星期四 Feb 9 2023 09:19

8 最小

FTSE Up; Wall Street Falls

The FTSE 100 rose in early trade on Thursday, just falling shy of yesterday’s all-time intraday high, whilst shares in Frankfurt and Paris rallied over 1% despite a weak session on Wall Street. On a busy day for corporate earnings in London, AstraZeneca rallied 2.5% as it detailed high single digit earnings growth in 2023. The S&P 500 declined more than 1%, whilst the Nasdaq declined almost 1.7% as investors parsed a pretty mixed set of corporate earnings and continued to digest whether the Fed has more rate hikes up its sleeve. Data this morning showed German inflation rose to 8.7% but was not as bad as feared. On the month, inflation stood at 1%…it is not going away anything like as fast as the bulls and central banks would like. Fed Governor Waller said: “We have farther to go. And, it might be a long fight, with interest rates higher for longer than some are currently expecting. But I will not hesitate to do what is needed to get my job done".

Inflation Not Slowing Unilever

Unilever shares ticked up as final results laid bare the inflation story we are facing - Underlying sales growth accelerated to 9%, with price growth of 11.3% and volumes declining 2.1%. Underlying operating profit improved slightly to €9.7 billion despite a margin decline of 230bps driven by input cost inflation. In the final quarter inflation rose to a record 13.3% but there is good news – inflation in the first half of the year is expected to be €1.5 billion, down from €2bn previously expected, and management expect “significantly lower” inflation in the second half. Management add: “In the first half, underlying price growth will remain high, and volume growth will be negative. Volume will improve as price growth softens, but it is too early to say whether volume will turn positive in the second half. We expect 2023 underlying sales growth to be at least in the upper half of our multi-year range of 3-5%.”

Tobacco, AstraZeneca, Standard Chartered; All Earning Movers

British American Tobacco reported a 7.7% rise in revenue to £27.6bn, a with operating profit +2.8% to £10.5bn. But shares fall as it delivered a 1.3% decline in diluted EPS to 291.9p. Company expects 3-5% organic constant currency revenue growth in 2023.

AstraZeneca – core earnings per share fell 17% to $1.38 but this was ahead of forecasts for $1.34. Fourth quarter revenues declined 7% largely on a drop in the sale of its Covid vaccine, whilst revenue growth declined to 17% excluding sales of its Covid vaccine, with the company seeing its revenues up 25% for the year. Core gross margins improved six percentage points to 80%, again reflecting lower Covid vaccine sales and more contribution from the higher margin oncology and rare diseases. Strong pipeline with over 30 Phase 3 trials this year – of which about a third could be ‘blockbuster’ drugs.

Standard Chartered – shares +7% or so on speculation of a takeover from First Abu Dhabi Bank...no news as yet but await a statement.

Taxi! Uber Looking Good

Uber showing some apparently very strong numbers here with record bookings and margins. Gross bookings up 19% year-on-year to $30.7bn (slowing from +26% last quarter), +26% on constant currency basis. Mobility bookings rose 31% (+37% CC) and Delivery +6% (+14% CC), indicating pressures from the stronger dollar. Trips during the quarter grew 19% YoY to 2.1 billion, an all-time quarterly high. Guidance for gross bookings growth of 20-24% is solid...but it’s all about cash and whether they can ever turn a profit.

Overall revenues rose by 49% YoY to $8.6bn, with revenue growth outpacing bookings growth in another positive signal, which management attributed to a change in the business model for UK business and the acquisition of Transplace by Uber Freight. Adjusted EBITDA rose $579 million YoY to $665 million, with margin as a percentage of 2.2%, up from 0.3% in Q4 2021.

But...it looks like the change in the business model in the UK amounts to an accounting trick whereby they count the entire fare as revenue as opposed to just their commission. Total costs and expenses rose 38% and the company still reported a loss from operations despite the “strongest quarter ever”. Adjusted EBITDA looks pretty much like a totally fake metric – follow the cash and it’s not so good.

Meanwhile: Disney, Blizzard and USD

Disney shares popped as investors liked what they saw from Bob Iger’s revival plan. Disney will cut 7,000 jobs globally as part of a turnaround designed to save about $5.5bn. Q4 earnings were better than the expected $23bn revenue and EPS of $0.78, with the latter coming in at $0.99. Profits rose 11% to $1.3bn. Streaming subscribers declined 2.4m but still were higher than expected and the company exceeded its target to slash the loss from the division by $200m, trimming the outflow by $400m. Shares rose more than 5% in after-hours trading. Iger has a plan and it involves making streaming profitable. Reassuring results and confidence that Iger can deliver.

