Wednesday Nov 6 2024 10:30

3 min

After about an hour of trade and time to digest the US election result, the risk is well bid: European indices are on the front foot, catching a ride with US futures on a strong play for equity markets on both sides of the pond. FTSE, CAC, and DAX all +1% early doors. Gold has come back a bit with the dollar giving up some of its gains in EM and in G10 spaces…yields are still firmer and more of a risk-on play – hard not to rally when the Dow is up 1000pts…plus this is the first inning of a long game running into the inauguration.

Big gainers in London include Ashtead, which is a straight US cyclical growth play – read across to the US small caps is clear—and then Ferrexpo – Ukraine peace play.

In the US, equities are ripping higher on the Red Wave - Dow looks to open at a record, up more than 1,000pts, Russell 2K +5%

Asian markets were higher except China with the Hang Seng –2% and mainland China marginally weaker – China is, of course, the play re tariffs, but you have to think that a Trump win forces the hand of Beijing to unleash full QE. Nikkei rallied on weaker JPY.

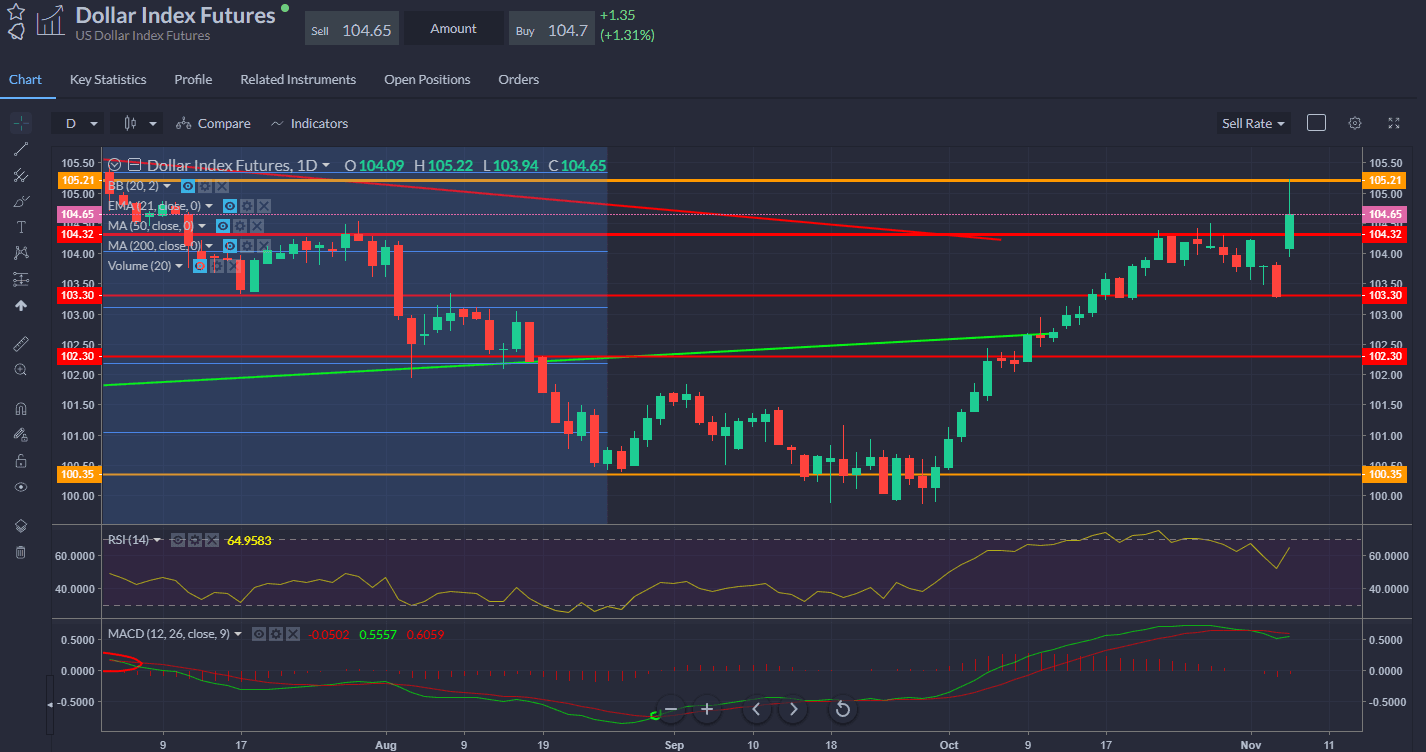

DXY – dollar is notching big gains but is currently a wee bit off its highs...tough for currencies to keep selling off when risk is so strongly big in the equity space...plus the result, whilst maybe more emphatic than hoped for, was largely expected by the market.

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.

Asset List

View Full ListLatest

View all

Thursday, 20 February 2025

8 min

Thursday, 20 February 2025

5 min

Thursday, 20 February 2025

2 min