星期三 Oct 25 2023 11:13

7 最小

European shares were a bit weaker at the open after a strong rally for Wall Street and generally positive moves in Asia overnight with a crop of corporate earnings being digested on both sides of the Atlantic. Treasury yields firmed up a bit off after the sharp reversal on Monday, helping the dollar recoup ground and keeping gold from rallying further. Oil softened further, whilst Bitcoin pulled back from a one-and-a-half year high above $35k to below $34k this morning.

The S&P 500 closed up three-quarters of a percent at its 200-day simply moving average.

Ahead of the European Central Bank meeting in Athens this week, Christine Lagarde is due to speak later today, whilst we also hear from the Fed’s Powell and RBA’s Bullock. The Bank of Canada is expected to refrain from raising rates today after inflation unexpectedly cooled to 3.8% in September.

On the ECB, we expected a pause as it awaits incoming data – the message from the September meeting was a dovish hike. Inflation in September declined to 4.3% down from 5.2% in August, which given some pressing economic risks should stay the hand of the Governing Council. Tomorrow will likely see the ECB switch from dovish hike to hawkish hold, but the message may be unconvincing.

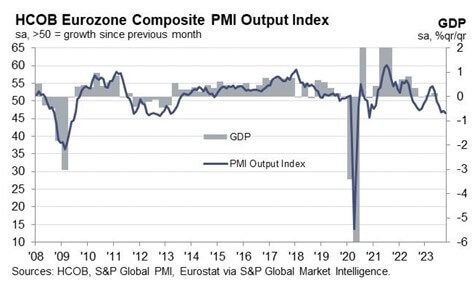

PMIs yesterday pointed to further contraction in Europe – worst performance in nearly three years in October. HCOB Flash Eurozone Composite PMI Output Index at 46.5, a 35-month low – you cannot be hiking into this?

The Flash UK PMI Composite Output Index was at 48.6, a 2-month high. Good news for the Bank of England - Input price inflation slowed for the third consecutive month in October to the lowest since the start of 2021.

Meanwhile, there was a sizeable drop in US flash PMI selling price gauge in October; the 2% target is in sight for the Fed for the first time in three years…I fear Ackman’s belief that things are slowing down faster than most think is true, but that don’t mean the Fed and other CBs just revert to cutting…we are entering the stagflation arena.

Bit of a mixed bag from the leaders of the pack…Microsoft earnings beat estimates – reacceleration in Azure cloud growth after two years of deceleration, boost from generative AI. Revenue +13% year over year, net income +27% from $17.56 billion, or $2.35 per share. MSFT rallied 4% after hours. Alphabet earnings beat estimates but cloud sales growth appears to have disappointed at +22% vs +26% expected. - shares dropped 6% post market.

Cyclicals – 3M +5%, Coca-Cola +3%, GE +6.5%, whilst GM fell as the company spiked its guidance due to strikes. The UAW expanded its action –which GM says is costing $200mn a week – to its super-profitable assembly plant in Texas. Coke – raising prices but the stock is still –11% YTD. Management guided up though - now expects comparable earnings growth of 7% to 8%, up from a prior range of 5% to 6%. Organic revenue is now forecast to increase 10% to 11%, up from the prior range of 8% to 9%.

About a quarter of S&P 500 companies reported so far and about three-quarters have beaten expectations. Earnings season is in full swing this side of the pond too.

Visa earnings are a beat, but volume growth is slowing.

![Visa Earnings are a bet]at](https://www.markets-apac.com/cdn/Visa_Earnings_are_a_bet_at_2b51c99b8e.jpg)

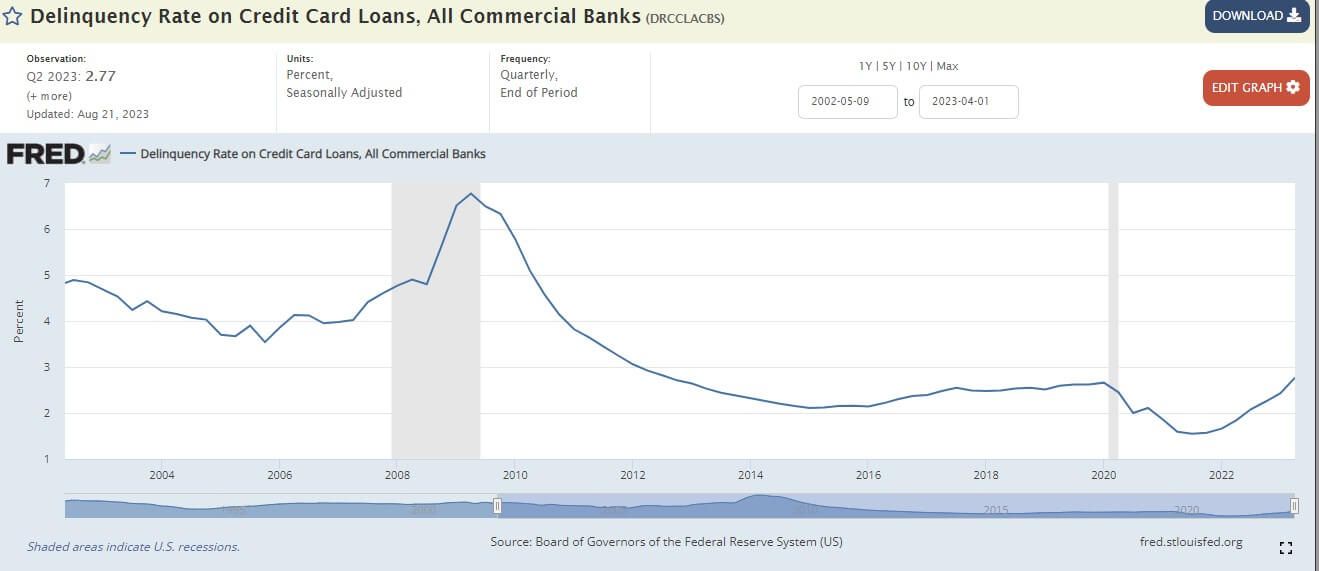

To which we may as this addendum – delinquency rate rising

Lloyds jumped around a bit as investors digested what look like pretty solid earnings. Profits were a beat but again it’s about the NIMs – net interest margin down to 3.08% on savings/mortgage mix. Guidance unch – looks solid but UK mortgage market is the worry. The bank reported underlying net interest income +10% to £10.4 billion with a net interest margin of 3.15%. Net interest margin in the quarter was down 6 basis points given the expected mortgage and deposit pricing headwinds…competition for savings and mitigating higher mortgage rates – the 3.14% in the prior quarter was itself down 8 basis points from the quarter before. So if we are at the top of the NIM cycle then I guess we look to cyclical growth…erm…

Deutsche Bank – 13 in a row. Thirteen quarters of profits for the venerable German lender. Q3 net profits -8% to €1.03bn...better than expected. Management talked about cost control but net revenues up 6% year on year to €22.2bn while noninterest expenses +7% to € 16.2bn. Provision for credit losses down - to € 245mn in the third quarter from €401mn in the second quarter. Shares +6% - raised capital outlook and seems to be shrugging off the investment banking revenue decline.

Kering – revenues down 13%, Gucci down 14%...luxury in a bind...takeovers coming!? Expect strong pressure on margins amid broad decline in sales and investments. Market has already gone a lot more cautious on luxury since the spring peak…inflection point coming? Shares fell almost 3% with Burberry following down nearly 2%.

Reckitt Benckiser – missed sales expectations, down 2%. Durex and Dettol (don’t use at the same time) are just not very exciting – shares have done nothing for almost ten years.