Tuesday Jan 30 2024 10:29

6 min

'We are on the brink of World War III,” Hard to argue with Donald Trump’s assertion, if it may be seen in a more nuanced way than the bald statement implies, that we are in a new paradigm of risk – the riskiest in decades. And then we could look at the following in a lot more detail but it’s just classic Trumpian rhetoric. “This is the Trump stock market because my polls against Biden are so good that investors are projecting that I will win, and that will drive the market up,” he posted on Trust Social. “Everything else is terrible (watch the Middle East!), and record setting inflation has already taken its toll. Make America Great Again!!!”. You could write a thesis on this kind of rhetoric. It doesn’t matter if it is true or not it is not the point. It is about controlling the narrative. Trump doesn’t just control it, he owns the narrative. So is the market really pricing in a Trump win? Few seem to agree with him but all opinions on such matters are laced with prejudice.

On WW3 – really? There is a LOT of hyperbole and certainly the US is being goaded into action and you see the risk of it being pulled ever further into the regional morass. Yet the market goes up – crude oil spiked but then tumbled just as quickly from two-months – no one holds the geopolitical risk premium for long. Oil is the surest proxy and it not exactly showing much stress given the talk. Crude is weaker this morning but the risk is to the upside – Biden cannot look soft with the election coming and Trump swinging. I talked about how the Afghan debacle left Biden permanently weakened, which could put him off entanglement of a Middle Eastern kind. Meanwhile, just on oil a second, Aramco has abandoned plans to increase its maximum production capacity from 12m to 13m bpd – currently it’s only delivering 9m bpd so no particular impact on the market today.

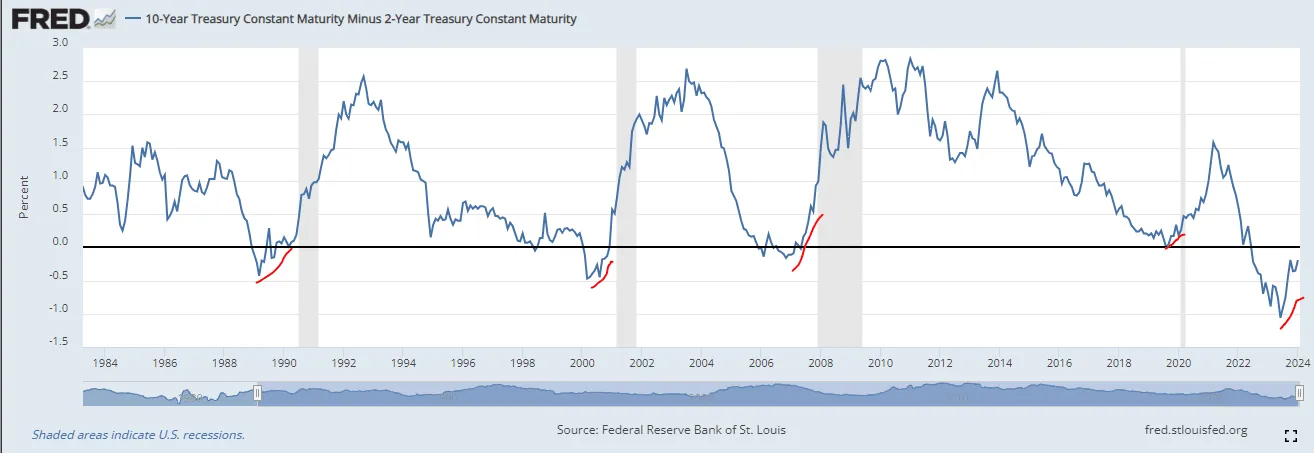

I keep seeing this and thinking it’s all just too easy...Re-steepening is always a signal of danger and the complacency about the Goldilocks disinflation soft landing is so pervasive as to be almost proverbial.

The thinking on rates I’m reading is that a little easing now will mean they don’t have to aggressively cut when the labour market craters, a little cutting now stops unemployment going higher...it’s the new fine-tuned Fed in action ... rapid disinflation requires some modest cutting to get things back on track...it’s also probably got something to do with being an election year and as we discussed in Overleveraged (our new podcast), there is bit of front-loading of cuts now to ensure they are not rushing into cuts this summer just before the election. The risk is that they're pivoting a bit early and inflation plateaus and then re-accelerates. Yields declined with the US 10yr Treasury at 4.05% as the Treasury cuts its Q1 borrowing estimate to $760bn, less than expected. The less issuance the more yields can come in.

All is bullish right now. The S&P 500 and Nasdaq 100 both closed at new record highs, and even the FTSE 100 caught up after suffering a bit of a slump in the first fortnight of the year. It’s rallied about three and a half percent since, up half of a percent this morning with European equity markets broadly higher. The FTSE 100 is now only down about 1% YTD whilst SPX is +3.31% and Nasdaq Composite +4.11%. Likewise small caps in the US are catching up with the broader market – which was largely tech driven – with the Russell 2000 up 1.67% yesterday to almost erase its YTD decline. Indeed breadth is getting much better with 84% of SPX stocks clear of their 100-day SMAs.

GS: “This has been one of the most powerful short-cycle rallies we’ve ever seen ... the 19% rip in SPX over the past three months registers in the 99th percentile of market history ... this type of move usually happens coming out of recessions.”

Chinese shares led the declines in Asia once more as Evergrande is wound up, Beijing clamps down on short selling (a topic we have covered here many times), and the details of Hong Kong’s new security law were revealed. Meanwhile the Chinese 10-year treasury futures hit a record high as investors bet on more easing. Everyone has moaned on and on (rightly) about UK equities’ valuation discount – about 10x vs about 15-20x for the rest of the world and US...well at least we are not China. The recent collapse means Chinese stocks are trading at 8x, the lowest valuation in a decade. Later today we look to the flash Eurozone GDP data, US consumer confidence and JOLTS job openings, ahead of the FOMC tomorrow and NFP on Friday, sandwiching the BoE decision on Thursday.