Friday Feb 17 2023 09:29

7 min

Hawks Circle

I’ve been saying it here for long enough – the Fed will go higher and for longer than the market keeps hoping. Now the latest PPI print and some more hawkish noises from James Bullard has scattered the bulls. The S&P 500 declined by almost 1.4% and the Nasdaq composite dropped by around 1.8% yesterday as markets moved to reprice rates expectations after the PPI came in hot at +0.7% vs the +0.4% expected. This came after the CPI earlier in the week hit +0.5% vs the +0.4% anticipated. This is telling us that inflation is proving to be stickier and broader than feared.

A Shifty Market

The shift in rates has been significant – a fortnight ago markets priced in one more hike and 2 cuts this year – now pricing the chance of 4 hikes this year. The 2yr US Treasury yield has risen from 4.1% to 4.7% in barely two weeks. The 10yr is now above 3.9%, its highest since November, from below 3.4% at the start of February. December 2023 Fed Funds implied rate has risen to 5.10% from 4.35%. What’s this telling us as investors? Fundamentally, the market and perhaps the Fed were declaring victory on inflation too soon. It’s the old pivot narrative from last year but remember the Fed was never going to pivot and now can’t because it’s become data dependent; and the data won’t allow it.

Some Market Retracement

European bourses were pushed lower by the weakness from the US session, whilst Asian markets also dropped on rates moves. The FTSE 100 pulled back around 0.4% in early trade to around 7,970, having surged above 8,000 this week. Frankfurt and Paris were down closer to 1%. Crude oil fell for a fifth straight day, with spot WTI slicing through its 50day line to $77. Rising rates and strengthening in the USD hit gold hard, which dropped to $1,819, its weakest since the end of December; now down –7% this month.

Hawks Squawk: Doves Coo

Fed hawks have been out and about on the wires, to underline the central bank’s position as the inflation data burst. St Louis Fed’s Bullard won't not rule out supporting a 50bps hike at the next meeting, adding that “it will be a long battle against inflation”. Cleveland Fed’s Mester said “we will need to bring Fed Funds rate above 5% and hold it there for some time”. Fellow Fed hawks Thomas Barkin and Elizabeth Bowman are due on the wires today so expect a bit more of the hawkishness narrative to come through, which may underpin a bid for USD and risk-off trade.

In contrast, Bank of England chief economist Huw Pill hinted policymakers are ready to slow the pace of rate hikes at the next meeting as they await the passthrough of past hikes. “Continuing to raise rates at the pace and magnitude seen over the past year would eventually – and perhaps soon – imply that monetary policy had cumulatively been tightened too much,” Pill said in a speech yesterday.

