We gebruiken cookies om bijvoorbeeld ondersteuning via live chatten te bieden en u content te laten zien die mogelijk interessant voor u is. Als u het prima vindt om cookies van markets.com te gebruiken, kiest u voor accepteren.

CFD's zijn complexe instrumenten en gaan gepaard met een hoog risico snel kapitaal te verliezen als gevolg van hefboommechanismen. 74.2% an de retailbeleggers lijdt verlies op de handel in CFD's met deze aanbieder. U dient zorgvuldig te overwegen of u begrijpt hoe CFD's werken en of u het zich kunt veroorloven om hoge risico's te nemen op het verliezen van uw kapitaal.

Donderdag Mei 23 2024 12:01

4 min.

California-based chipmaker Nvidia reported first-quarter earnings after the bell on Wednesday that topped expectations, while also announcing a 10-for-1 stock split and an increased dividend, mirroring moves by other Big Tech firms to boost shareholder returns.

The company posted adjusted earnings per share (EPS) of $6.12 on revenue of $26 billion, up 461% and 262% respectively from a year ago.

Analysts had forecasted adjusted EPS of $5.65 on revenue of $24.69 billion, according to Bloomberg data. In the same quarter last year, Nvidia reported adjusted EPS of $1.09 on revenue of $7.19 billion.

For the current quarter, Nvidia expects revenue of $28 billion, plus or minus 2%, surpassing analyst expectations of $26.6 billion.

Nvidia stock surged nearly 7% to trade above $1,000 in pre-market trading on Thursday.

Bereken uw hypothetische winst en verlies (samengevoegde kosten en vergoedingen) als u de transactie vandaag had geopend..

Markten

Instrument

Account Type

Richting

Hoeveelheid

Bedrag moet gelijk zijn aan of hoger zijn dan

Aantal moet lager zijn dan

Aantal moet een veelvoud zijn van de laagste lotverhoging van

USD

EUR

GBP

CAD

AUD

CHF

ZAR

MXN

JPY

Waarde

Commissies

Spread

Hefboom

Conversievergoedingen

Vereiste marge

Nabeurs swap

Voorbije prestaties zijn geen betrouwbare indicator voor toekomstige resultaten.

Alle posities in instrumenten die in een andere munteenheid worden genoteerd dan de munteenheid van uw account, worden ook onderworpen aan wisselkosten bij het sluiten van de positie.

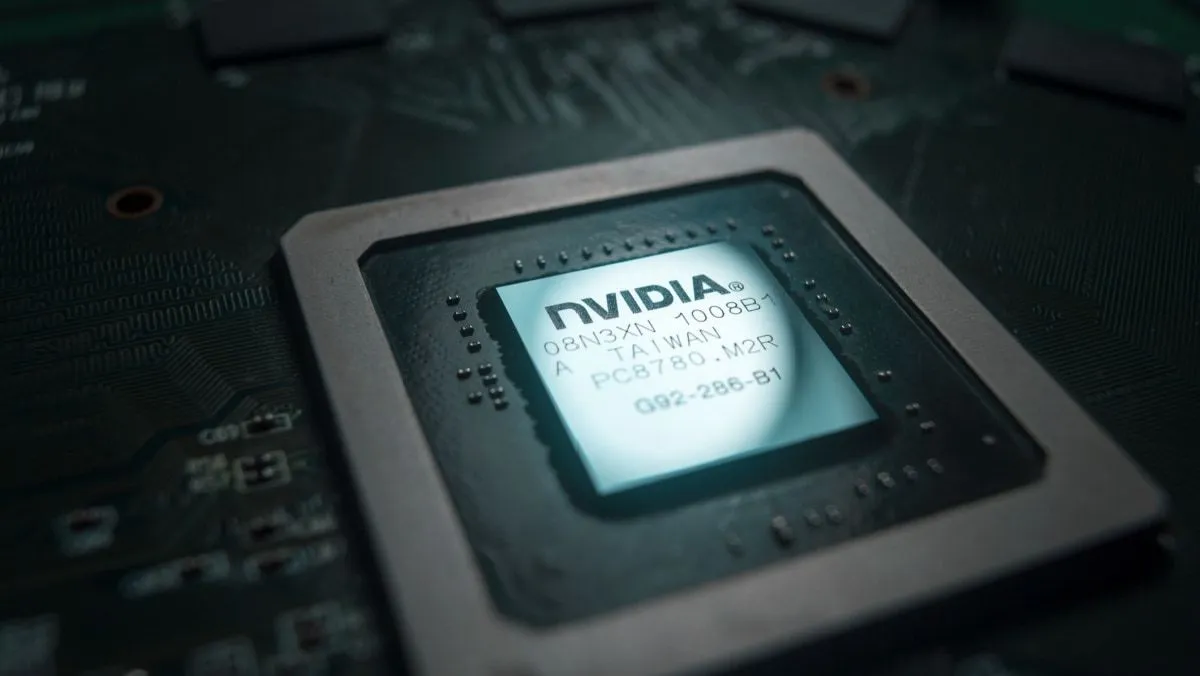

Wall Street analysts have previously expressed concerns about the significant portion of Nvidia's Data Center revenue derived from hyperscalers like Microsoft, Google, and Amazon, especially as these companies develop their own AI accelerator chips.

Despite the growing use of Nvidia chips outside hyperscalers, CFO Colette Kress noted that large cloud providers accounted for approximately 45% of the company's Data Center revenue.

Nvidia's Data Center revenue increased 427% year-over-year to $22.6 billion, making up 86% of the company's total revenue for the quarter.

However, Kress highlighted a significant decline in revenue from China, due to halted shipments of the company's most powerful chips to the country and anticipated ongoing competitiveness in the region.

Nvidia's gaming segment, once its leading business, reported revenue of $2.6 billion.

The earnings report also saw the announcement of a 10-for-1 Nvidia stock split, where shareholders will receive 10 shares for every one share they currently own. The change will take effect on June 7, with the new dividend paid on June 28 to shareholders of record as of June 11.

The Nvidia stock split may spark speculation about Nvidia joining the price-weighted Dow Jones Industrial Average (DJIA), alongside other Big Tech companies like Apple, Amazon, and Microsoft.

The DJIA, a U.S. equity benchmark with a history extending over 125 years, has recently added more tech firms as constituents it attempts to stay relevant as a stock market barometer. In the latest move, e-commerce giant Amazon replaced Walgreens Boots Alliance Inc. in the 30-stock index in late February.

Nvidia stock was trading near $1,015 per share in premarket hours on Thursday, which would translate to $101.5 per share post-split.

Nvidia's increased dividend follows similar announcements from Facebook parent company Meta Platforms and Google parent Alphabet, which introduced quarterly dividends for the first time this year, and Apple, which raised its dividend earlier this month.

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.

Overzicht van activa

Volledig overzicht bekijkenTags

Alles bekijkenLaatste

Alles bekijken

Donderdag, 20 Februari 2025

3 min.

Donderdag, 20 Februari 2025

5 min.

Donderdag, 20 Februari 2025

2 min.