Thursday Oct 3 2024 12:31

5 min

Joe Biden responded “no” when asked if the US would support Israel attacking Iran’s nuclear sites, which echoed his one-word “don’t” command to Iran to dissuade them from going after Israel. I remember when the president could conduct international diplomacy on Twitter – and it seemed to have worked.

Oil remains on the front foot with the Middle East situation tense. It’s a tricky one for traders – an escalation of conflict versus ample supply and worries about deteriorating demand.

Oil futures jumped a lot on Tuesday and then pared gains with the rally fizzling out quickly without an immediate major Israeli response, before rising again this morning. OPEC is planning to stick to its production increase in December – reports of this last week had already pushed oil prices lower, so may be largely priced in. The geopolitical situation is the main driver for short-term moves right now.

Сalculate your hypothetical P/L (aggregated cost and charges) if you had opened a trade today.

Market

Instrument

Account Type

Direction

Quantity

Amount must be equal or higher than

Amount should be less than

Amount should be a multiple of the minimum lots increment

USD

EUR

GBP

CAD

AUD

CHF

ZAR

MXN

JPY

Value

Commission

Spread

Leverage

Conversion Fee

Required Margin

Overnight Swaps

Past performance is not a reliable indicator of future results.

All positions on instruments denominated in a currency that is different from your account currency, will be subject to a conversion fee at the position exit as well.

Currency markets are also seeing some Middle East concerns – a safe-haven bid for the US dollar and the implication that a conflict would dampen economic optimism and perhaps require more aggressive easing in the UK and Europe. Gold pulled back chiefly on the strong dollar.

Stocks in Europe are generally weaker amid a broad risk-off tone. The FTSE 100 initially rose about a quarter of one percent with oil heavyweights Shell and BP considerable weightings in the index benefitting from the oil price, before the blue-chip index was weighed down into the red by the broader selling pressure.

Yesterday also saw big gains for energy stocks in the US. Shell is now up 5% for the week, whilst the XLE Energy ETF is up 6%. Tesla shares fell as the EV maker missed delivery expectations, Nike tumbled as it pulled its full-year guidance. Hong Kong stocks were lower in volatile trade whilst mainland China was closed for a holiday. Tokyo rose on weakness in the Japanese yen.

There is a bit of nervousness out there but not some overweening concern that the US is going to get pulled into a conflict with Iran. The Vix spiked on Tuesday but the major indices on Wall Street closed a little higher on Wednesday. The dollar continues to attract big safe haven flows – it had been well trodden down and positioning on the short side was stretched.

And we’ve had some rather strange comments from new Japanese PM Shigeru Ishiba which sparked some aggressive yen selling. "I do not believe that we are in an environment that would require us to raise interest rates further," he said after a meeting with Bank of Japan governor Ueda.

Meanwhile, sterling was offered on some comments from Bank of England Governor Andrew Bailey, who dangled the prospect of more aggressive rate cuts. GBPUSD fell to a two-week low – lots of downside risks apparent all of a sudden after some bold moves higher, but the UK is over the worst of the deleveraging and Labour is in a good position cyclically. European Central Bank President Christine Lagarde also indicated said the October rate cut is on.

ADP payroll data was better than expected ahead of the nonfarm payrolls (NFP) report on Friday. Weekly unemployment claims data is due out later, expected at 220,000.

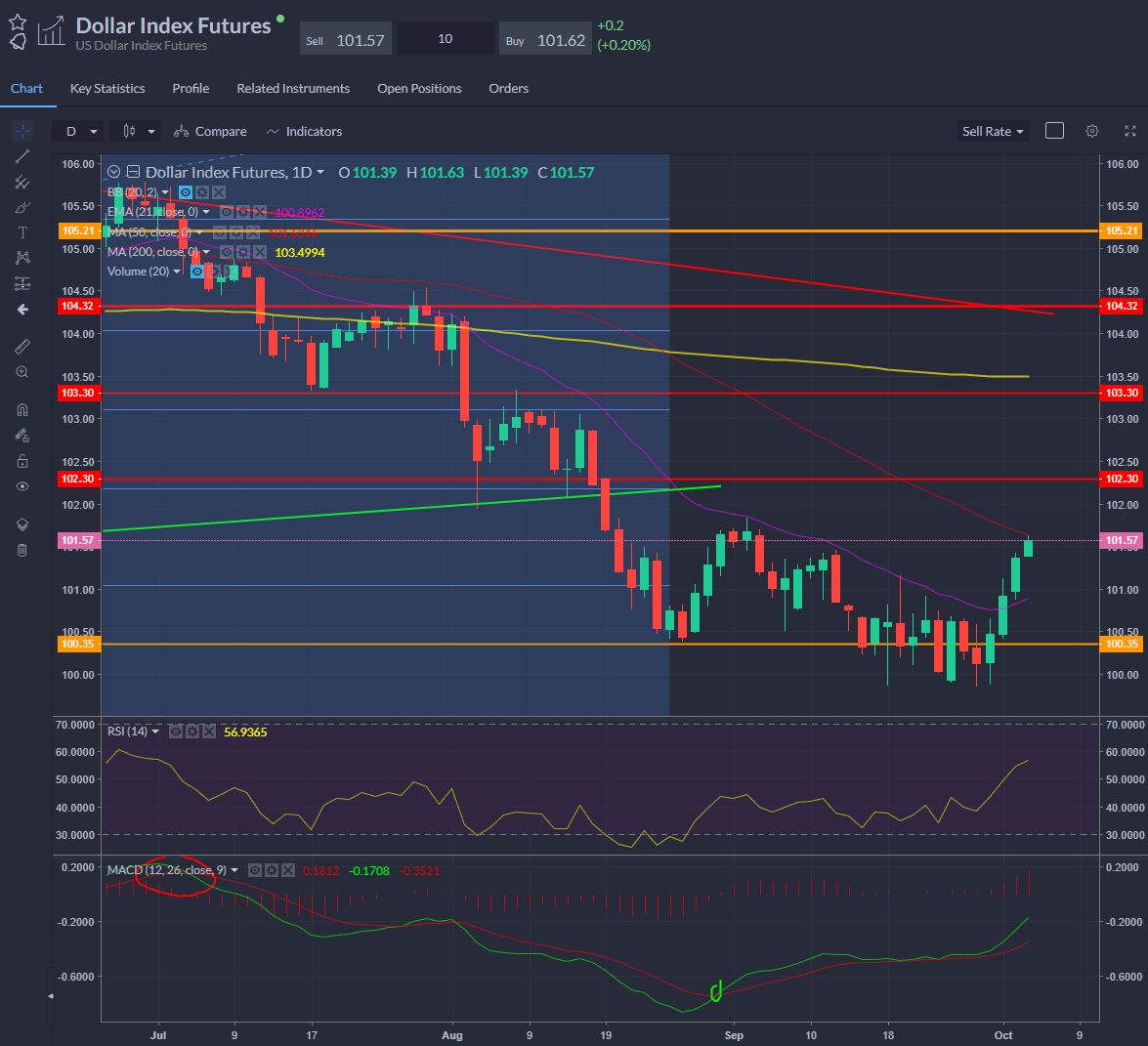

As noted earlier — the US dollar caught a haven bid but had already turned higher before the Iran attack.

The US dollar index (DXY), a gauge of the greenback’s strength in relation to a basket of major currencies, has gained close to 1% over the past 5 days, last trading at 101.83. The DXY is up 0.5% year-to-date as of Oct. 3.

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.

Asset List

View Full ListLatest

View all

Tuesday, 8 April 2025

4 min

Monday, 7 April 2025

6 min

Monday, 7 April 2025

4 min