In the Charts

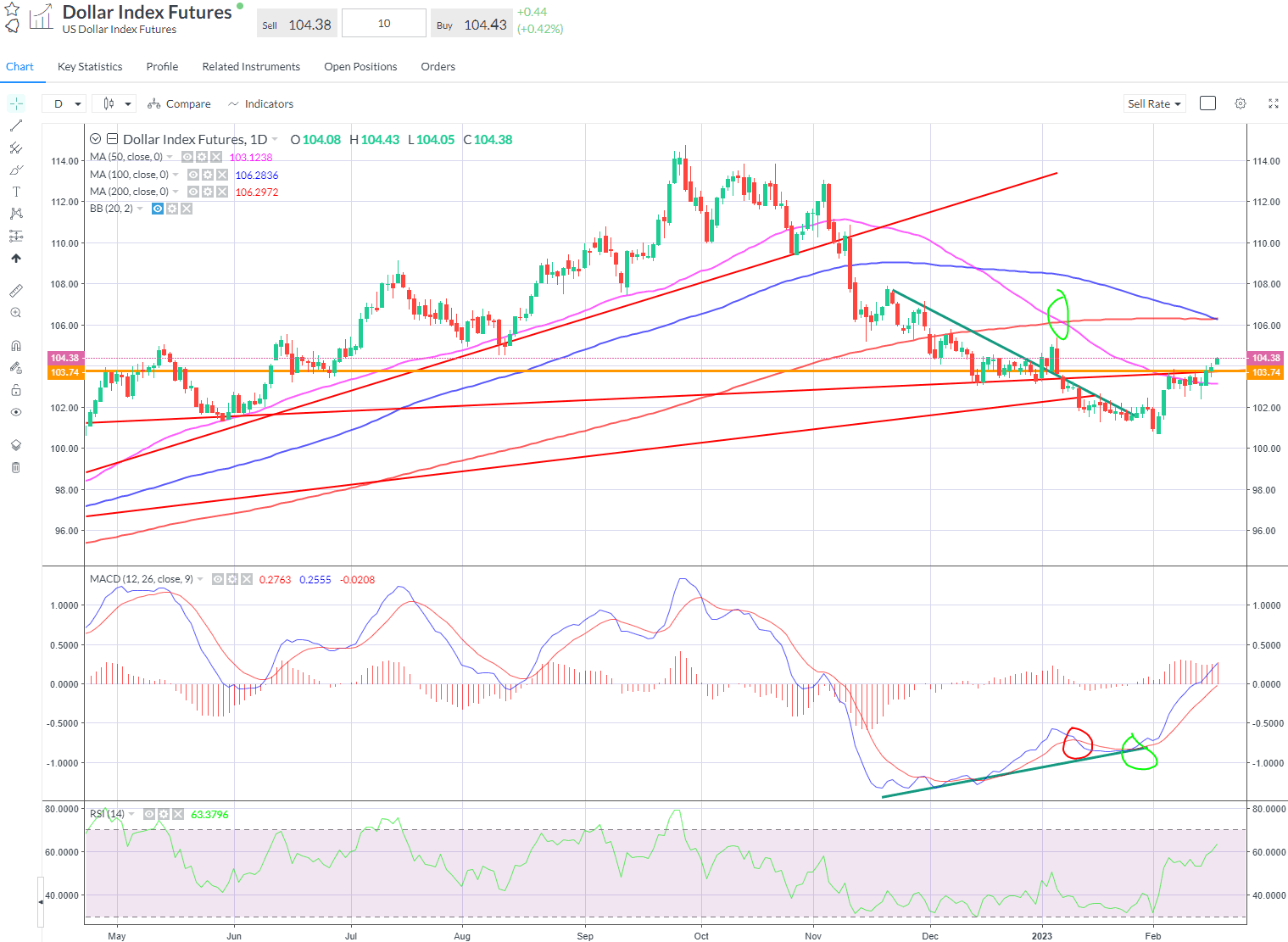

The hawkishness around the Fed is driving the dollar bid today. The market should act to price in a tad more Fed hawkishness, but we are getting closer to the point at which the market will have fully priced in the appropriate number of rate hikes – there will be uncertainty over duration for a while longer.

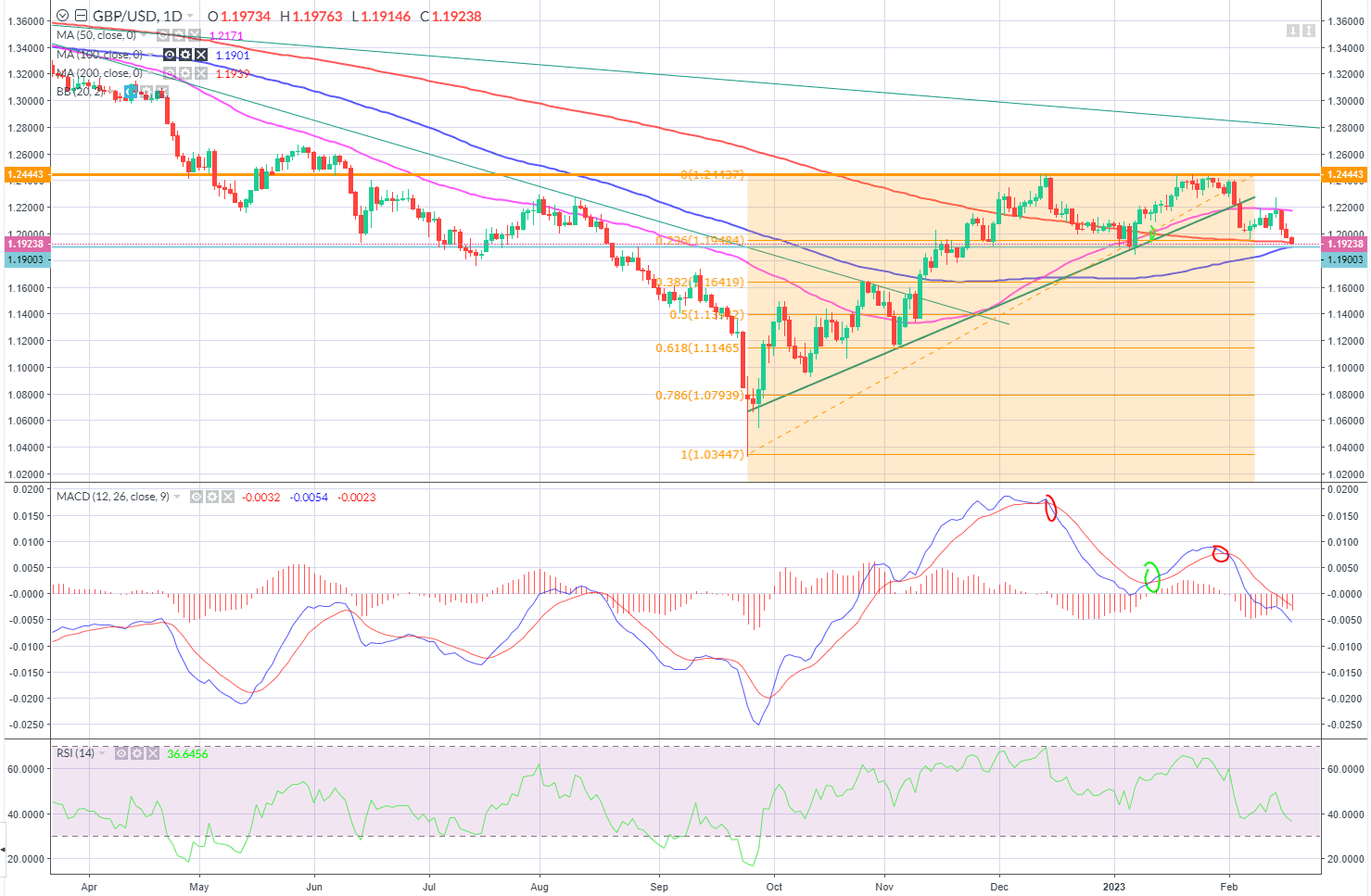

Bullish MACD crossover still in charge – divergence on the MACD earlier this year that began at the back end of 2022 was an important signal. DXY has broken free of the recent range but needs to clear 105.40 swing high for bulls to take charge.

Sterling has broken down at $1.20, dropping below its 200-day moving average for the first time since the start of January and resting at its 1.1940/50 23.6% retracement level. It’s unclear whether this now acts as support. Given the UK housing market dynamics there is a real chance it cuts later this year even if inflation remains too high – the BoE will point to easing wage pressures in the medium term as a reason, but it won’t be correct. This will fuel divergence with USD and could see 1.15 retested soon.