Thursday May 23 2024 10:17

6 min

Mourn on the fourth of July? Torn on the fourth of July? Forlorn (hope) on the fourth of July? Worn (out) by the fourth of July? We don’t have long before the UK election, but there is lots of fun to be had.

Get ready for an overdose of political analysis on which seats are going to be important, whether the UK election is going to be too close to call etc. I put out some comments yesterday afternoon about what the markets may make of it all, and we should see some more details from both main parties in terms of fiscal/economic outlooks, but I think safe to say that for now, the market is not overly worried.

Cable has pulled back a touch from a two-month high struck yesterday, shares are not budging, and gilts are more worried about the inflation outlook than what Keir Starmer and Rachel Reeves might have in store for them. But traders will be tooling up for the next 6 weeks – some heavy central bank activity between now and the UK election also makes for some interesting times ahead.

Сalculate your hypothetical P/L (aggregated cost and charges) if you had opened a trade today.

Market

Instrument

Account Type

Direction

Quantity

Amount must be equal or higher than

Amount should be less than

Amount should be a multiple of the minimum lots increment

USD

EUR

GBP

CAD

AUD

CHF

ZAR

MXN

JPY

Value

Commission

Spread

Leverage

Conversion Fee

Required Margin

Overnight Swaps

Past performance is not a reliable indicator of future results.

All positions on instruments denominated in a currency that is different from your account currency, will be subject to a conversion fee at the position exit as well.

Higher UK inflation and some slightly hawkish noises from central banks has pushed risk down a bit, with the Dow Jones for its worst day so far in May. Minutes from the last Fed meeting showed members’ frustration with a lack of progress on inflation and their “willingness to tighten policy further should risks to inflation materialise”.

The RBNZ was also a bit cautious about inflation. Metals have sharply retreated after a frenzied ramp in prices — gold pulled back further from the record as yields firmed along with the USD, whilst copper cratered as China buyers baulked at the high prices. Silver fell for a second day to near the $30 mark.

Money markets are also scaling back European Central Bank rate cut expectations for this year — though a June cut seems a certainty given the talk from Lagarde and co.

Europe was mixed early on after a broadly softer session in Asia that took its cue from a downbeat day for Wall Street. The DJIA shed 200 pts, or about half a per cent, whilst the S&P 500 was off by a quarter of one per cent to sit just above 5,300. Target shares declined 8%, signalling weakness in the consumer.

Vix is down to its lowest since 2019 at 11.53. Futures though indicate the S&P 500 index to open up about 30pts though as Nvidia shares delivered the kind of shot in the arm this slightly flagging bull market needs. Tesla shares fell 3.5% to $180 as European sales fell to a 15-month low. For more on TSLA have a listen to the latest Overleveraged podcast (Episode 19: Is Tesla a Fraud? The Case Against Elon Musk).

Stocks in Europe are a bit mixed this morning with the DAX and CAC both higher and the FTSE 100 down a touch with utilities taking a beating as National Grid announced a £7bn capital raise to help fund investment.

Shares in the company fell 9% with Severn Trent and United Utilities both down 5% in sympathy. Miners also scrubbed a few points off the index as metal prices retreated. Meanwhile Hargreaves Lansdown shares soared after it rejected a private equity bid – yes, we have seen the FTSE 100 hit record highs, but UK stocks, the mid-caps in particular, are still offering tremendous value. Cue more soul-searching about how undervalued UK stocks are still despite the recent improvement.

A UK election could make a difference to valuations – once the dust settles and the market gets some clarity on policy.

Nvidia (NVDA) reported first-quarter earnings after the bell on Wednesday that topped expectations while also announcing a 10-for-1 stock split and an increased dividend, aligning with other Big Tech firms that have recently boosted quarterly payments to shareholders.

Revenues were up +262% vs. about +242% expected, net income was up to almost $15bn, and there was strong demand for the new Blackwell chips. “We will see a lot of Blackwell revenue this year,” said CEO Jensen Huang.

Worries about ‘air pockets’ in demand were dismissed — it was the kind of health beat the market wanted. Nvidia shares rallied 7% after-hours to a new record, passing the $1,000 mark for the first time. Scottish Mortgage rallied 2% this morning with NVDA the largest holding at 8% of the investment trust.

