Friday Jan 31 2025 06:06

12 min

During the week commencing the 3rd of February, market participants will be keeping a close eye on the US labour market, with the country delivering its first job numbers, related to this year. The US will deliver the long-awaited NFP and unemployment figures for January, which has been rising during the last three releases. New Zealand and Canada will also be among those countries to shows what’s happening in their labour market. Trade balance numbers will be delivered by various top countries, such as Canada, Turkey, Australia and Germany.

Here are the week’s key events:

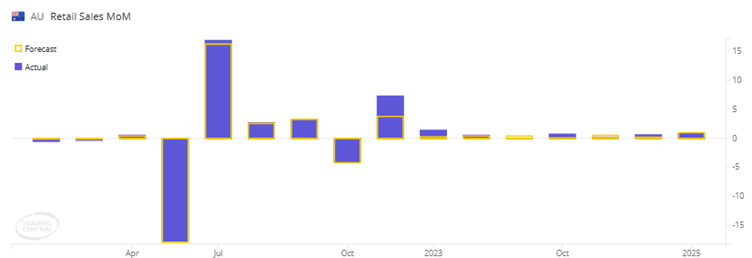

We will have a relatively active start of the week, as Australia will kick off the economic calendar with the country’s retail sales figures on a MoM and QoQ basis. At the time of writing, we do not have a forecast for the QoQ figure, however, the MoM number is believed to have slid slightly lower. We believe there might not be major shifts in the AUD against its major counterparts as the currency could remain vulnerable to the broader market trends.

(Source: Trading Central)

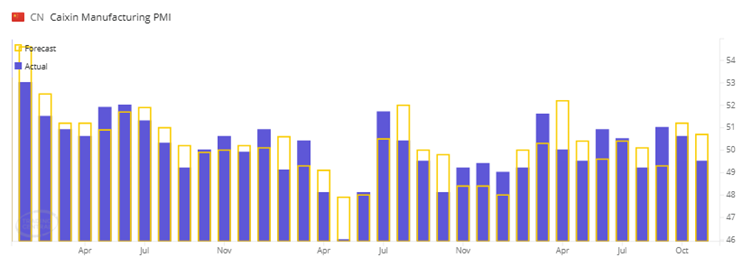

Although mainland China will continue to celebrate the Chinese New Year, we should be receiving the Caixin manufacturing PMI reading for January. For now, the forecast remains the same as previous, however, if we look at the most recent China manufacturing PMI, released on 27th of January, the figure fell into contraction, coming out at 49.1. This makes market participants believe that there might a surprise to the downside with the Caixin number as well. A drop into contraction may hold the FTSE China A50 Index from moving in the upwards direction. That said, if we see any official government rhetoric about supporting the market by announcing possible stimulus, this could change sentiment towards a more positive one.

(Source: Trading Central)

During the European trading hours, the EU will provide us with a glimpse into its inflation number for January, by delivering the preliminary CPI figure.

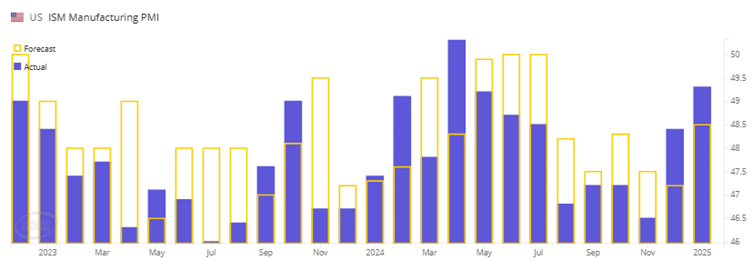

To finish off the day, the US will release the ISM manufacturing PMI figure for the month of January. The number has been on a rise since October of last year, however it continues to show readings below 50, indicating contraction. Even if we see a higher number than the previous, if it still comes out below 50, this might not be taken as a positive for the US dollar.

(Source: Trading Central)

Top US company earnings: Palantir, Tyson Foods

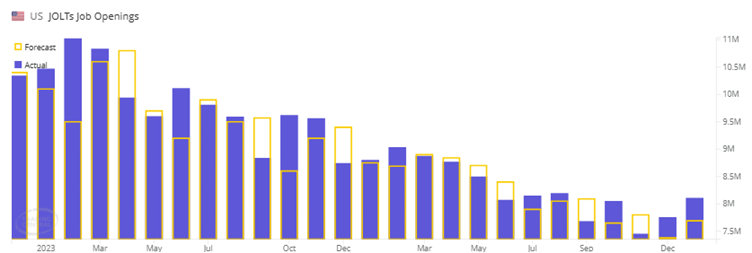

Given that its the week of economic data relating to the US labour market, on Tuesday we will get the JOLTs job opening figures. At the time of writing, we do not see any forecast, however, the index has been showing upside momentum after bottoming back in October.

