Wednesday Jun 28 2023 09:44

5 min

Risk tone is better again with European shares broadly higher after Tuesday saw the major bourses snap a 6-day losing streak. The FTSE 100 rallied around 0.3% in early trading on Wednesday to retest the 7,500 area, whilst the DAX added about half a percent to take another look at 16k. Oil is pressing lower despite signs of life after a larger-than-expected draw on crude stocks in the US. Yields keep pressing higher with the UK 2yr gilt yield tapping on 5.3% this morning for a fresh 15-year high....US 2yr a tad softer but you are looking at a lot of T-bill issuance still to come and this is going to need to be offering a better yield than the overnight rate – comes down to the question of whether the reverse repo facility (RRP) can drain to absorb the new issuance or not. I think the story of H2 will be the rolling over of liquidity and markets will become a lot more volatile.

US markets arrested their decline on a turnaround Tuesday. The S&P 500 put on over 1%, led by a bounce for tech. The Dow rallied 0.63% after it had fallen for 6 days straight – longest losing streak since September. The Nasdaq added 1.65% and is on track for best first half in 40 years. Data yesterday was positive and in the good news is good news camp since inflation is not racing away - CB consumer confidence at its highest in 18 months, durable goods strong, housing sales rebounding...probably need those last two hikes. Fed bank stress test results are due out later...could be interesting. PCE inflation is on Friday.

Reports suggested the Biden administration is considering new restrictions on exports of AI chips to China ...more trade wars...seemed to weigh on the Shenzhen exchange, which fell as the broader Chinese market held up. Also Chinese industrial profits fell sharply, underscoring relative weakness in the post-pandemic recovery. Meanwhile Australia’s inflation rate dropped more than expected, easing concerns about the need for more rate hikes. CPI fell to 5.6% from 6.8%, a 13-month low. It comes after slower Canadian inflation yesterday – both have tended to lead the US a bit – disinflation + soft landing type data yesterday was positive for risk.

Yen intervention coming – more strong words from the authorities overnight, emphasising they are watching FX moves with a sense of urgency...this is the kind of language that precedes intervention – 145 for USDJPY may be the line in the sand....trades around 144 now, an eight-month low for the yen. Ultimately not a to gain from this as the rates differential is just too big...BoJ has to normalise but the market doesn’t think it has the spirit to do it after some dovish messaging from new governor Ueda dashed hopes of a yen rally.

Sintra is the big ticket today with Powell, Ueda and Bailey all to speak. ECB President Christine Lagarde took a very hawkish stance yesterday, stressing that Eurozone inflation has entered a new phase with lasting implications. Speaking at the ECB Forum on Central Banking in Portugal, she warned of the persistence of inflation and the necessity for continuous price-fighting efforts. Turning a blind eye to recession risks for the time being, Lagarde took up a hawkish poise as she warned that the ECB would need to take ‘persistent’ action to avoid Euro area wages increasing by 14% by 2025.

Bit of a greedflation story here - Lagarde suggested corporations tolerate rising labour expenses in their profit margins to meet these issues – if companies retain a quarter of lost profit margin from rising labour costs over the next few years it would result in inflation stabilising around 3%, she said. “While we do not currently see a wage-price spiral ... the longer inflation remains above target, the greater such risks become,” said Ms Lagarde. The ECB chief also underlined the significance of committing to keeping interest rates higher for an extended period to minimise expectations of easing – other policymakers this morning underlining the likelihood of hikes in both July and September.

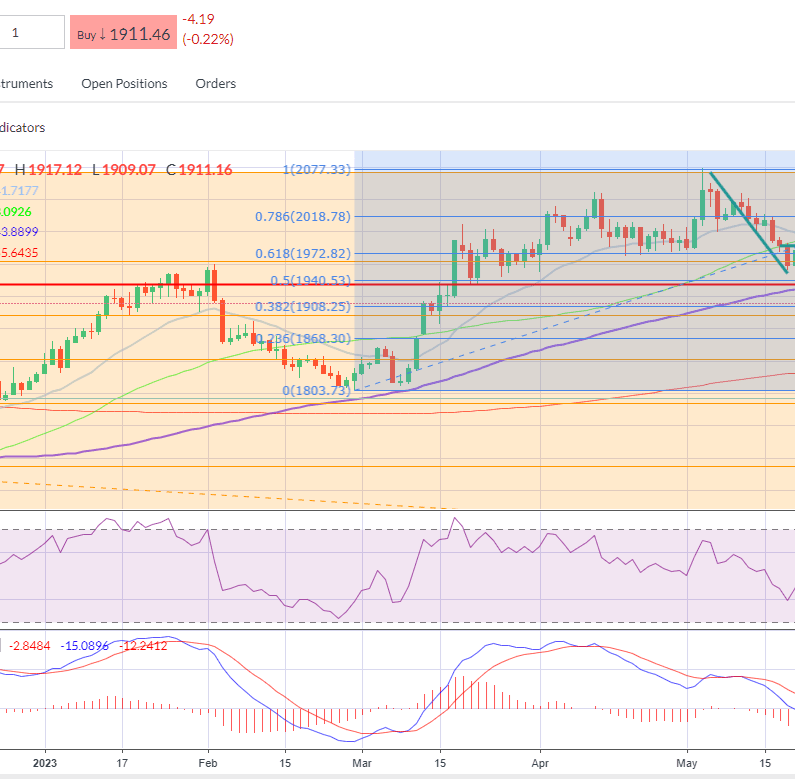

Gold keeps fading lower as short-term rates rise – higher for longer rates + soft landing type data is pressing it lower. Watching a big level here around $1,910 after breaching the 100-day line. I think a week ago Tuesday I talked about the prospect of a break lower as bulls looked exhausted and it seems to have arrived. Question is whether we hold here or retest the $1,842 area.

Oil – rate hikes worry, China gloom...but US data holding up and inventories drawing. Reserve rebuilding + OPEC actions may create a floor here as the triangle nears the end?