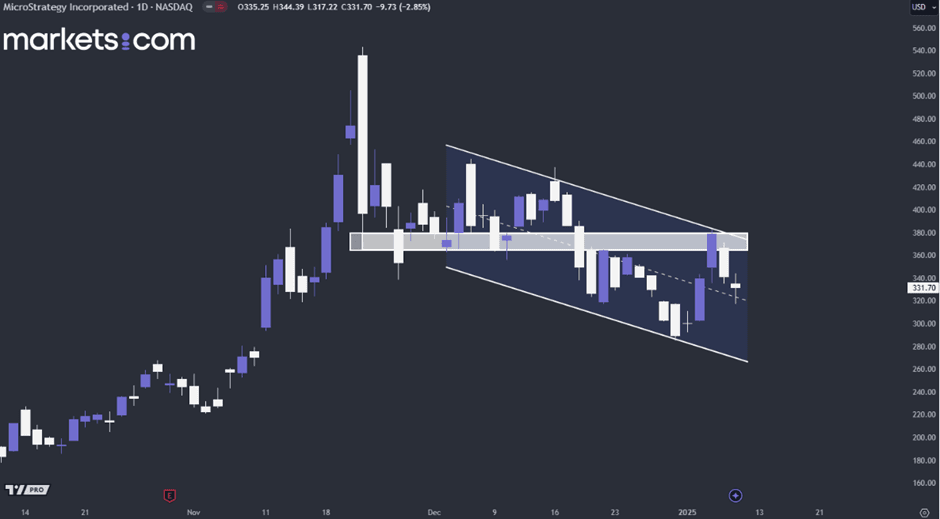

(MSTR Daily Price Chart, Source: Markets.com)

From a technical analysis perspective, MicroStrategy's stock price is trending downward within a bearish channel, as indicated by the lower highs and lower lows. It has retested the broken bullish structure, as well as the resistance of the bearish channel, where it faced rejection and is now driving the price lower. There is a possibility that the price will continue to decline, potentially reaching the channel's support level.

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.