CFD's zijn complexe instrumenten en gaan gepaard met een hoog risico snel kapitaal te verliezen als gevolg van hefboommechanismen. 77.3% an de retailbeleggers lijdt verlies op de handel in CFD's met deze aanbieder. U dient zorgvuldig te overwegen of u begrijpt hoe CFD's werken en of u het zich kunt veroorloven om hoge risico's te nemen op het verliezen van uw kapitaal.

Woensdag Mar 12 2025 07:46

5 min.

The U.S. year-over-year (YoY) inflation rate for January stood at 3%, with February's figure anticipated to edge down slightly to 2.9%. Meanwhile, the month-over-month (MoM) inflation rate was 0.5% in January and is projected to moderate to 0.3% in February. This data is set to be released on 12 March at 12:30 GMT.

This expected decline is likely due to a combination of factors, including easing energy prices, improved supply chain conditions, and tight monetary policy by the Federal Reserve, which continues to curb demand-driven inflation. Furthermore, the YoY slower rise may be due to base effects from the previous year, and the MoM deceleration may be caused by seasonal changes.

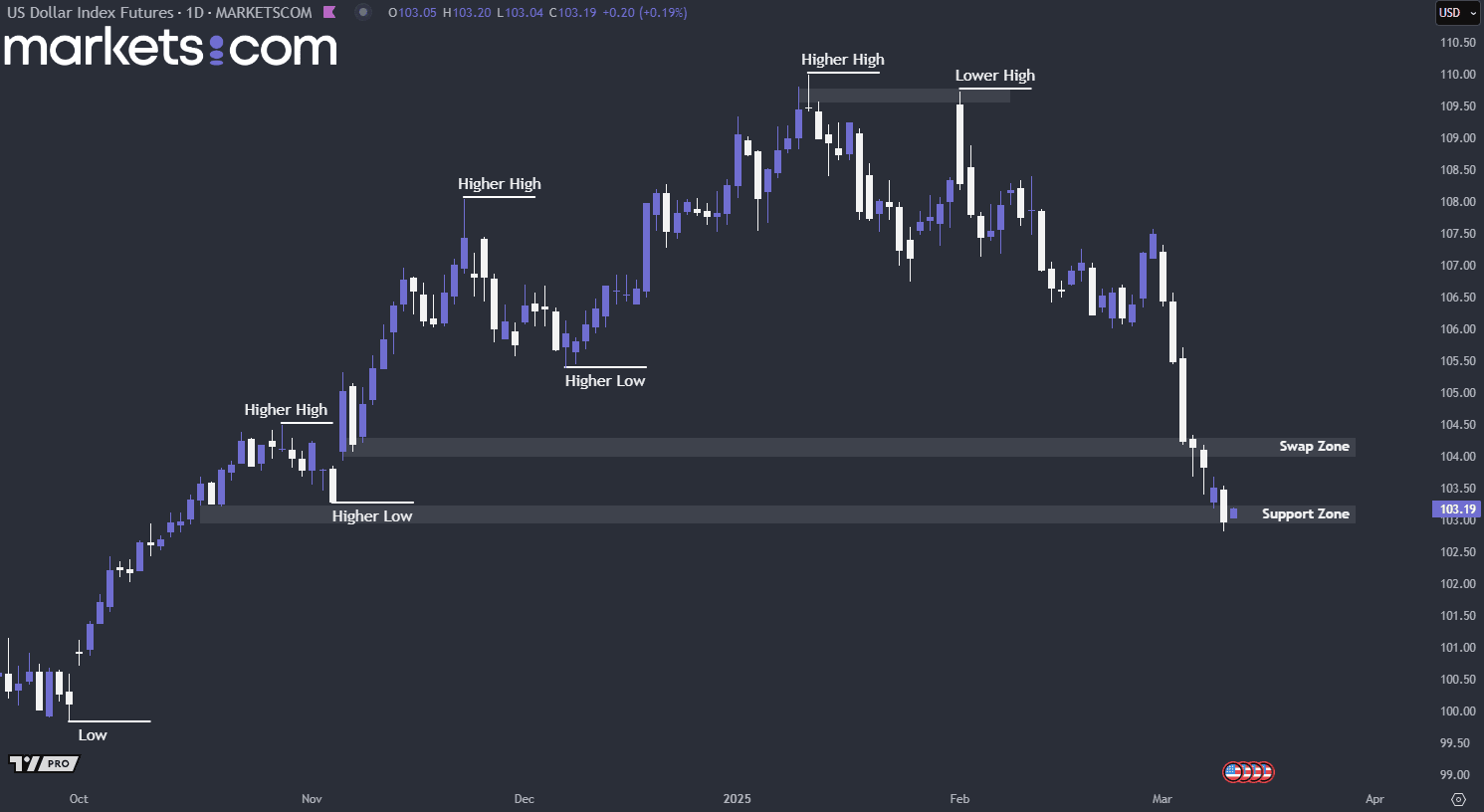

(U.S. Dollar Index Daily Chart, Source: Trading View)

From a technical analysis perspective, the overall trend of the U.S. Dollar Index has been bullish since the end of September 2024, as indicated by the formation of higher highs and higher lows. However, the index began to decline in early February 2025, marked by a significant double-top candlestick pattern.

