Wednesday Mar 20 2024 12:33

7 min

The British pound winged around a bit on a sharply lower inflation reading that gives the Bank of England (BoE) more rope to slacken its message a bit tomorrow.

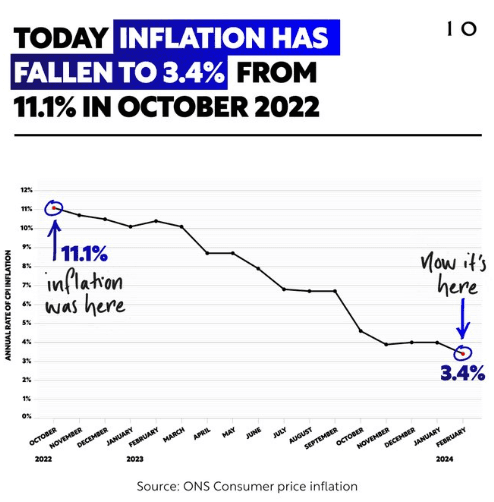

The UK Consumer Price Index (CPI) declined to 3.4% in February from 4.0% in January, whilst core inflation slipped to 4.5% from 5.1%.

It’s good headline news, even if services inflation remains way too high at a decidedly sticky 6.1% — the BoE is not in a rush, even if its bias is leaning towards cutting rather than hiking more… Ultimately it’s kind of what I’ve been talking about for ages now — the fine line between balancing growth and inflation because the latter is out of the bottle.

Once it’s out, it’s very hard to put it back in, and we are still in that reality – without really smashing the economy, which central banks are not keen to do, they have to accept permanently higher inflation and they won’t have the forces of hyper globalisation to help them out this time. They may have the forces of greater productivity, but until Britain weans itself off cheap low-skilled foreign labour, productivity won’t improve.

The government made the most of the decline, posting this:

GBP to USD was quite volatile on the news but left as you were – off yesterday’s lows but the bias remains bearish.

European stock markets were lower on Wednesday morning, led by a sharp fall for luxury stocks on a profit warning from Kering. The CAC declined 0.75%, whilst the DAX index and FTSE 100 were down just 0.1%.

Stocks had rallied on Tuesday, the FTSE 100 was up about 0.2%, holding its position above 7,700, whilst the DAX index inched closer to 18k. Wall Street also finished Tuesday’s session on a firmer footing with the S&P 500 up 0.56% and the Dow rallying 0.83%. Tech was broadly higher to lift the Nasdaq composite up 0.4% for the day.

All of this is kind of a preamble ahead of the main event – Jay Powell today will outline what the Fed’s thinking on inflation is and how many cuts we can expect this year. The assumption is that the Fed keep rates on hold and maintain its guidance for 2024/25 unchanged, though it could raise the dots for 2026.

Expect also a plan to taper quantitative tightening (QT) that could begin quite soon. It’s a delicate balancing act – the Fed does not want to see inflation reaccelerate. Recent data on that front has not been terribly encouraging – disinflation has stalled. But it doesn’t want a recession. Currently, the FOMC thinks the neutral rate is about 2.5%, which means there are 300 basis points of cuts just to get too neutral. That’s why despite the inflation data we’ve had lately, the market is still minded to think it will start cutting before H1 is out.

The gold price is drifting down the channel – waiting for the Fed to call it.

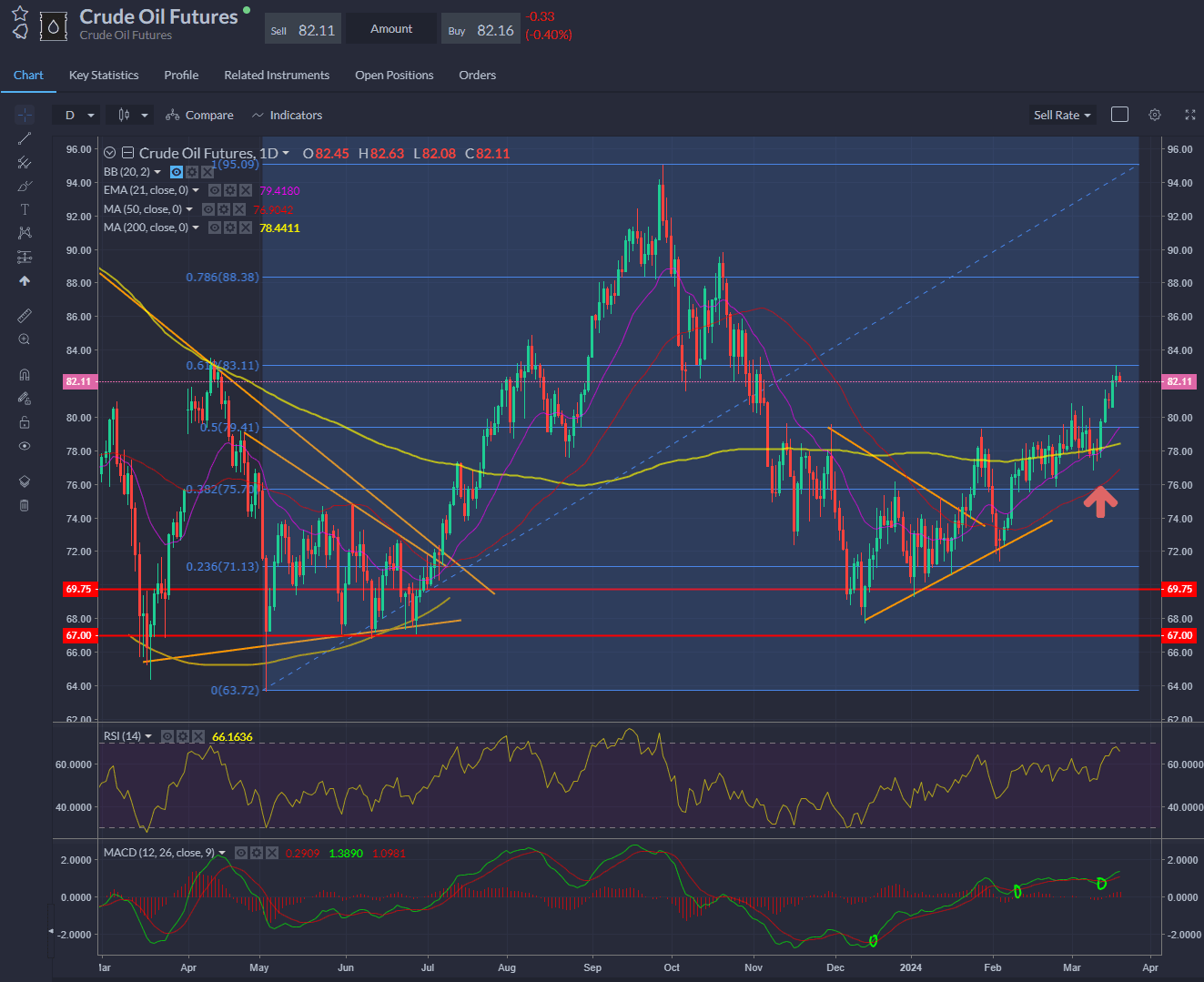

Oil prices rose to October highs, with market participants pointing to Ukrainian drone attacks on Russian refineries and OPEC+ supply cuts. WTI showing a clean pair of heels after breaking through its 200-day line, resistance found at the 61.8% retracement level.

Cocoa price – top in? Not so sure, there seems to be a scramble for beans still.

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.