星期一 五月 15 2023 09:59

6 最小

The main story this morning is Turkey as votes are counted in the presidential election. Turkish stocks fell sharply at the open and the lira was weaker at a 2-month low as Erdogan heads for a run-off – BIST 100 down more than 6% before trimming losses. The US dollar rallied to a 5-week high seemingly on a bit of haven bid, extending gains from its biggest weekly rally since September as traders looked to trim short positioning that had become too crowded. DXY futures through the 50-day line, first time above this since March 20th. The key test this week for USD is retail sales – are consumers still wearing higher prices? Bonds are pretty steady with the 10yr Treasury sitting a tad under 3.5% and gold rising after three days of losses. Oil prices fell for a fourth day, having rallied for the previous four, leaving spot WTI sitting just under $70.

Stocks in Europe however made broad gains in early trading on Monday, following a broadly positive Asian session that saw the Nikkei 225 hit its highest in 18 months. It rose 0.8% to 29,626, its highest close since November 2021, whilst the Topix rallied to an almost 30-year high. The FTSE 100 added around a third of one percent in early trading to nudge the 7,800 area, whilst the DAX pushed up to test the 16,000 resistance level, just a whisker below its YTD high. Currys +7% on better than expected results – strong margin gains…signs retailers are enjoying inflation now…FY UK & Ireland EBIT expected to rise 40% and FY adjusted profit before tax guidance raised to £110-120m, from around £104m previously - consumer still robust and pricing. More profit-led inflation, which becomes more political the longer it goes on, esp with Labour the government-in-waiting.

US stocks were mixed last week, with the Dow off more than 1%, whilst the Nasdaq made a modest gain of 0.4%. Still looking very range bound and the S&P 500 continues to crab around the 4,100-4,200 area. Futures point to a higher open.

Regarding the debt ceiling - some progress. House Speaker Kevin McCarthy due to meet President Biden on Tuesday to work on a deal. US facing "significant risk" of defaulting on payment obligations within the first two weeks of June, the Congressional Budget Office said on Friday. Payment operations will be uncertain until then.

Factory activity in the New York Fed’s district offers the main economic data today. The Empire Fed manufacturing index jumped to 10.8 in April from –24.6 in March, easily beating expectations, whilst the prices component ticked up also. Forecast to drop back to –3.7.

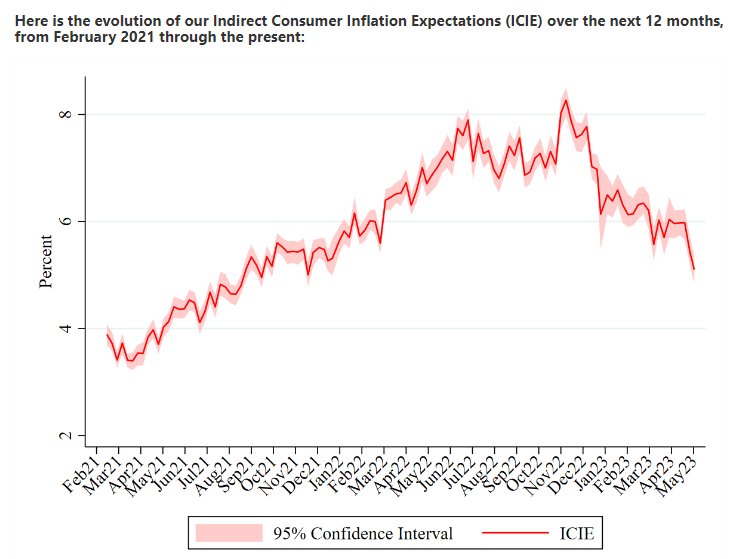

What good are forecasts? Notable discrepancy between actual inflation and expected...seems the consumer thinks things are getting worse maybe than they are – maybe they don’t trust the central banks...signs last week that inflation is cooling a bit but whether it’s enough for the Fed to pause yet is still unclear.

UoM long-run inflation expectations for the US rose to their highest reading since 2011, lifting from 3.0% last month to 3.2% this month. Year-ahead expectations fell a touch but remain high; consumer sentiment slid to a six-month low.

Eurozone inflation expectations have also jumped. Year ahead expectations rose from 4.6% in February to 5.0%. Expectations for inflation three years ahead rose from 2.4% to 2.9%. The ECB notes dryly that inflation expectations remained well below the perceived past inflation rate. They might also note that staff projections are similarly wide of the mark. And of course we noted last week the Bank of England’s projections for inflation, which seem somewhat optimistic.

Markets continue to trade on the trade-off between inflation and tightening – at present the market thinks we are near the peak and cuts are coming...still too optimistic.

Cleveland Fed’s Indirect inflation index coming down sharply though...

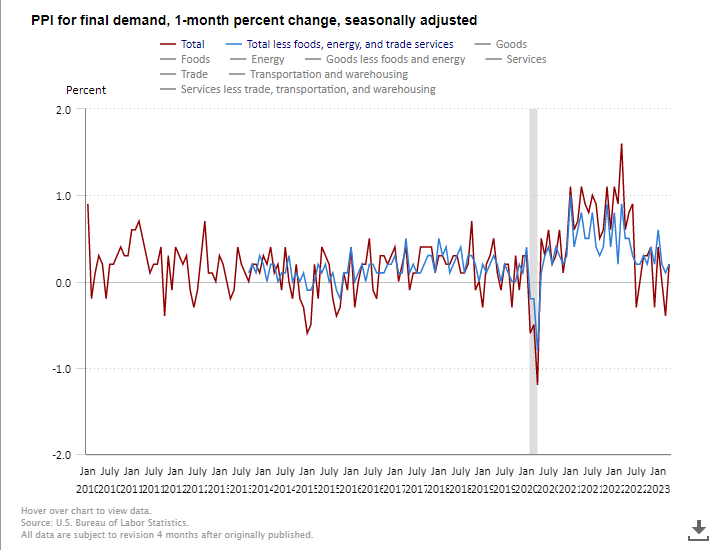

PPI – leading indicator coming down

Forex

EURUSD (daily) – testing the trendline and 50-day SMA

GBPUSD (1hr) breach confirmed, support found at the May 2nd swing low