Friday Apr 19 2024 10:22

6 min

Oil prices jumped and then fell back as Israel launched a retaliatory attack on Iran. Geopolitics is unbelievably hard to price – oil had just fallen to where it was before the Apr. 1 attack on the Iranian embassy in Damascus, with WTI futures touching $81.

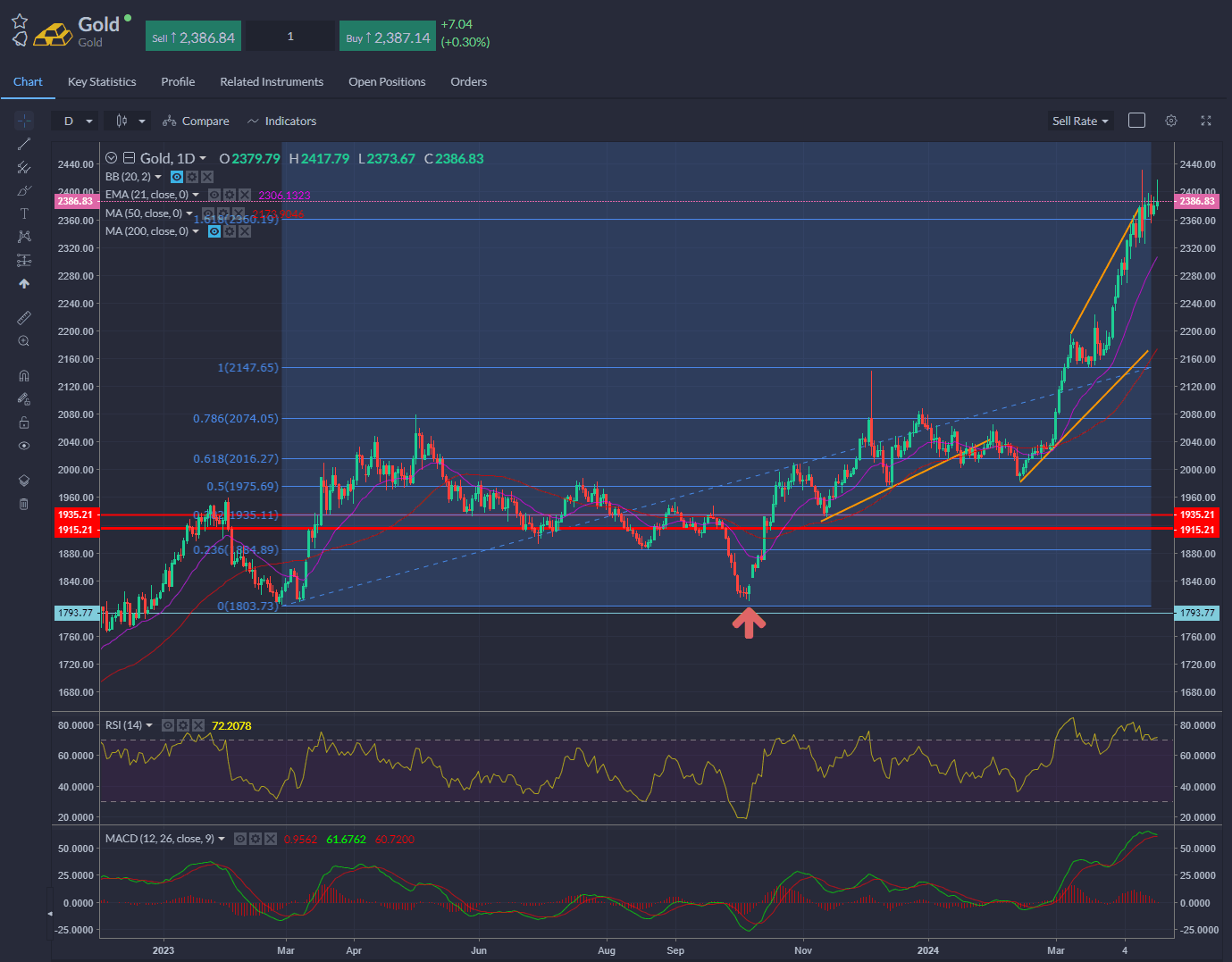

The gold price spiked north of $2,400 and then fell back. Bitcoin bounced firmly off the $60k support to $65k. What’s driving these two assets? We look at Bitcoin and gold in our latest episode of Overleveraged.