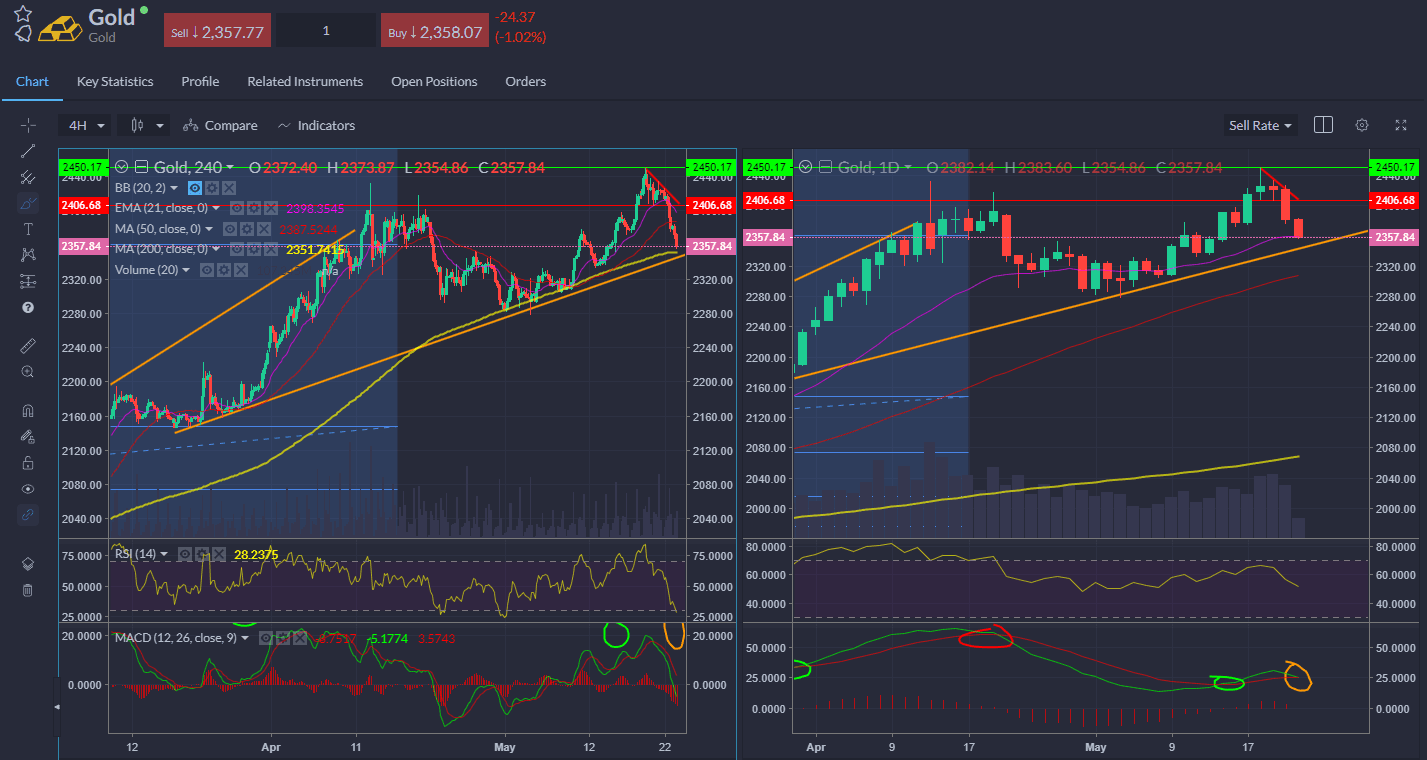

Firmer yields and a stronger dollar, with the DXY index at a weekly high, pushed down on gold again as it extended the pullback from the record high with prices this morning on the 21-day EMA (right) at 2,358, approaching the medium-term trend support and 200-period moving average on the 4hr chart (left), where there is a fair bit of support.

Oil prices continued to fall – Brent down to test the $81 support

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.

Asset List

View Full ListLatest

View all

Thursday, 3 April 2025

5 min

Wednesday, 2 April 2025

5 min

Wednesday, 2 April 2025

4 min