CFD's zijn complexe instrumenten en gaan gepaard met een hoog risico snel kapitaal te verliezen als gevolg van hefboommechanismen. 74.2% an de retailbeleggers lijdt verlies op de handel in CFD's met deze aanbieder. U dient zorgvuldig te overwegen of u begrijpt hoe CFD's werken en of u het zich kunt veroorloven om hoge risico's te nemen op het verliezen van uw kapitaal.

Vrijdag Jan 17 2025 08:37

10 min.

All eyes will be on Donald J. Trump’s inauguration on January 20th. Market participants will be carefully monitoring Trump’s speech, especially those involved in the crypto world, as the new upcoming president is likely to ease regulations surrounding cryptos.

The economic calendar will be somewhat on the modest side. However, JPY traders might be glued to the charts on Friday, when we receive the BoJ interest rate decision.

The earnings season is in full swing in the US, with major companies delivering their Q4 results. Some of the major companies include Netflix, P&G, Abbott Labs, Texas Instruments and American Express.

The World Economic Forum in Davos will be on everyone’s watch as top leaders and CEOs gather in Switzerland for the annual meeting. This year’s headline is “Collaboration for the Intelligent Age”. The key figures who are expected to take part in the Forum are Donald J. Trump, President-elect of the United States (who will join via live video link for an interactive dialogue with participants); Ursula von der Leyen, President of the European Commission; Ding Xuexiang, Vice-Premier of the People's Republic of China; Javier Milei, President of Argentina; Olaf Scholz, Federal Chancellor of Germany; Matamela Cyril Ramaphosa, President of South Africa; Pedro Sánchez, Prime Minister of Spain; Nikol Pashinyan, Prime Minister of the Republic of Armenia; Ilham Aliyev, President of the Republic of Azerbaijan and many more.

Here are the week’s key events:

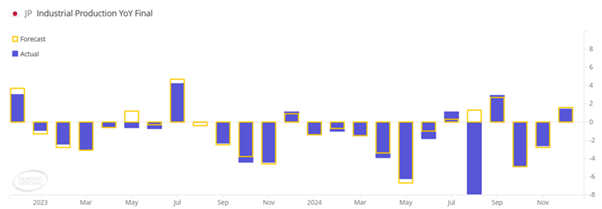

Monday, we will kick off with various data from Japan, where the country will be delivering its machinery orders for the month of November, both MoM and YoY. The current expectation is for the actual reading to be on the lower side. Japan will also release its final MoM and YoY industrial production figures for November, with the expectation for a decline. If the actual figures do come on the lower side, we may see some initial weakness in Nikkei. However, this might be short-lived, as slightly weaker data might be interpreted as a positive. One would think that this could push the BoJ towards holding off on hiking rates; however, it seems that the market is already accepting a 25-bps hike at the end of this week.

(Source: Trading Central)

Later in the day, from Europe, we will receive German and Swiss PPI readings for December. Both are expected to improve slightly. Some volatility may be observed in EURCHF.

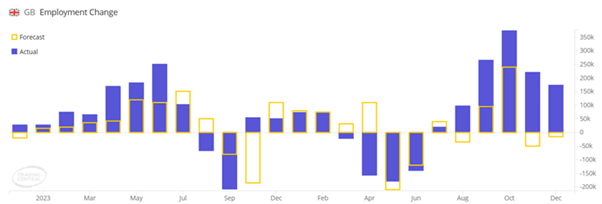

On Tuesday, the UK will start its trading day by delivering jobs numbers for November. At the time of writing, the forecast for the unemployment number is the same as previous, at 4.3%. However, average earnings, including and excluding bonuses, are expected to decline slightly. We will also keep a close eye on the country’s employment change numbers, which have been on a gradual decline since August 2024. If that path continues, this could show signs of economic weakness in the UK. This could be seen as a negative for the British pound, applying further downward pressure. Weaker data might imply that the Bank of England should make efforts to cut the interest rate in order to impose some economic stimulus.

(Source: Trading Central)

Germany will be showing us how its ZEW economic conditions and sentiment look like for the month of January. Given that at the time of writing we do not have any available forecasts, we know that the numbers have been falling, indicating concerns among German businesses.

(Source: Trading Central)

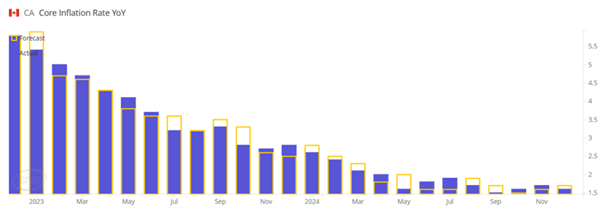

The main event on Tuesday will probably be the Canadian CPI figures for December. Most likely, the BoC will keep a close on the release, as both core and headline YoY figures have been on the lower side of the Bank’s inflation target ranging between 1 and 3 percent. Given this, if the CPIs stay within that range, the BoC may keep its finger on the rate-cutting button as the Bank continues to try to support the economy. Now, a figure slightly higher than the forecast might temporarily strengthen the CAD against its top counterparts. However, that might be a temporary occurrence unless we start seeing the inflation curve showing signs of an upside trajectory for a few consecutive months.