Activision Blizzard shares are down more than 3% after the UK’s Competition and Markets Authority dealt a major to Microsoft’s $69bn acquisition, arguing in a preliminary statement that the takeover would hurt gamers. The CMA will consider companies' responses before issuing its final report by April 26th.

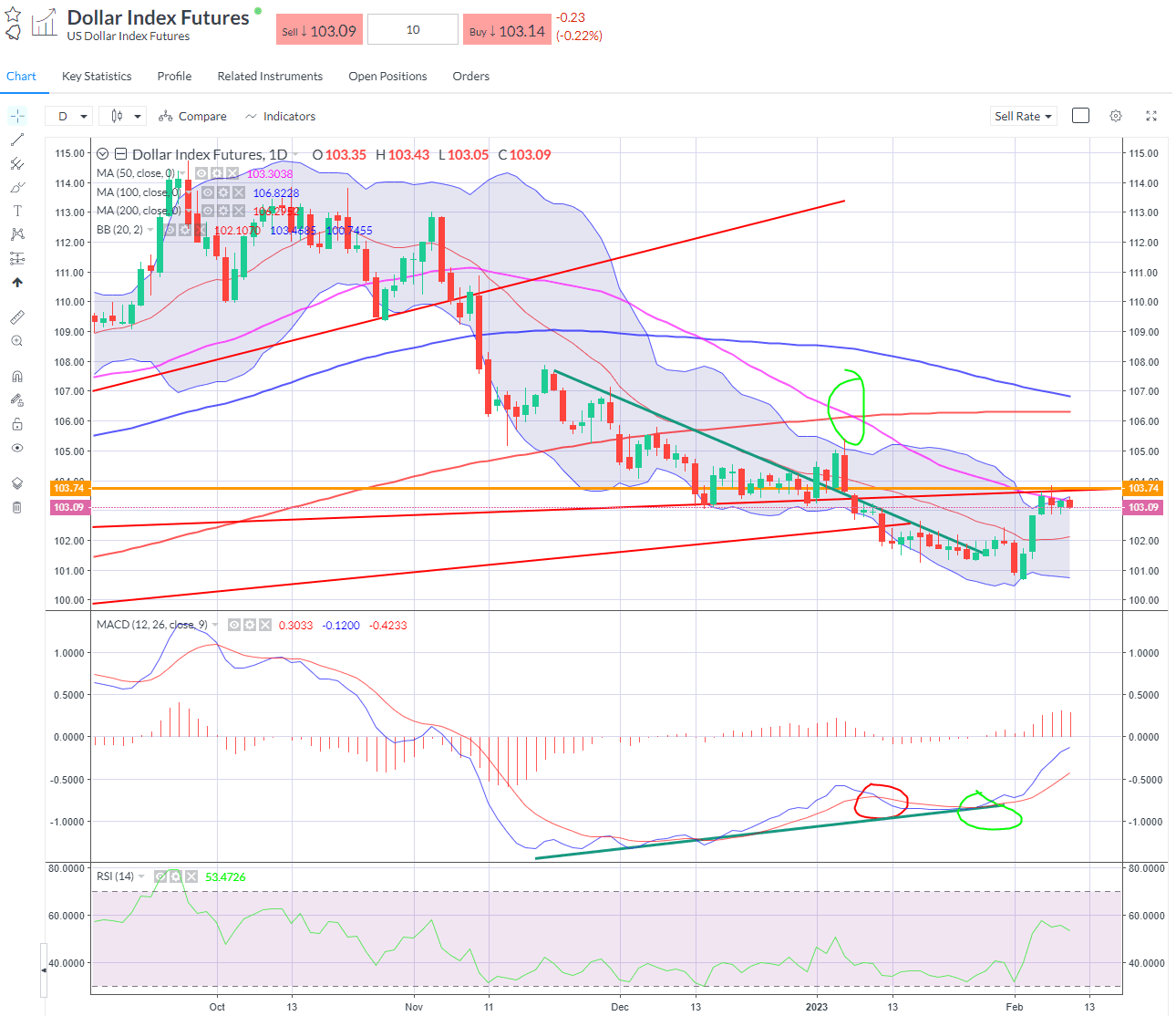

The dollar is trying to catch a bid but is struggling around the 50-day line to make much headway with little fresh direction in terms of the Fed, yields or economic data. Later today EU economic forecasts and US weekly unemployment numbers are due.