Thursday Apr 10 2025 08:56

7 min

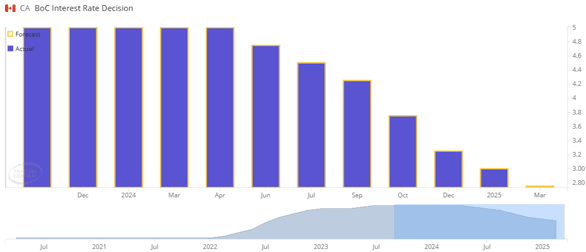

On Wednesday, 16 April, U.K. CPI YoY is projected to rise to 3.2% at 06:00 GMT, with MoM steady at 0.4%, while U.S. Retail Sales are forecast to slow to 2.6% YoY and 0.1% MoM at 12:30 GMT, and the BoC Interest Rate Decision is expected to remain at 2.75% at 13:45 GMT.

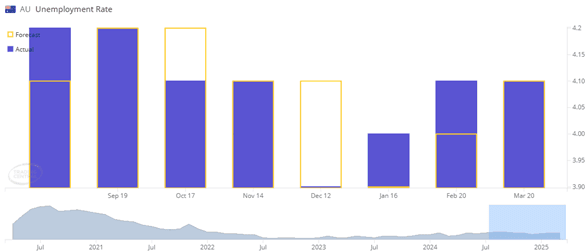

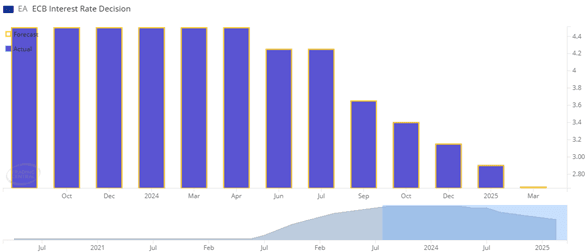

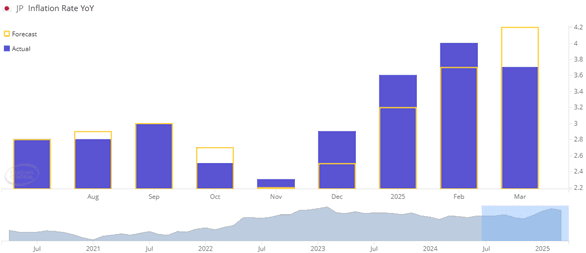

On Thursday, 17 April, Australia’s Unemployment Rate is expected to stay at 4.1% at 01:30 GMT, the ECB Rate Decision is anticipated to cut from 2.65% to 2.4% at 12:15 GMT, and Japan’s Inflation YoY is projected to rise to 4.3% at 22:30 GMT.

Here are the week’s key events:

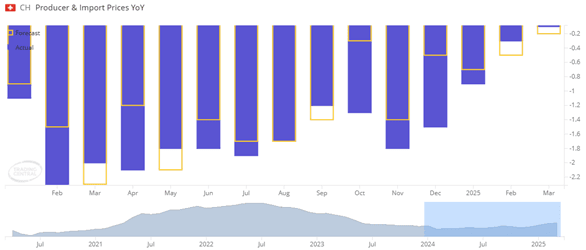

In February, Switzerland’s Producer Price Index (PPI) showed a year-over-year decline of 0.1%, while the month-over-month figure rose by 0.3%. For March, market expectations point to a YoY increase of 0.1% and a MoM rise of 0.3%, unchanged from February's monthly pace. The anticipated shift in the year-over-year figure from -0.1% to +0.1% likely reflects base effects and stabilisation in input costs. Meanwhile, the unchanged MoM forecast of 0.3% suggests continued moderate cost pressures at the producer level, likely driven by stable commodity prices, recovering external demand, or seasonal pricing factors. This data is set to be released on 7 April at 06:30 GMT.

(Switzerland PPI YoY Chart, Source: Trading Central)

Top US company earnings: Goldman Sachs (GS)

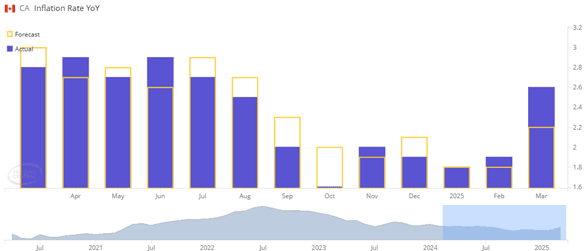

Canada's year-over-year inflation rate stood at 2.6% in February, and market expectations for March project a slight decline to 2.5%. The anticipated moderation in inflation is likely driven by base effects, easing energy prices, and slower growth in core components such as food and shelter. As high price levels from early 2024 roll off the comparison base, and assuming more stable monthly price changes, the YoY rate may edge down. This data is set to be released on 15 April at 12:30 GMT.