(Source: Trading Central)

Top US company earnings: Netflix, Charles Schwab, 3M.

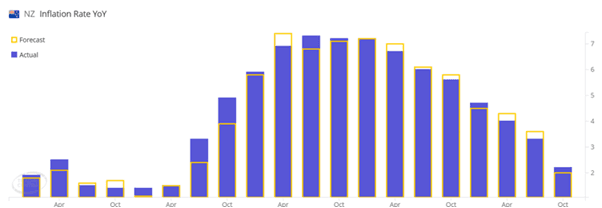

In the early hours of the Asian morning, New Zealand is set to deliver its Q4 2024 inflation readings. The YoY reading is expected to have paused at the previous +2.2%, which is still within the RBNZ inflation target range between 1 and 3 percent. If the actual number shows up as expected or slightly higher, this may help slow the pace of monetary policy easing. We might see a slight recovery in the damaged NZD.

(Source: Trading Central)

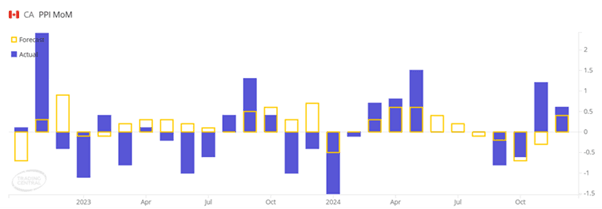

Due to the absence of any other major economic release, the spotlight might fall on the Canadian MoM Industrial Producer Price Index. The number is believed to have drifted further south, moving closer to the zero mark.

(Source: Trading Central)

Top US company earnings: P&G, J&J, Abbott Labs, Haliburton.

Thursday’s main economic events will start off with the Japanese trade balance release for the month of December. At the time of writing, the expectation is for the number to jump back into positive territory. If so, this could break the 5-month streak of negative results, potentially giving Nikkei a boost. This would mean that Japan was able to increase its exports in December significantly, returning a surplus. Certainly, one of the main reasons for this would be a weaker yen. But, as we know, the BoJ wants to tackle that by raising rates in the future. This means that going further, we may see the Japanese trade balance moving back into negative territory. Especially considering the possible trade restrictions on the Japanese goods by the new coming US government. As we know, the US is the largest importer of Japanese goods.

(Source: Trading Central)

Kicking the ball further, Canada will deliver its final retail sales numbers for November, and the US will show the weekly initial and continuing jobless claims numbers. The Canadian YoY retail sales figure is expected to show further improvement, which may help slow down the fall of the Canadian dollar.

Top US company earnings: GE Aerospace, Texas Instruments, Union Pacific, CSX, American Airlines.

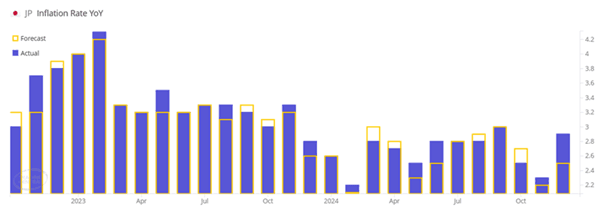

Finally, on Friday, Japan is set to deliver its national core and headline December CPIs. The latest November figure showed a strong spike in the data, going from the previous +2.3% to +2.9%. Certainly, such a trend is taken positively by the BoJ in order to justify the upcoming potential rate hike later in the day. The December figure is believed to be on the lower side, at around +2.6%. However, this might still be seen as a possible upward trajectory for the YoY national CPI. Regarding the Japanese yen, the currency might strengthen if the reading comes close to the forecast or higher.

(Source: Trading Central)

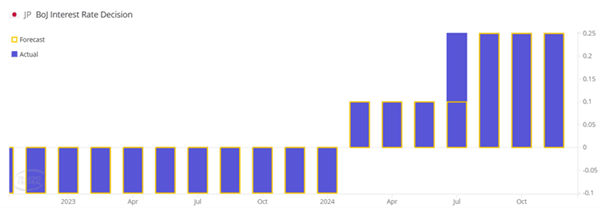

But the main economic data set from Japan will be the BoJ’s interest rate decision. The Bank is expected to hike by 25 bps, which could help strengthen the Japanese yen. It seems that it doesn’t matter what result we will get on the CPI reading; the market demands a hike in order to safeguard the yen from future devaluation shocks.

(Source: Trading Central)

Japanese yen traders will be carefully monitoring the data released on Friday, as JPY may find some buying interest if the above-mentioned data comes in favour of the Japanese currency.

The economic calendar continues with some flash composite, manufacturing and services PMIs delivered by the EU and some of its individual member states. Later, the US S&P Global will provide us with the same flash PMIs from their side.

Top US company earnings: American Express, Verizon, NextEra Energy.

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.