星期五 Jun 9 2023 13:40

5 最小

European stocks were a tad lighter with the FTSE 100 under 7,600 and DAX below 15,950 as they continue to chop around the ranges; Wall Street rallied with the S&P 500 notching a fresh closing high for 2023 and the Dow Jones rallying for a third day. The Nasdaq bounced back, rallying 1% as yields came off their highs as jobless claims leapt to their highest level since October 2021 – signs of cracks in the labour market being taken as a sign the Fed is more likely to pause rate hikes. The dollar moved sharply lower with DXY futures to a fortnight low at 103.25, allowing sterling to reach its highest in a month, whilst the euro hits its best in two weeks. Lower yields and dollar lifted gold and silver rallied sharply, whilst crude softened. Copper extended its two-week surge to rally through its 200-day SMA where the resistance was felt.

US weekly jobless claims rose to 261,000 versus 235,000 expected, offering more support to the idea that the Fed can pause and wait for the lagged effects of rate hikes. But it’s all about next week’s CPI inflation report a day before the FOMC decision. This was JPM in April: “A rising trajectory in [jobless claims] took hold last month ... A sustained move well above 250k in the coming months would send a signal that the economy is sliding into recession.”

China data overnight was soft – factory gate inflation sinking - Producer Prices fell 4.6%, more than expected and a steeper decline than prior -3.6%, while CPI ticked up to 0.2% year-on-year...disinflationary.

Markets may be a little cautious with a huge central bank calendar next week with not only the Fed, but also the European Central Bank and Bank of Japan in action. Meanwhile key US CPI inflation is due up on Tuesday. Slowing headline CPI inflation in the US was what the market wanted a month ago– stocks rallied led by the Nasdaq as yields compressed. Headline CPI declined to 4.9% in April, but core inflation remained stubborn at 5.5%. Coming as the Fed kicks off its two-day meeting, the data will be pored over for what it means for policymakers. The Cleveland Fed’s nowcast of inflation points to month-on-month inflation of 0.19% and core inflation of 0.45%, which would result in annualised inflation rate of 4.1% and 5.3% respectively. BofA says pause: “The Fed is much less likely to surprise the markets than most other central banks. Absent new messaging from the Fed — perhaps in the form of a ‘sources story’ in the business press — a hike is unlikely, in our view.”

Overnight Ueda told Japanese parliament that "there is various uncertainty surrounding the inflation outlook. What's important is corporate price-setting behaviour, which is somewhat overshooting expectations". Question is - has the BoJ missed the window to normalise policy? Q1 growth was really strong and consumption is good but if the lagged effects of ECB and Fed hikes hits exports and creates headwinds in H2 and H1 '24, inflation + growth may cool and the BoJ could be left holding on without ever normalising policy...? PM Kishida wants trim Covid-era spending and boost wages- this is key. BoJ is unlikely to move on yield curve control next week and maintain econonomic forecasts, but it could signal inflation is a little above where it would like. It’s been trying desperately to get inflation for years and now it has it the BoJ doesn’t know what to do.

Officials have been sounding more hawkish as inflation has continued to rise above expectations. Lagarde warned that it’s too early to call a peak in core inflation. Rate hikes at this meeting and July seem assured. There is a definite sense that the ECB now maintains a bias towards higher interest rates rather than looking to pause. At its last meeting in May, the ECB hiked rates by 25bps and signalled more to come, though no formal guidance was provided on what is next. “The inflation outlook continues to be too high for too long,” the statement said. The ECB also said it would likely stop reinvestments under the Asset Purchase Program (APP) in July, which was seen a bit more hawkish than the low-ball hike. June and July seem set for hikes – less clear beyond that as the ECB is worried about slowing growth and lag effects from the hikes already in the system.

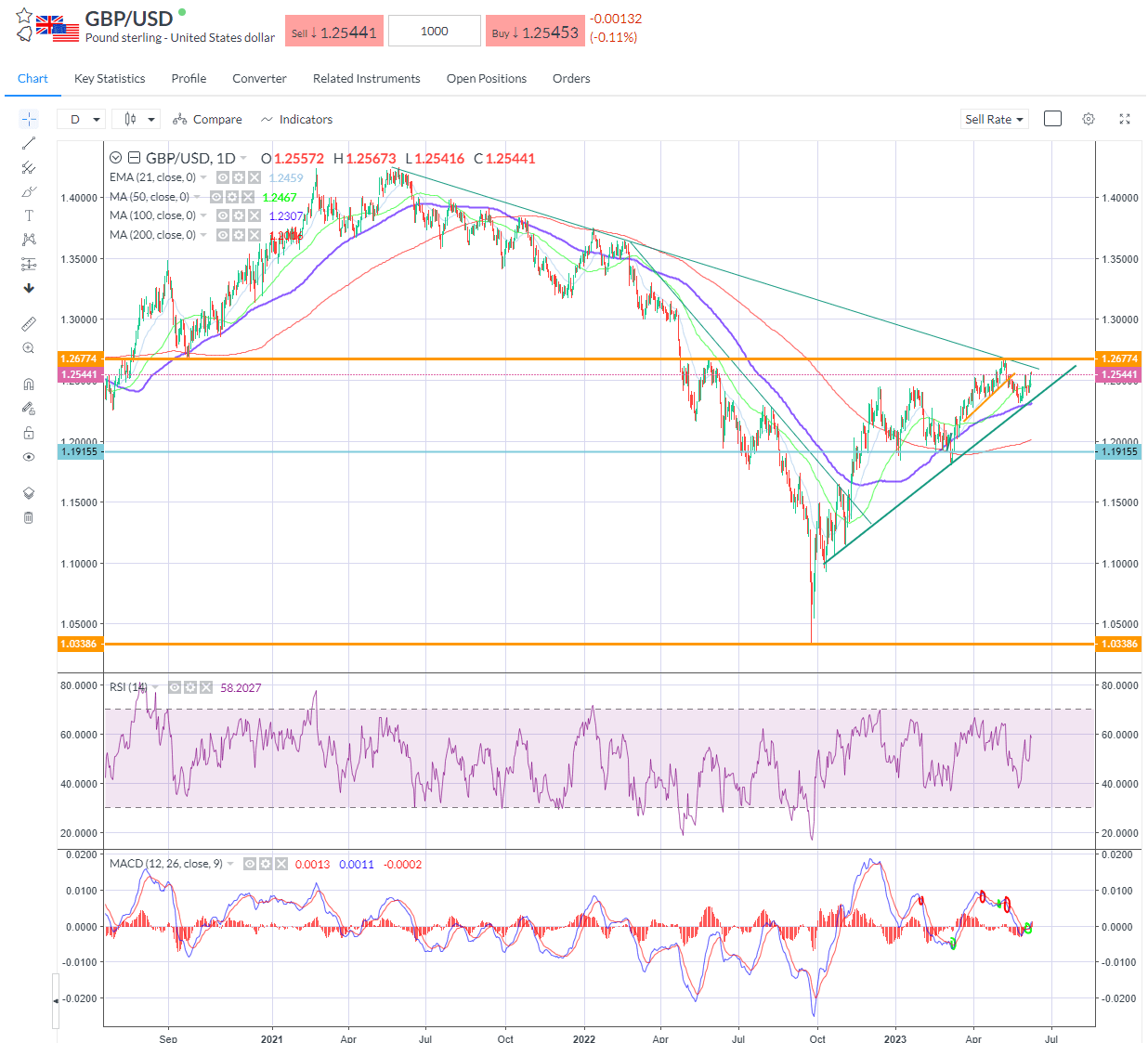

GBPUSD – big test coming at 1.26?