Thursday Oct 31 2024 09:35

6 min

A thumbs up from the market? Not so fast.

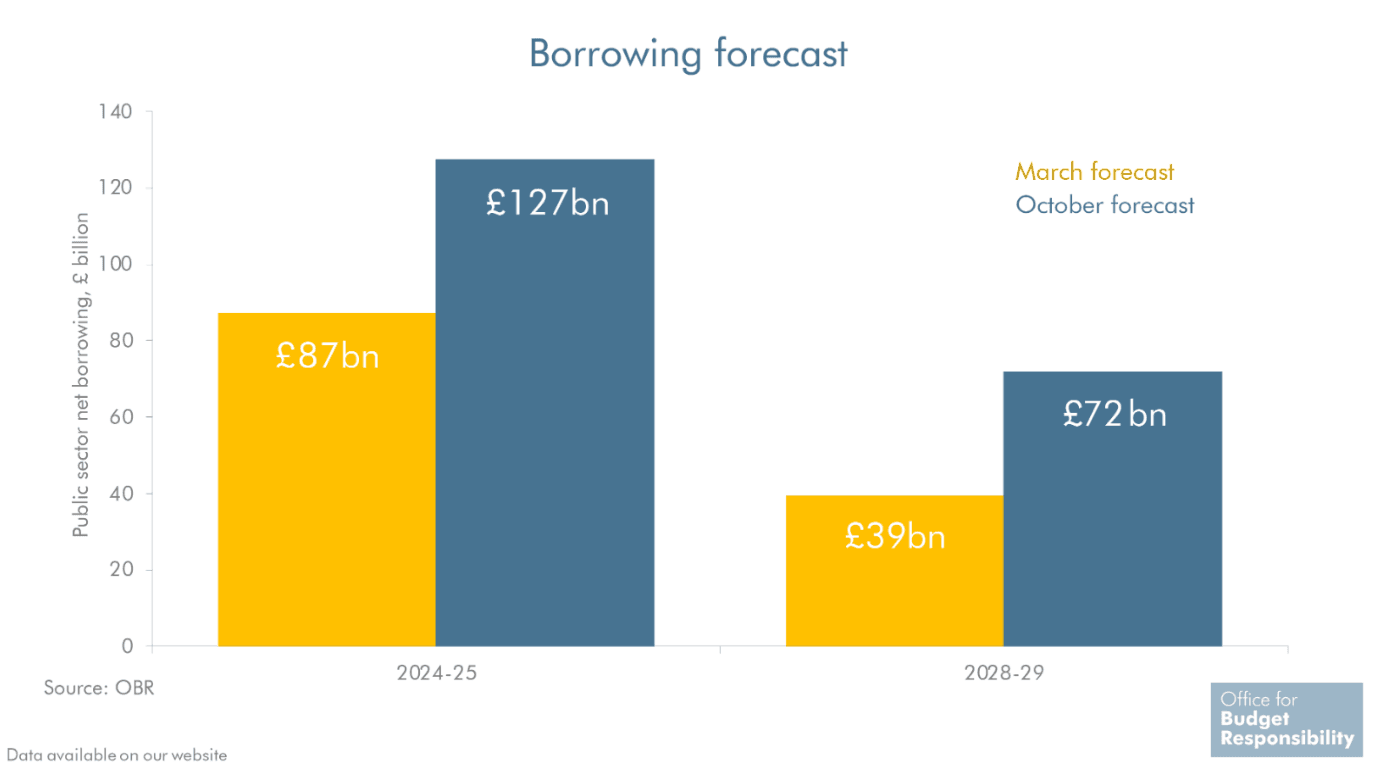

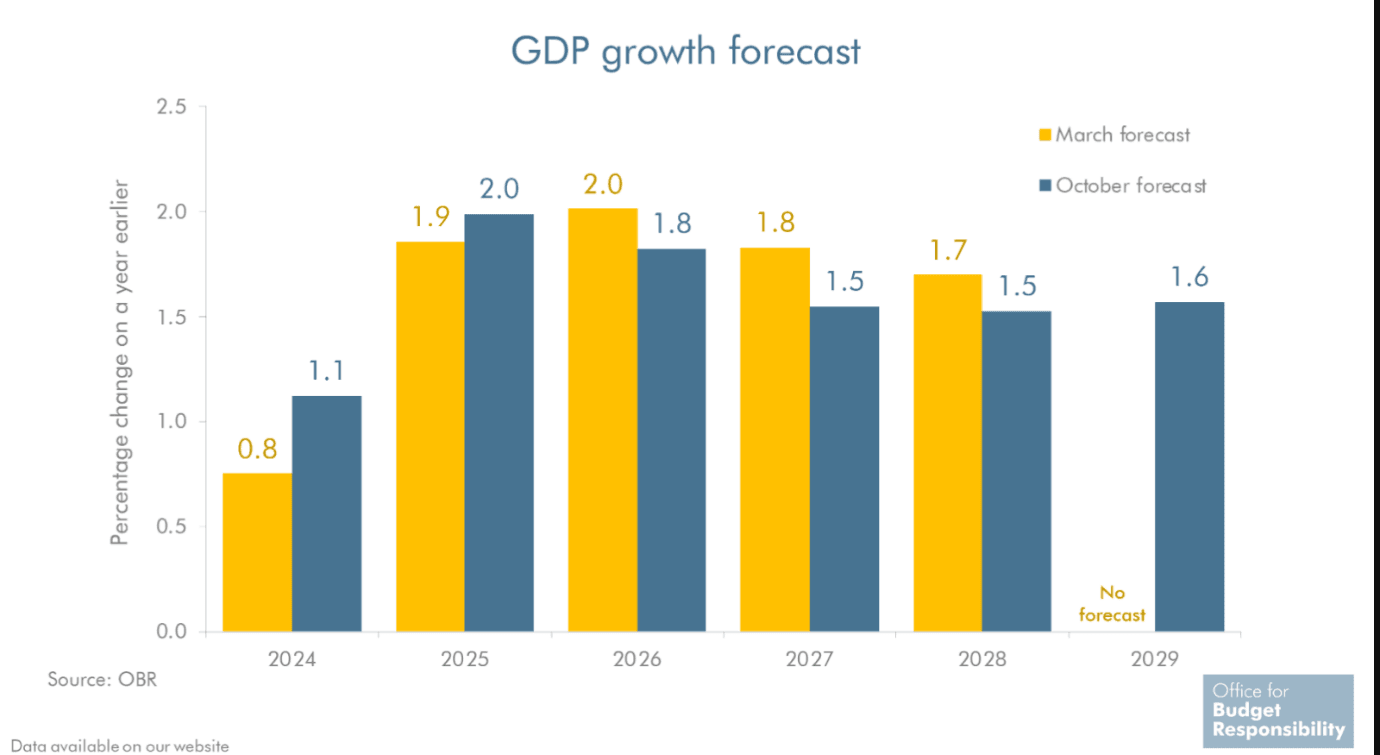

The new head of the Office for Value for Money, David Goldstone, is on the board of HS2…that great paragon of ‘value-for-money'! Can you grow the economy by taxing people more? The OBR itself doesn’t seem to think so – the standout thing about this Budget is that the growth figures remain very poor considering all the extra tax and borrowing…where is the return? And if they are all about growth, where is it due to come from?

Big market reaction in the FTSE 250, +1.64%, with a notable spike at 13:15 around the corp tax cap at 25% announcement and news on non-doms and cut to duty on draught drinks… Ceres led the way with a gain of almost 9% with green energy investment pledges, oil and gas stocks (Hunting, Harbour +5% or so) up big as tax changes were less than feared, housebuilders up with £5bn for building (Travis Perkins, Crest Nicholson +5% or so), devolution deals seen as positive, alcohol duty cut good news for pub shares (MAB +4.4%), 40% business rates relief positive for retailers and hospitality … generally picking some momentum on bigger govt investments in a range of sectors – eg £5bn into housing, £1bn into aerospace, £2bn in automotive, £2.9bn into defence...

