星期一 Sep 4 2023 10:28

7 最小

Stocks rose across European indices on Monday morning with some unclenching going on in the wake of the US jobs report Friday and China’s efforts to stimulate the property market boosted sentiment across Asia overnight. There was a relief rally for some Chinese shares, including a big pop for the embattled developer Country Garden as it was given permission to extend a maturing bond to avoid a default. The FTSE 100 advanced half a percent to clear 7,500 and the made similar gains to move above 15,900 once more. US stocks finished Friday mainly higher and notched their best week since June. Wall St will be shut today for the Labor Day holiday.

Friday’s labour market report from the US was painted as some kind of perfect setup for the Fed: slowing jobs and growth, higher unemployment creating looser conditions with the market as new workers raised the participation rate...but the market reaction was I believe a tad more confused. Yields initially tumbled before kicking up higher again...the 10yr rising to its highest in a week, whilst the 2yr was a little more subdued so the inversion between the 2yr and 10yr Treasuries narrowed – the re-steepening tell before a recession.

What else was there to consider? Firstly, the revisions were quite big – about 110k fewer jobs the previous two months. And the 7-8 months of downward revisions we have seen is kind of what happens when the market is kind of maxed out. The good news for the Fed and is there are lots more workers and the economy couldn’t absorb them quick enough – lots looser, can suppress wages + inflation impulse. Indeed, the labour force increased by 736k, but the economy could only absorb a net 77k, suppressing wage growth - this is the key. Can these find jobs and keep the economy moving along nicely whilst simultaneously pushing down inflation and wages...? That would be the ultimate win for the Fed. The market now sees the Fed already at the peak in rates, and has brought forward cut expectations to May from June. The question is about the pace of change – is this where we are at now in terms of jobs or is this just a snapshot capturing the pendulum swinging violently in the other direction (from extreme tightness to a cyclical cratering in jobs)? The other data set on Friday saw the ISM manufacturing PMI contracting for 10th straight month, whilst the Prices Index registered 48.4 percent, up 5.8 percentage points compared to the July figure of 42.6 percent.

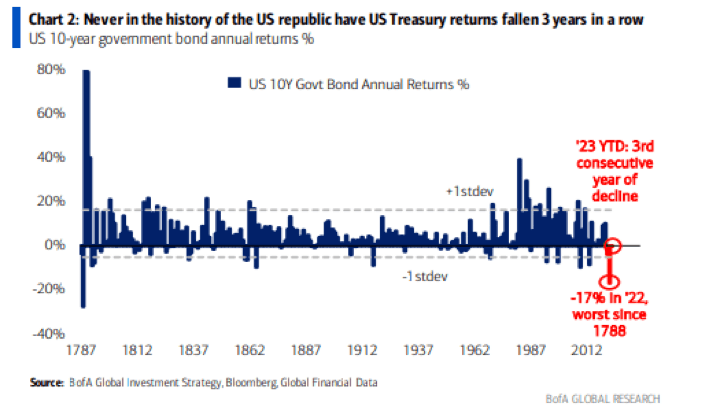

Few more things to consider as we head into the autumn and the Labor Day holiday in the US gives us pause for a moment. Seasonality – September often weak, as has been well described, and volatility which has been incredibly low is due a return. 4.34% on 10yr is the big number to watch and we have all the big 4 central banks in action this month and a decent heap of uncertainty around them all in some ways or another. For the Fed a pause is almost baked in (7% chance of a hike), but the key will be the dots – do policymakers think they need to do another 25bps later in the year, or is the top indeed in? For the ECB and Bank of England it’s a much closer call on a hike or not. Another thing we have seen is that the impact of yields on stocks is more about the speed of moves than where they are at – we have seen a huge repricing in rates this year and stocks are kind of saying ‘it’s ok we can handle rates here’. The S&P 500 has practically retraced 78.6% of the rout from the Dec 2021 highs to the Oct ‘22 low…what kind of pace of change can we see in bonds from here?

Tomorrow: the Reserve Bank of Australia paused for a second consecutive month in August and may well choose to stand pat again this week. Australia’s inflation rate eased to 4.9% in July, down from 5.4% in June to its lowest level in 17 months. Although this is still too high, the RBA is likely to choose to wait and see if it comes down further before committing to what would likely be a final 25bps to 4.35% some time later in the year. Also look out for China’s Caixin services PMI.

Signs of a slowdown in Canada’s economy are likely to ensure the country’s central bank stays on the sidelines at its September meeting, which takes place on Wednesday. The economy contracted by 0.2% in the second quarter. The Bank of Canada paused rate hikes in March and April, resuming with two further 25bps hikes through to July as inflation remained too high. Having raised rates to 5%, it’s now likely the BoC will stay on hold until it gets more data on the economy and prices, leaving the door open to further hikes if necessary. Look out for the ISM services PMI and Fed Beige Book for more colour on the US economy.

Is the inflation genie slowly going back in the lamp? China slipped into outright deflation in July and is likely to see report a similar story for August on Thursday. China saw a 0.3% decline in consumer prices in July from a year ago, and a 4.4% year-on-year drop in producer prices. Whilst the CPI points to waning domestic demand amid a property crisis, the PPI figure is considered an important leading indicator for global consumer prices. US weekly unemployment claims data is due later in the session and will be closely watched.

More from China on Friday in the shape of data on new loans issued to consumers and businesses and M2 money supply figures, revealing whether moves to ease policy and stimulate growth are working. In a similar fashion, traders will watch the US consumer credit figures late in the day. Between these we have Canadian employment data and final German CPI inflation.

Good chart here from BofA showing what’s happened to bonds since covid.

DXY – top or a bull flag?

EURUSD – bears retake control

Gold – sharp rally on Friday initially after the jobs report reversed at the 100-day line as yields and the dollar reversed higher; back to the $1,942 resistance.

Oil (spot WTI) – steady above $85 with traders expecting OPEC+ to extend supply cuts. Better activity in China’s factories also a factor.