星期三 Aug 30 2023 09:36

5 最小

U.S. investment bank Morgan Stanley recently decided to lower its rating on cybersecurity firm CrowdStrike (CRWD) from Overweight to Equal-weight, citing concerns about the consensus estimates for 2023/24 amid potential downsides in a note to clients.

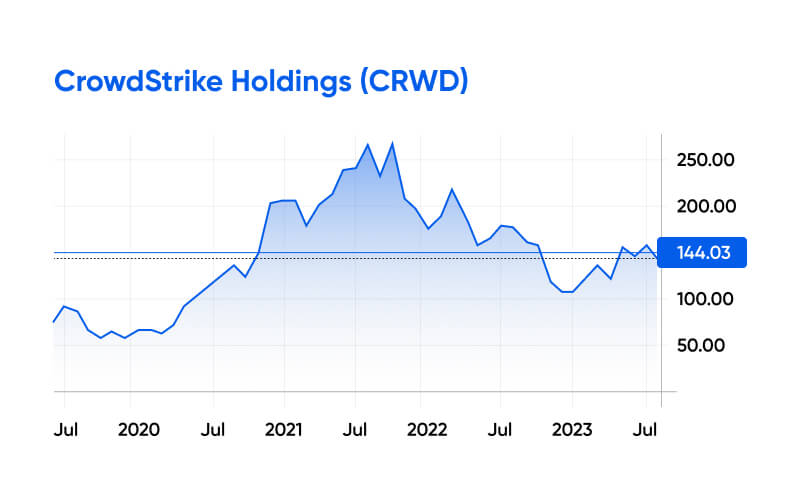

Morgan Stanley also revised its price target for CRWD, lowering it to $167 from the previous target of $178. CrowdStrike’s Q2 results are set to be revealed after the market closes on Wednesday, August 30.

The analysts expressed caution as CrowdStrike approaches its Q2 earnings report, pointing out that the projected rebound in H2 2024 estimates might be too optimistic given the current challenging demand environment.

The analysts added that there is a likelihood of further reduction in consensus estimates for CrowdStrike’s 2023/24 Annual Recurring Revenue (ARR). They noted that despite the stock's impressive year-to-date (YTD) gain of over 45%, the risk-reward balance now appears more even.

Morgan Stanley's perspective is rooted in recent assessments and data collected over the past month. This information highlights a continued slowdown in important industry sectors — particularly tech, telecommunications and retail — which has affected prominent CRWD customers like Target (TGT) and Home Depot (HD).

The experts project that when combined, these sectors account for over 20% of the entire company's ARR. They anticipate that these sectors will adopt a more cautious approach to spending, potentially resulting in staggered implementations and smaller deal sizes. In a broader sense, the analysts predict that the decrease in fundamental endpoint security is anticipated to persist until 2024, followed by a resurgence in 2025.

CrowdStrike, established by current CEO George Kurtz, Dmitri Alperovich (former CTO) and Gregg Marston (CFO, now retired) in 2011, is a cloud-based cybersecurity firm based in Texas. Its core focus is advanced endpoint and cloud workload defense. The firm’s main product is the Falcon platform, which provides a comprehensive solution for businesses to spot and counter security breaches across their IT systems. The company was publicly listed through an IPO on the NASDAQ in 2019.

The corporation has taken part in inquiries regarding numerous notable cyber breaches, such as the 2014 Sony Pictures breach, the 2015–16 cyber assaults on the Democratic National Committee (DNC), and the 2016 email exposure incident related to the DNC.

In mid-December 2022, Morningstar analyst Malik Akhmed Khan offered a highly optimistic outlook of the company:

“We view CrowdStrike as a leader in endpoint security, a prominent part of the cybersecurity stack that protects an enterprise’s endpoints from nefarious activity. As enterprises undergo digital transformations and cloud migrations, we foresee endpoint security further gaining wallet share of an enterprise’s security spend. Within this growing market, CrowdStrike has emerged as a leader and we think the stickiness of its platform, Falcon, is clear in the firm’s impressive gross and net retention metrics.”

As of August 29, CrowdStrike had a Hold rating in Seeking Alpha's Quant Rating system, while the Seeking Alpha authors' average rating is more positive with a Buy, while the average Wall Street analysts' rating is Strong Buy.

Drawing from the opinions of 30 Wall Street analysts who provided 12-month price forecasts for CrowdStrike Holdings in the past three months, the mean target price at TipRanks stands at $179.71, with the rating listed as a Strong Buy. This projection ranges between a high CRWD stock price estimate of $235.00 and a low estimate of $128.00. The calculated average price target reflects a 24.77% potential upside.

The consensus forecast cited by Investing.com listed a Buy rating, with the 12-month average price target coming in at $179.29, indicating a potential +24.48% upside on the $144.03 closing price on August 28. Based on a poll of 29 analysts covering CrowdStrike stock, the platform’s forecast was in line with other market experts and investors.

Remember that trading involves a significant degree of risk and could result in capital loss. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested.

**This information is provided for informative purposes only and should not be construed to be investment advice.