(Source: Trading Central)

Top US company earnings: BAlphabet, PepsiCo, AMD, Pfizer, PayPal, Mondelez

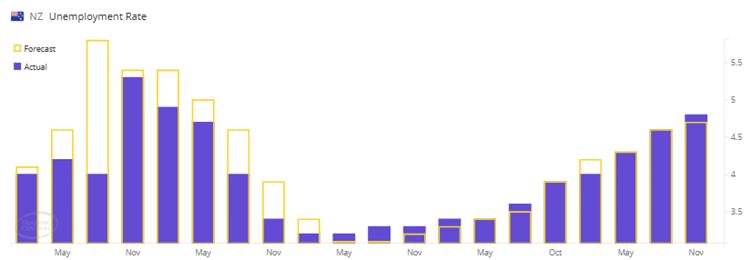

On Wednesday, during the early hours of the Asian morning, we will be getting the New Zealand job numbers for Q4. The country is expected to show a higher unemployment number than the previous 4.8%. From around mid-2022, the official percentage of people without work in the country has been on a rise. This, of course, has not been playing well for NZD against its major counterparts, as the currency kept on devaluating, due to central bank easing. If we see a lower than the forecast unemployment figure, this might push NZD a bit lower against its major counterparts.

(Source: Trading Central)

Australia and Japan will show us what’s happening with their final services PMI figures for January. For Japan, we are expecting the number to stay in the lower 50s, but for Australia, the question is, can the index jump back into expansion territory? We may see mild volatility in AUD and JPY pairs straight after the release.

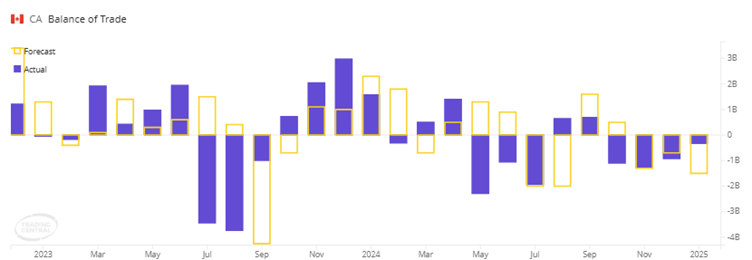

Canada will be delivering its trade balance figure for December. For the past 4 months, the number has been in negative territory, however, it continues to hold the upwards trajectory. We might see some positivity in CAD, if the figure jumps into surplus territory, that said, the Canadian currency could remain mostly vulnerable to fluctuations in the oil market.

(Source: Trading Central)

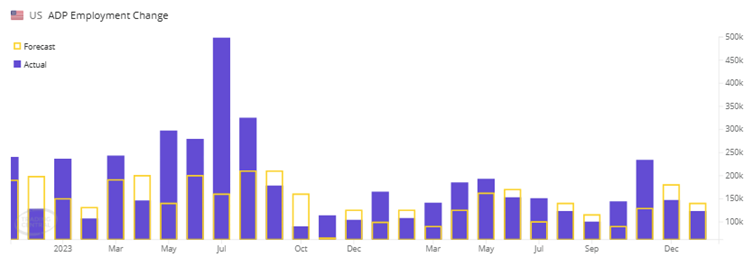

To continue on the topic of the US labour markets reports, we will be receiving the ADP employment change reading for January. Although the number still remains in positive territory, the figure stayed on the lower side, in comparison to activity seen in 2023. The closer it gets to zero, the more concern this may raise among market participants. Given that the index is carefully monitored by those, who are trying to predict the Friday’s NFP figure, we strongly advise not to gauge that number with the ADP one.

(Source: Trading Central)

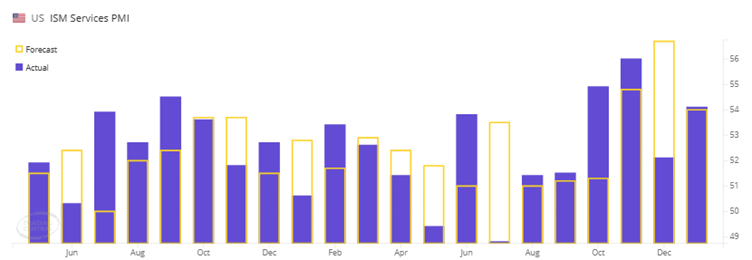

US will also deliver the ISM Services PMI reading for January. At the time of writing, we do not have any forecast available, but by looking at historic data we can see that the index changed its course towards the downside. If the actual reading comes out lower than the previous, we might see some temporary weakness in the US indices.

(Source: Trading Central)

Top US company earnings: Walt Disney, Qualcomm, Uber Tech, Yum! Brands.