Recently, consecutive bearish candlesticks with strong downward momentum have pushed the price lower, signalling a valid trend reversal from bullish to bearish. The index is currently retesting the support zone of 103.00 – 103.20. If it can find support here, it may potentially rebound and retest the swap zone of 104.00 – 104.30. Conversely, if the index breaks solidly below this support zone, it may continue to decline further.

The Bank of Canada’s previous interest rate stood at 3%, and it is expected to be reduced by 25 basis points in the upcoming rate decision, set to be released on March 12 at 13:45 GMT. This anticipated cut is likely driven by signs of slowing economic growth, easing inflationary pressures, and the need to support consumer spending and business investment. With inflation trending closer to the central bank’s target and concerns over a potential economic slowdown, policymakers may decide to adopt a more accommodative stance to maintain financial stability and sustain economic momentum.

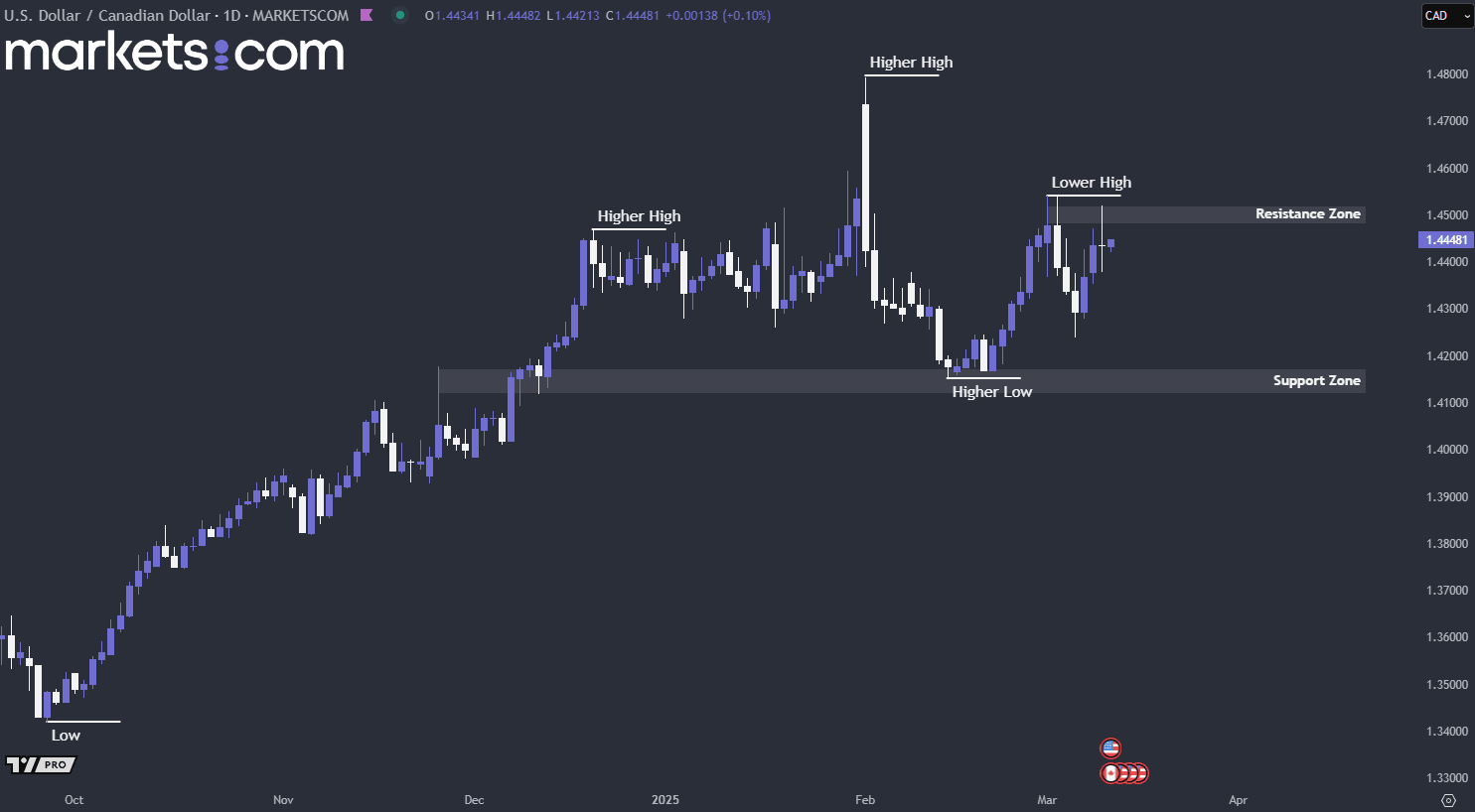

(USD/CAD Daily Chart, Source: Trading View)

From a technical analysis perspective, the overall trend of the USD/CAD currency pair has been bullish since the beginning of October 2024, as indicated by the formation of higher highs and higher lows. However, strong bearish momentum pushed the price downward at the start of February 2025, and the candlestick pattern has begun to shift to a bearish structure, as evidenced by the lower high pattern formed in March 2025.

