We gebruiken cookies om bijvoorbeeld ondersteuning via live chatten te bieden en u content te laten zien die mogelijk interessant voor u is. Als u het prima vindt om cookies van markets.com te gebruiken, kiest u voor accepteren.

CFD's zijn complexe instrumenten en gaan gepaard met een hoog risico snel kapitaal te verliezen als gevolg van hefboommechanismen. 77.3% an de retailbeleggers lijdt verlies op de handel in CFD's met deze aanbieder. U dient zorgvuldig te overwegen of u begrijpt hoe CFD's werken en of u het zich kunt veroorloven om hoge risico's te nemen op het verliezen van uw kapitaal.

Woensdag Apr 29 2020 13:05

3 min.

European stocks added to gains and US futures extended higher after a report indicated positive results from Gilead’s drug trials for treating Covid-19.

Gilead said it was aware of positive data emerging from the National Institute of Allergy and Infectious Diseases’ (NIAID) study of its antiviral drug remdesivir for the treatment of Covid-19. Gilead will share additional data on its own trials in due course, stating in a PR: ‘This study will provide information on whether a shorter, 5-day duration of therapy may have similar efficacy and safety as the 10-day treatment course evaluated in the NIAID trial and other ongoing trials. Gilead expects data at the end of May from the second SIMPLE study evaluating the 5- and 10-day dosing durations of remdesivir in patients with moderate COVID-19 disease.’

This is undoubtedly positive for risk – the closer you get to treatment or a vaccine the quicker we reopen the economy and the lower the risk of a 2nd, 3rd wave outbreaks. Rumours of positive results from Gilead a week ago helped lift spirits and this is yet more encouraging news. We are also hearing that there will be a press conference later today with Dr Fauci on the NIAID results, which may offer further details for markets.

The FTSE 100 extended gains to take out 6060, whilst the DAX moved aggressively back to with touching distance of 11,000. The S&P 500 headed to open up at 2920, with the Dow seen up +400 points at the open around 24,540.

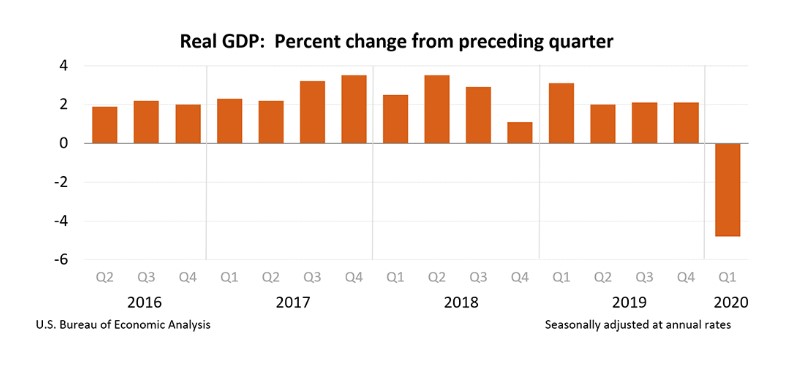

Meanwhile, after some delay and an initial misprint we learned US GDP contracted 4.8% in the first quarter. The usual caveats pertain – it’s backward-looking data and the worst of the damage will be done in Q2, but nonetheless it was worse than the –4% expected.

Overzicht van activa

Volledig overzicht bekijkenLaatste

Alles bekijken

Donderdag, 17 April 2025

7 min.

Donderdag, 17 April 2025

3 min.

Woensdag, 16 April 2025

4 min.

Maandag, 21 April 2025

Indices

Stock Market Today: Dow, S&P 500, Nasdaq Fall as Trump Rips Fed Chair Powell

Maandag, 21 April 2025

Indices

Morning Note: Trump's Fed Pressure Slams Stocks, Boosts Gold; Oil Recovers