Wednesday May 20 2020 12:43

1 min

Today’s incoming US crude oil inventories data is expected to show a build of 1.1 million barrels.

However, last week’s report revealed a surprise draw of over 700,00 barrels, and yesterday’s data from the American Petroleum Institute showed a drop of 4.8 million barrels. Analysts had forecast a 7.6 million build.

If today’s official figures from the Energy Information Administration are in the same ballpark as the API’s it would represent the biggest decline in stockpiles this year. So far in 2020 the two sets of reports have largely printed in line with each other, although historically there can be large discrepancies.

Futures on West Texas Intermediate crude oil for delivery in August continue to trade around the nine-and-a-half-week high struck on Monday. Prices are up around $0.80, or 2.3%.

Brent oil futures for July are trading $0.90, or 2.6%, higher.

Concerns over the vast demand destruction caused by the Covid-19 pandemic continue to weigh on oil markets; gains for WTI could be undone if the EIA crude oil inventories data does show another build.

Asset List

View Full ListLatest

View all

Sunday, 20 April 2025

6 min

Saturday, 19 April 2025

5 min

Thursday, 17 April 2025

7 min

Tuesday, 22 April 2025

Indices

Commodity market today: Crude Oil Fluctuates as OPEC+ Modifies Production Goals

Tuesday, 22 April 2025

Indices

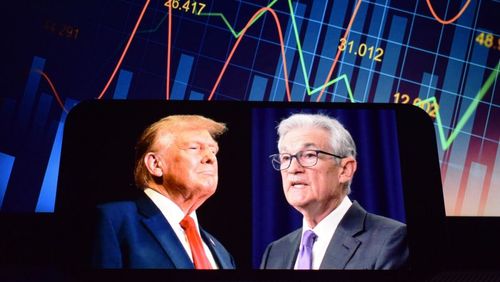

Morning Note: Trump Calms Fed Fears; Tesla Disappoints; UK Trade Talks Begin