On Thursday, Australia will deliver its trade balance figure for December, where the current expectation is for a slight drop. Later on, the EU will be releasing their retail sales numbers for December on both MoM and YoY basis.

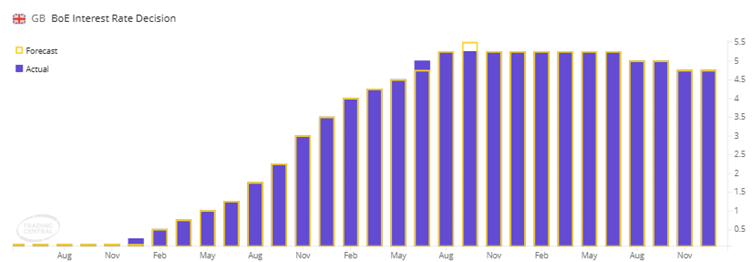

However, probably, the main spotlight will fall on the Bank of England interest rate decision, which will be the first one in 2025. For now, the expectation is to see another 25bps cut, bringing the rate to +4.50%. Since peaking in at the end of 2023, the BoE had made two 25bps rate cuts. Such actions have not played out positively for the British pound, especially against the US dollar, despite the Fed doing more cuts. If the BoE continues cutting, but the Fed takes a pause, this could potentially allow the bears to take control again of GBPUSD, at least for some time in the near future.

(Source: Trading Central)

Top US company earnings: Amazon, Eli Lilly, Philip Morris, Kellanova, Hershey Co.

On Friday, the economic calendar is full of various small data releases, like the German December trade balance, which is forecasted to show a slight increase in the surplus. If so, this may help boost investor morale, pushing away the negativity that currently surrounds the German economy.

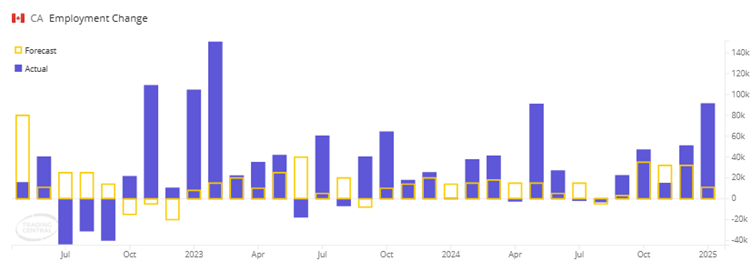

However, the most anticipated releases will be the Canadian and US employment numbers. Canada is believed to show a slight increase in the unemployment number, going from 6.7% to 6.8%. Also, we will be carefully monitoring the country’s full-time employment change figure. The past four releases showed positive results, however, a sudden drop close to, or below zero, might playout negatively for the CAD.

(Source: Trading Central)

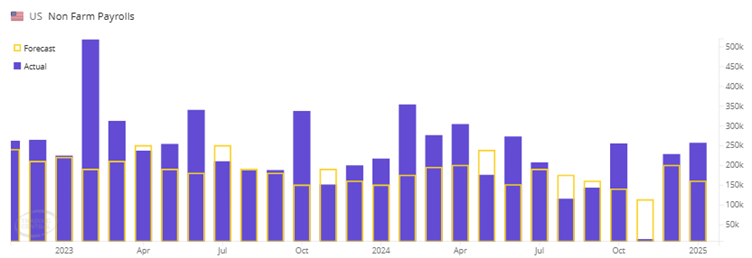

However, the big spotlight will be on the first 2025 Non-Farm Payroll number from the US. At the time of writing, there is no forecast available, however, the latest figures have been on the higher side. An actual reading above the 200k mark could keep investors positive and show that the US labour sector is still doing well. That said, a reading below the 150k zone could make market participants worry slightly.

(Source: Trading Central)

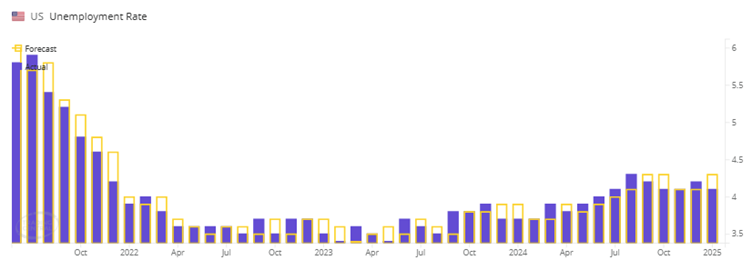

When we are talking about the Fed, the Bank will keep a close eye on the unemployment rate. If the reading comes out above 4.2%, this will place the US unemployment rate back to levels seen at the end of 2021. Investors could get spooked temporarily, leading to some possible selling of US equities. That said, some might see it as a positive, as it may force the Fed to increase the amount of rate cuts this year.

(Source: Trading Central)

Top US company earnings: CBOE Global.

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.