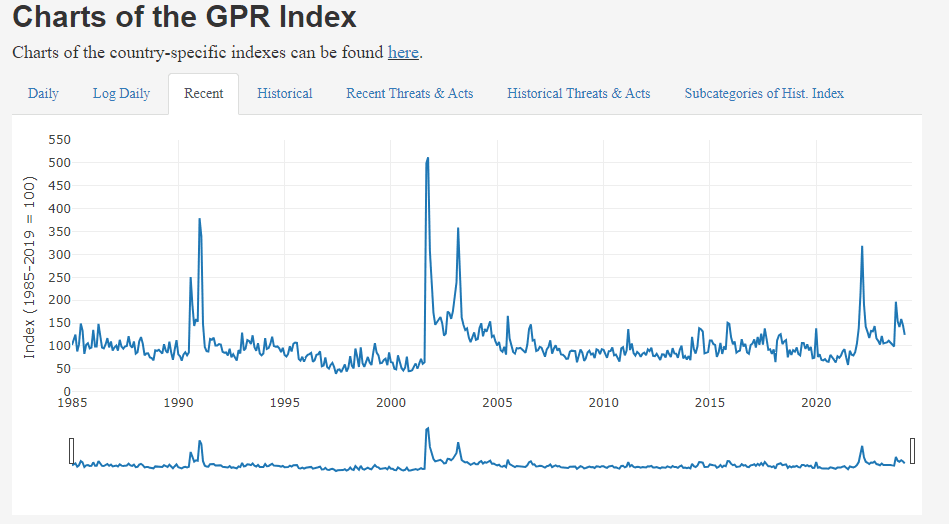

How risky is it? Another topic we are covering soon on the podcast is GPR — the Geopolitical Risk Index.

As for the gold price: the red arrow marks the bottom the day before the October 7th attacks. A clear geopolitical risk premium has been driving the market, though a simple metric of M1 to gold above ground implies a gold price of $2,400 is about average.

The spot gold price was $2,382 at the time of writing on April 19, as per Bloomberg data.

A number of brokerages have revised their projections on the yellow metal with a recent gold price forecast from Goldman Sachs saw it trading at $2,700 by year-end.

Stock markets were more obviously risk-off, with the FTSE 100 declining half a per cent, the DAX down 1% after Asian markets were broadly lower. Wall Street was lower again, the S&P 500 closing down for a fifth straight day – its worst losing streak since October.

Markets were already primed for de-risking on thoughts that the Federal Reserve is maybe not going to cut at all this year, so the Israeli strike is just noise for now. Wider escalation is the tail risk that is hard to price but a tighter Fed is cover for pulling in the horns. The IAEA says no damage to Iran’s nuclear facilities, which is... good? Reaction thus far is limited – what happens next is anyone’s guess.

Netflix reported operating income up 54% in Q1 as it added 9.3 million subscribers globally, a result of previous efforts to reduce password sharing. Total memberships rose 16% in the first quarter, reaching 269.6 million, but shares fell 5% after hours net as management said net additions would slow in the second quarter compared to the first quarter “due to typical seasonality.”

Operating margin rose by seven percentage points to 28% and management raised its FY24 margin guidance to 25%.

I thought it might be worth a look at Tesla ahead of earnings. Here was Bernstein a year ago saying that Tesla “may struggle to meet 2024-unit expectations," as Chinese rivals offer models "that are larger and offer similar performance at similar to lower prices. Our survey work suggests that Tesla's brand is ... increasingly polarizing."

They slapped a $150 price target on Tesla stock and yesterday it fell through that level, down 40% year-to-date. Barclays is out with a note this week calling for the Q1 earnings call to be a “negative catalyst” for the stock, expecting soft margins and a miss on earnings.

The focus for the call is simple – to understand how Tesla is pivoting strategy away from producing a mass market vehicle (the Model 2) to focus on autonomous driving.

Elsewhere, sterling hit a fresh 5-month low against the dollar, with GBPUSD taking a 1.23 handle briefly overnight as risk took flight. UK retail sales were unexpectedly flat – cue the chatter about Bank of England interest rate cuts. MPC voter Greene, however, says there is no rush to cut.

Three more MPC members spoke today. Bears are still in charge of cable with monetary policy divergence as the driving narrative, but there could be reasons to be more cheerful about the UK – stay tuned for next week’s episode of Overleveraged.

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss. Note, trading Cryptocurrency CFDs and spread bets is restricted in the UK for all retail clients.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.

Asset List

View Full ListLatest

View all

Wednesday, 16 April 2025

4 min

Wednesday, 16 April 2025

5 min

Wednesday, 16 April 2025

5 min