BUT … FTSE 250 is still -0.5% over the last month, so we need to think of this as a reaction to all the flummery and kite flying – not as bad as thought for a chunk of businesses with a domestic focus. The fact is that apart from the 250 and AIM kneejerk to not being as bad as expected, we are not seeing a major ‘buy Britain’ trade…more of a ‘hold Britain’ trade rather than a ‘sell UK’ trade.

The FTSE 100 is doing nothing, really; it is still down on the day. AIM shares are rallying a bit more, with the Aim all-share +4%, and changes are less bad than feared.

Gilts – 10yr yield down about 4bps on the day…lower issuance than some had feared but the devil is in the details and longer-term forecasts…at last look it backing up…and importantly, the spread with the US Treasury had widened a bit and flipped positive – i.e. UK yield premium to the US…is this a growth premium!?

Sterling – GBPUSD initially down but then sharply reversed to its highest since Oct 21st – partly on US slowdown in growth Q3 adv GDP +2.8% vs +3.0% expected) with USD offered and EURUSD also sharply higher today though, so DO NOT READ too much into cable moves today!!

Some thoughts -

*Update: Gilts now on the move

Since sending this…woha gilt yields now really moving higher – 10yr +11bps to 4.43%...then back down 5bps to 4.38% in short order – volatility selling which is not good to see…2yr surging 12bps then trimmed a bit…

..reflects the major concern we had before the Budget at last – markets were pretty sanguine at first but now reflecting a premium due to extra borrowing and slack growth outlook. Spending a lot for not very much, and bond vigilantes are sniffing it out.

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.