Thursday Jan 18 2024 13:58

6 min

A fresh set of U.S. bitcoin exchange-traded funds (ETFs) has attracted significant investor attention over the past few days — although the sustainability of their inflows in the coming weeks remains uncertain.

In the initial three days of trading, investors allocated $1.9 billion to nine recently launched exchange-traded funds that track the spot price of bitcoin. Data from issuers and analysts revealed that fund giants BlackRock and Fidelity secured most of these flows.

The cumulative flows into these nine funds outpaced the post-launch flows into the ProShares Bitcoin Strategy ETF, which set a record with $1.2 billion in the first three days of trading after its launch in 2021. The SPDR Gold Shares ETF attracted $1.13 billion in the first three days after its introduction in 2004.

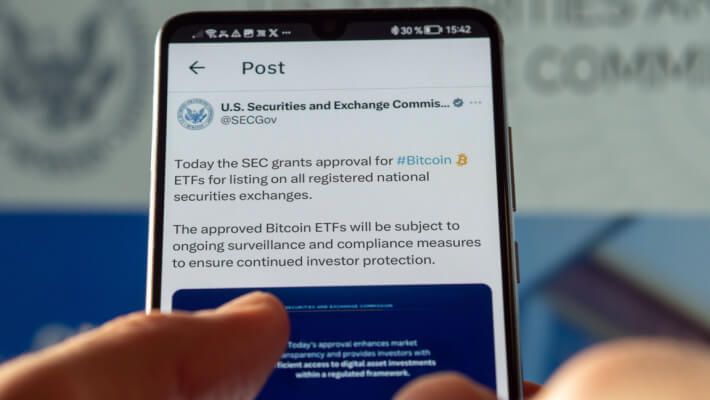

Although the investments in these eagerly anticipated ETFs, which received approval from the U.S. Securities and Exchange Commission (SEC) on January 11, fell short of the most optimistic estimates predicting first-day flows in the billions of dollars.

Market participants are keen to observe whether funds tracking the notoriously volatile cryptocurrency will continue to attract both retail and institutional investors, and which issuers will emerge as frontrunners. Some optimistic analysts have suggested that flows could reach between $50 billion and $100 billion by the end of the year.

Сalculate your hypothetical P/L (aggregated cost and charges) if you had opened a trade today.

Market

Instrument

Account Type

Direction

Quantity

Amount must be equal or higher than

Amount should be less than

Amount should be a multiple of the minimum lots increment

USD

EUR

GBP

CAD

AUD

CHF

ZAR

MXN

JPY

Value

Commission

Spread

Leverage

Conversion Fee

Required Margin

Overnight Swaps

Past performance is not a reliable indicator of future results.

All positions on instruments denominated in a currency that is different from your account currency, will be subject to a conversion fee at the position exit as well.

Bitcoin has declined by more than 8% since January 11, following months of anticipation for SEC approval of the ETFs.

Todd Sohn, an ETF analyst at macro research firm Strategas, told Reuters:

"So far, the launches have almost measured up to the hype. The next question is, what is their staying power? What will those flows look like in six months' time, or six years from now?"

Sui Chung, CEO of Kraken-owned CF Benchmarks, which is providing the index against which six of the new ETFs will be measured, told Reuters that fees would play a key role in the success or failure of these new instruments:

“Fees are clearly a key determinant for success. Those that charge the lower management fees will unsurprisingly make themselves more appealing compared to their peers. Brand recognition is another core aspect”.

As noted by Chung, the primary drivers currently attracting investors seem to be lower fees and established brand recognition, with the renowned asset management firms BlackRock and Fidelity leading the day.

BlackRock’s iShares Bitcoin Trust ETF has attracted over $700 million in investments, while Fidelity's Wise Origin Bitcoin Fund has topped $500 million, as reported by cryptocurrency research and analysis firm BitMEX Research.

The fees across the nine issuers, before any waivers, span from a minimum of 0.19% to a maximum of 0.39%.

BlackRock has implemented a fee structure of 0.12% for the initial $5 billion in assets during the initial 12 months of trading, with an increase to 0.25% thereafter. Fidelity, on the other hand, is initially charging zero, which will rise to 0.25% after July 31. These fee levels remain considerably below the average ETF fee of 0.54%, as calculated by Morningstar Inc.

The next challenge for these funds will likely be their ability to gain acceptance among institutional investors, including pension funds and investment advisers.

Markets.com Chief Market analyst Neil Wilson weighed in on the SEC’s approval of spot bitcoin ETFs last Thursday.

He questioned whether the agency’s decision was a sign of it caving to pressure from Wall Street and the broader financial industry, pointing to major investment banks’ skepticism over the asset. J.P. Morgan CEO Jamie Dimon has been one of bitcoin’s most vocal critics in recent years. Wilson wrote:

“Quite how the SEC has come to view the spot bitcoin market as safe enough I don’t know – the spot market is totally unregulated still. It seems that the SEC has bowed to a huge amount of industry pressure. And CME futures mean there is an existing, regulated venue to provide the level of surveillance etc. to discover fraud, manipulation [and so forth].

This is up for debate, of course, but the SEC seems to have bought the argument of ARK and others that there is enough correlation between spot bitcoin and futures to approve the spot ETF. But this raises a question about what the actual underlying market is – is it the spot, i.e. physical, market of Bitcoin on exchanges like Kraken etc., or is it really going to be the CME futures derivative that is in charge? The spot market is very immature and basically a hive of fraud, whales and manipulation, albeit very liquid. The futures [market] is not like that...who wins? The implications will be important for bitcoin as an asset as well as whether investors feel like it’s the kind of place they can do business. A key question is whether the big boys get involved – and by big boys we mean JPM, and Jamie Dimon has not been keen”.

Note, trading Cryptocurrency CFDs is restricted in the UK for all retail clients.

The information provided here is for general information only. Our offering includes products that are traded on margin and carry a high degree of risk to your capital. It is possible to incur losses that exceed your initial investment. You should ensure that you fully understand the risks involved and seek independent advice if necessary. Any information provided shall not be construed as investment advice and has been prepared without taking your individual objectives and financial situation into account.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money

Asset List

View Full ListLatest

View all

Wednesday, 16 April 2025

5 min

Tuesday, 15 April 2025

6 min

Tuesday, 15 April 2025

6 min