星期五 Aug 2 2024 06:22

4 最小

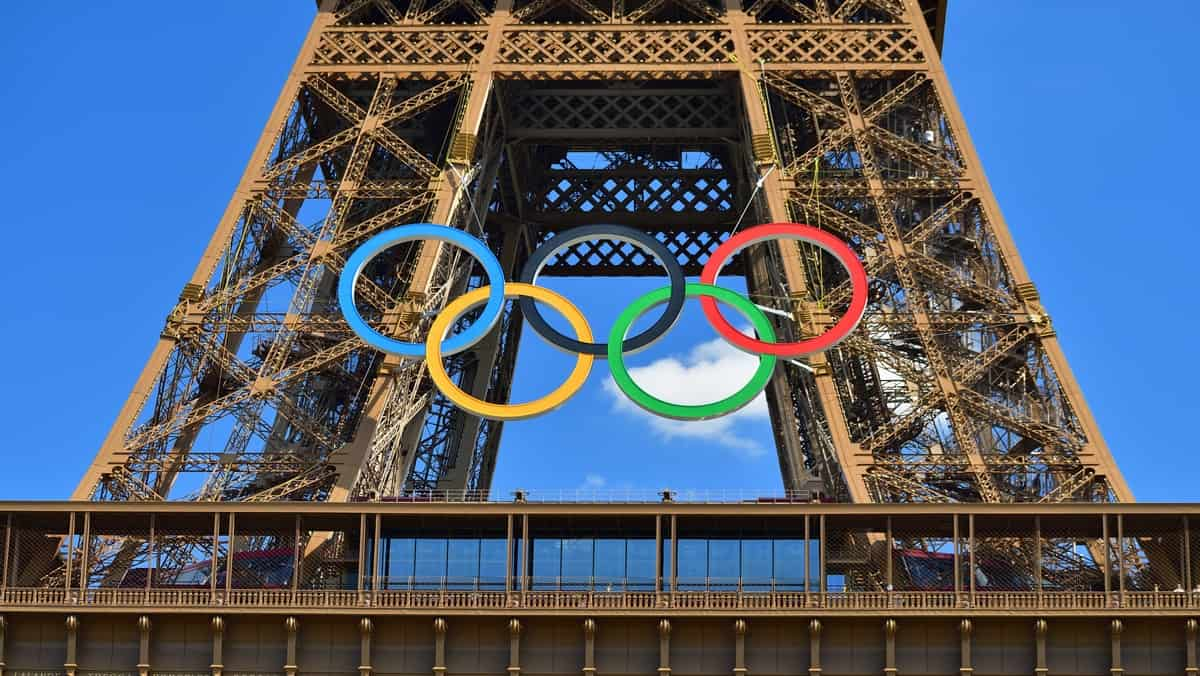

The Olympic Games can significantly impact stock markets through various channels. Hosting the event often boosts the local economy, leading to increased consumer spending and business investment, which can positively affect stocks of companies in sectors like hospitality, retail, and construction. Conversely, the cost of hosting can strain government finances and potentially lead to higher taxes or reduced public spending, which might negatively impact stocks. Additionally, companies that secure sponsorships or exclusive broadcasting rights often see a rise in their stock values due to increased visibility and revenue. Overall, the impact varies based on the scale of the games and market conditions.

The Olympic Games can influence stocks in several ways. Hosting the event can boost local economies, benefiting companies in sectors such as construction, hospitality, and retail, which may see a rise in their stock prices. Additionally, companies involved in the Games as sponsors or suppliers, such as Samsung or Coca-Cola, can experience increased visibility and potential revenue growth, positively impacting their stock performance. Conversely, the high costs of hosting can strain public finances, potentially affecting stocks negatively if it leads to reduced government spending or higher taxes. Overall, the impact on stocks varies based on the event’s scale and the market conditions.

Firstly, the stock market indices rise at the time of announcement. Secondly, Olympic stocks, they identified as connected to the Olympics by media, social media, or sponsors/partners outperformed other non-Olympic matched stocks. Moreover, this higher valuation seems to be permanent and persists even after the games. Lastly, there is a larger co-movement among Olympic stocks with each other and also with the stock index. Nonetheless, the co-movement does not persist and is reversed after games.

The sports industry encompasses various sectors, including sports apparel companies like Under Armour, Adidas, and Nike, which not only produce sportswear but also equipment. Additionally, media networks such as NBC Sports and Disney-owned ESPN play a crucial role. Investing in these companies provides traders and investors with the possibility to capitalize on the growth of the expanding sports industry.

Sponsorships and advertising are vital to sports financing, with major brands like Visa and Coca-Cola enhancing their global presence and associating their brands with the values and communal aspects of sports. Investing in companies with significant sponsorship deals, or in agencies that facilitate these partnerships, offers an intriguing potential opportunity to diversify a portfolio and explore different sectors.

Technology has become a major focus in the stock market, and its integration into sports—from data analytics and wearables to the booming e-sports industry—creates new investment opportunities. Events like the Olympics showcase these technological advancements on a global stage, attracting worldwide attention to tech companies involved, such as Samsung, Atos, and Intel. This heightened visibility can generate increased interest in their innovations, presenting additional potential financial opportunities for investors with a keen interest in technology.

The Olympic Games can impact stocks by boosting local economies, benefiting companies in construction, tourism, and retail. Increased visibility and revenue for sponsors and suppliers can also lift their stock prices. However, the high costs of hosting may strain public finances, potentially leading to negative effects on stock markets.

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.