(Canada Inflation Rate YoY Chart, Source: Trading Central)

Top US company earnings: J&J (JNJ), Bank of America (BAC)

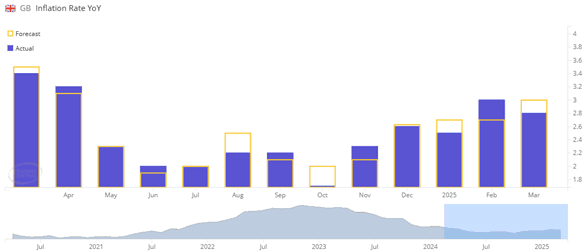

The UK’s year-over-year inflation rate was 2.8% in February, which is expected to rise to 3.2% in March. Meanwhile, the month-over-month inflation rate held steady at 0.4% in February, with forecasts pointing to the same 0.4% increase in March. The projected uptick in the annual inflation rate can be attributed to base effects, as March 2024 prices are being compared against a relatively low base from March 2023. Despite this, the stable MoM forecast at 0.4% suggests that price momentum on a short-term basis remains moderate but consistent, potentially reflecting persistent underlying inflation in key sectors, even as the Bank of England maintains a cautious stance on monetary policy. This data is set to be released on 16 April at 06:00 GMT.

(U.K. Inflation Rate YoY Chart, Source: Trading Central)

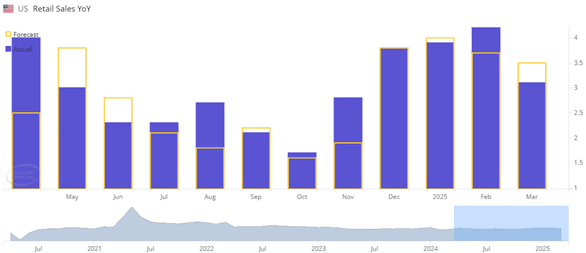

U.S. retail sales rose 3.1% YoY in February, but growth is expected to slow to 2.6% in March, reflecting softer consumer demand and the impact of higher interest rates on spending. On a monthly basis, sales increased 0.2% in February, with a smaller 0.1% gain projected for March. This suggests a deceleration in momentum as households become more cautious amid tighter financial conditions and lingering inflation pressures. This data is set to be released on 16 April at 12:30 GMT.

(U.S. Retail Sales YoY Chart, Source: Trading Central)

The Bank of Canada’s most recent interest rate decision held the policy rate steady at 2.75%, and the upcoming decision is also expected to maintain the rate at 2.75%. This expectation reflects the central bank’s cautious approach as inflation trends gradually ease but remain above target, while economic growth shows signs of slowing. Holding rates steady allows policymakers to assess the full impact of previous hikes without further tightening conditions. This data is set to be released on 16 April at 13:45 GMT.

(BoC Interest Rate Decision, Source: Trading View)

Top US company earnings: Louis Vuitton (LVMUY), ASML (ASML)

Australia’s unemployment rate stood at 4.1% in February and is expected to remain unchanged at 4.1% in March. The steady forecast reflects a stable labour market, where job growth and participation rates are balancing out. While there may be some softening in hiring due to slower economic growth, the resilience in employment levels suggests that no significant shifts in unemployment are anticipated for the time being. This data is set to be released on 17 April at 01:30 GMT.

(Australia Unemployment Rate Chart, Source: Trading Central)

The European Central Bank’s most recent interest rate decision set the benchmark rate at 2.65%, but the upcoming decision is expected to result in a cut to 2.4%. This anticipated reduction reflects slowing inflation across the eurozone and weakening economic activity, prompting the ECB to consider easing policy to support growth. With price pressures moderating and demand softening, a rate cut would align with the ECB's goal of maintaining stability while preventing a deeper economic slowdown. This data is set to be released on 17 April at 12:15 GMT.

(ECB Interest Rate Decision Chart, Source: Trading Central)

Japan’s year-over-year inflation rate was 3.7% in February, with March’s figure expected to rise to 4.3%. The projected increase is likely driven by higher energy and food prices, along with a weakening yen that continues to inflate import costs. Additionally, seasonal factors and recent wage adjustments may contribute to stronger price pressures, supporting expectations of a temporary uptick in inflation. This data is expected to be released on 17 April at 23:30 GMT.

(Japan Inflation Rate YoY Chart, Source: Trading Central)

Top US company earnings: Taiwan Semiconductor (TSM), UnitedHealth (UNH)

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.