Recently, it managed to close above the swap zone of 1.4300 – 1.4340 at the end of last week and is now nearing the resistance zone of 1.4480 – 1.4520. If it fails to break above this resistance zone in the near term, this indicates that bearish momentum persists, potentially pushing the rate downward.

Software giant Adobe (ADBE) will be a key focus in this week’s earnings lineup, as the digital media solutions provider is set to report its fiscal first-quarter results on March 12 at 21:00 GMT. Revenue for Q1 is expected to rise 9% year-over-year to $5.65 billion, up from $5.18 billion in the same quarter last year. Meanwhile, earnings per share (EPS) are projected to grow 11% to $4.97, compared to $4.48 per share a year ago. In fact, Adobe has also produced an average EPS surprise of 2.55% over the previous four quarters.

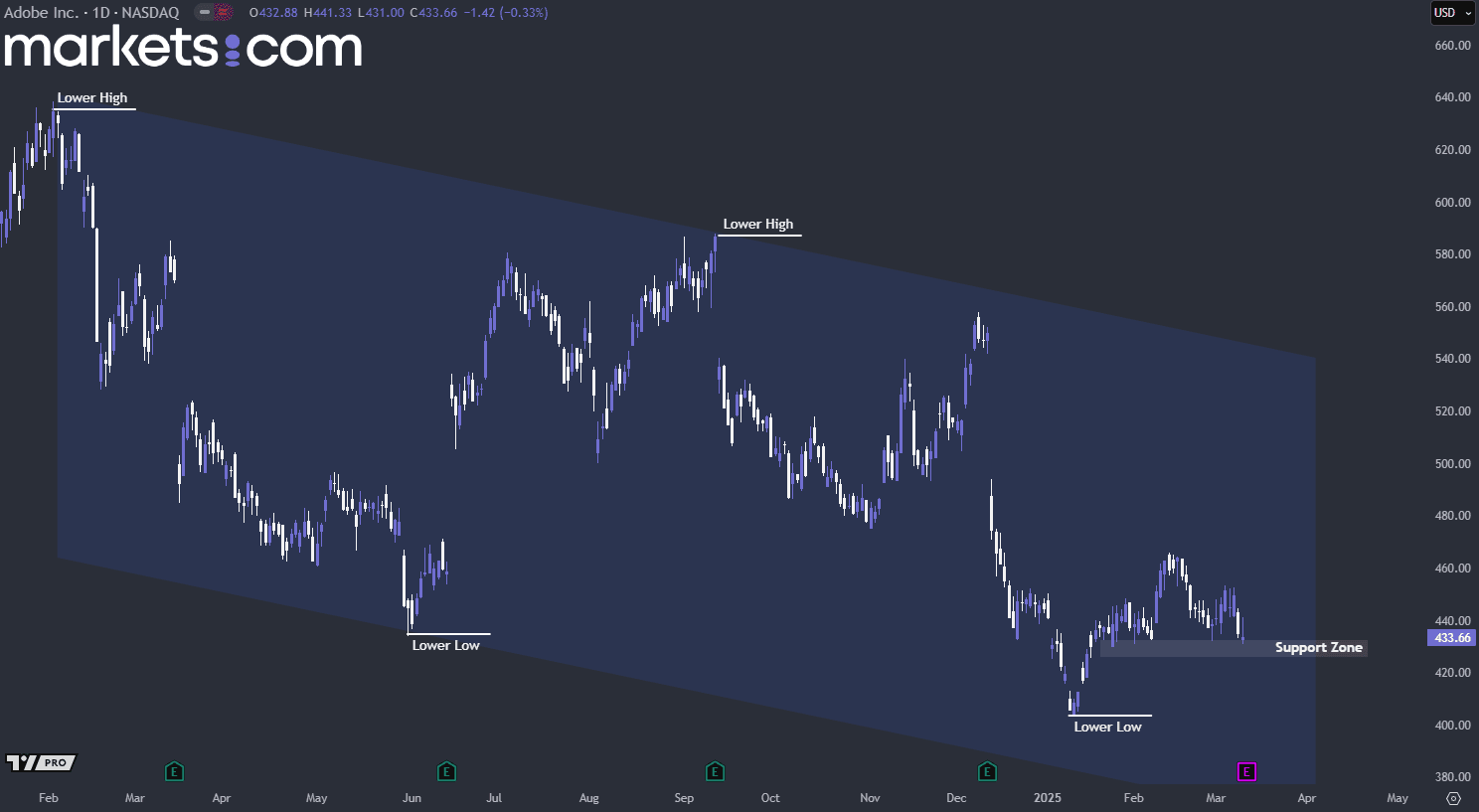

(Adobe Shares Price Daily Chart, Source: Trading View)

From a technical analysis perspective, Adobe's share price has been in a bearish trend since the beginning of February 2024, as indicated by the formation of lower highs and lower lows within a descending channel. Recently, it has been testing the support zone of 425 – 433. If this zone fails to hold, bearish momentum may drive the price downward, potentially forming another lower low.

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.