星期四 Nov 21 2024 01:15

3 最小

European stock markets continue to tread water. The major bourses are a little higher early on Wednesday but not great shakes. On Wall Street, tech rallied again on Tuesday, with Nvidia rising about 5% ahead of earnings. Oil prices firmed up again, while gold retreated overnight on Wednesday after two days of gains, with Treasury yields and the dollar a bit firmer. Bitcoin is above $93k.

Howard Lutnick has been chosen as Trump’s commerce secretary – i.e. the one to drive trade policy and tariffs. A win for team Cantor, but it leaves open the Treasury Sec position, which is the more important Marc Rowan of Apollo Global Management is said to be the frontrunner. Still, we can assume Lutnick is a Trumpian when it comes to trade. Recently, he said, “When was America great? At the turn of the century, our economy was rocking! This was 125 years ago ... We had no income tax. And all we had was tariffs.”

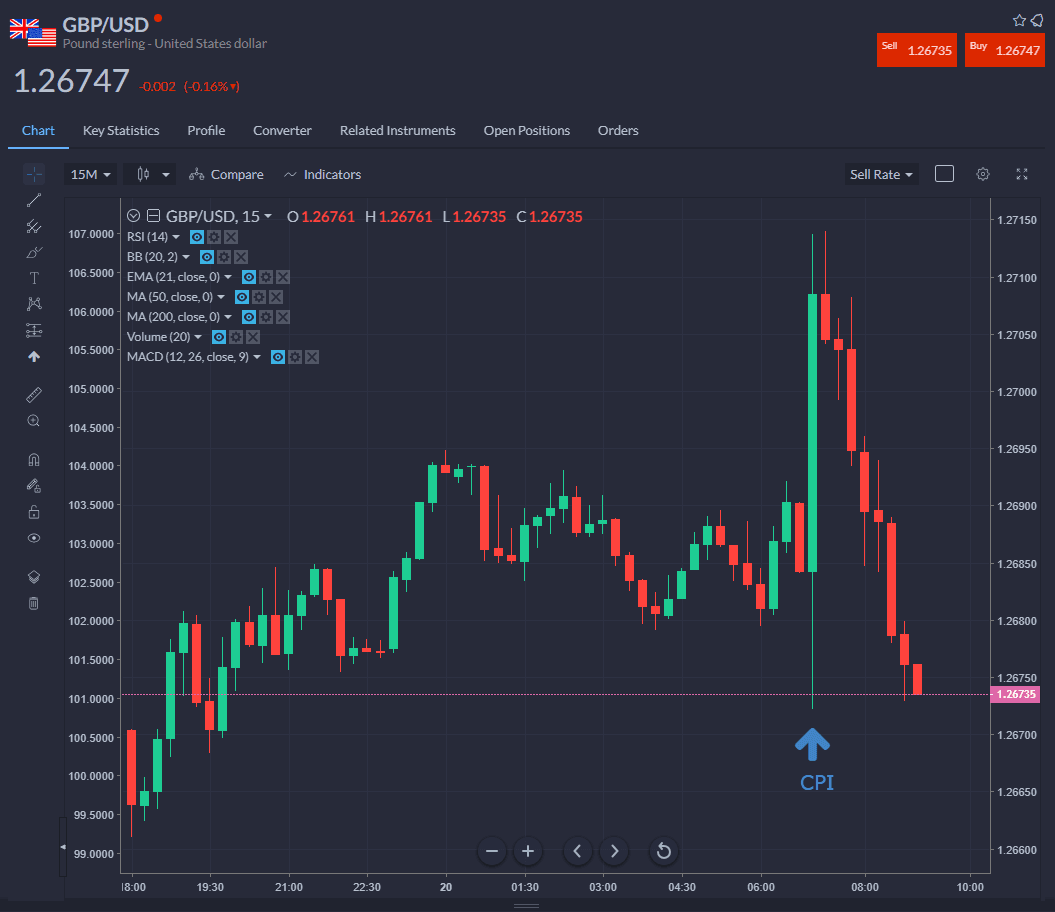

UK inflation jumped, putting the brakes on ideas of further cuts by the Bank of England. Inflation rising, growth non-existent...it’s the nightmare stagflation situation. Consumer price inflation hit 2.3 per cent in October, up from 1.7 per cent in September and above analyst expectations. Core also rose to 3.3%, and the belief is that inflation will continue to move up slightly – this is not a blip. Sterling jumped then sharply retraced the move – higher for longer doesn’t mean a thing if the economy is in dire straits. It suggests the Bank of England will forego a cut in December and continue to take a gradual approach to cuts.

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.