星期三 Jul 19 2023 09:27

5 最小

Annual CPI inflation declined to 7.9% in June from 8.7% in May, in what’s probably a huge relief for Threadneedle St. Core inflation was also down. It doesn’t really matter too much what the finer details are and what the actual number is as far as markets are concerned, it’s all about the direction; and it’s going the right way. Gilt yields fell sharply with the 2yr back to a one-month low at 4.833%, dropping ~25bps on the session for its biggest drop since March, having traded near 5.50% two weeks ago. It cements the market’s disinflation narrative, and this is good for risk, albeit sterling is being offered on the news a touch, though bigger picture ought to be lower inflation = stronger economy = stronger pound.

Firstly the rate of inflation is still WAY TOO HIGH and is not about to come down to 2% any time soon. I note that pay was up 7.3%…wage price spiral realm means sticky core only down to 6.9% from the 31-year high of 7.1% in May. Services inflation was also stubbornly above 7%...way too early to declare victory, but perhaps it’s the end of the beginning? Tentative reasons for optimism and remember markets always overreact on the way up and on the way down. Terminal rate was always going to be lower than what the market had a couple of weeks ago.

Housebuilders are extending gains on the news with Barratt and Redrow +6% with the sector trading at a one-month high as yields come back down and the market reprices more sensibly for how high the Bank of England goes with rates. Persimmon added more than 7% - sector was too oversold as market was too bearish on high the BoE would need to go. Anything with any rate sensitivity is in play today – utilities +2%, real estate +7%.

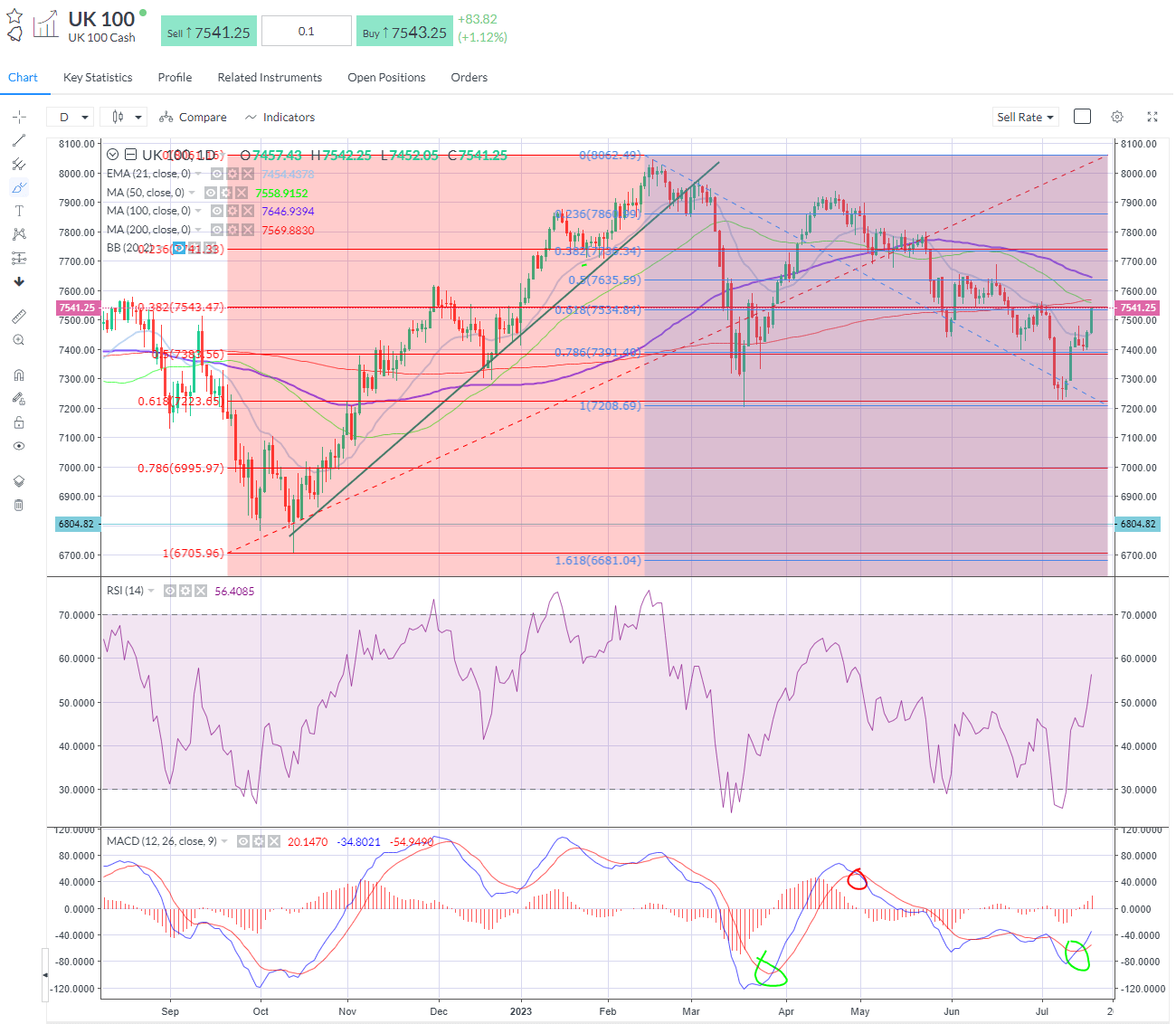

European stock indices traded broadly higher on Tuesday and are extending gains early on Wednesday, with the FTSE 100 up close to one percent on lower yields and a softer sterling in the wake of the inflation numbers to north of 7,500 to test the big double 38.2/61.8% Fib level around 7,535/43. And to put in context – the FTSE 100 is up 1.3% vs a 0.25% gain for the DAX…way more positivity around London this morning with a real sense that the peak is in. The mood for the domestic economy is much more positive with the FTSE 250 – really cyclical and sensitive to the inflation/rate dynamic – up 3% for its best day in six months.

FTSE 100 testing important Fib levels this morning

Wall Street made fresh gains led by big tech as Nvidia and Microsoft rallied 2.2% and 4% respectively. The S&P 500 gained 0.7% to 4,554 and the Nasdaq 100 rallied a further 0.8% to 15,841, whilst the Dow rose again with financials leading the charge to notch its best run since March 2021. Banking shares rallied strongly on earnings beats and upbeat guidance from the likes of Morgan Stanley (+6.5%) and Bank of America (+4.4%). Today we have updates from Netflix and Tesla.

Updates – ASML beat on revenues, Microsoft rallied to a record high after launching a $30 AI plugin for Office – added something $150bn in market cap in a single session, just to underline how huge the big boys are becoming. TSLA – consensus is for revenues +45% and income +33% to $2.9bn. Watch for impact of price cuts on margins.

In FX, USDJPY is trading firmer above 139 after 138 held after BoJ’s Ueda says long way off hitting sustainable 2% inflation. DXY futures seem to have made a tentative bottom at the 99 handle and trade a little firmer this morning

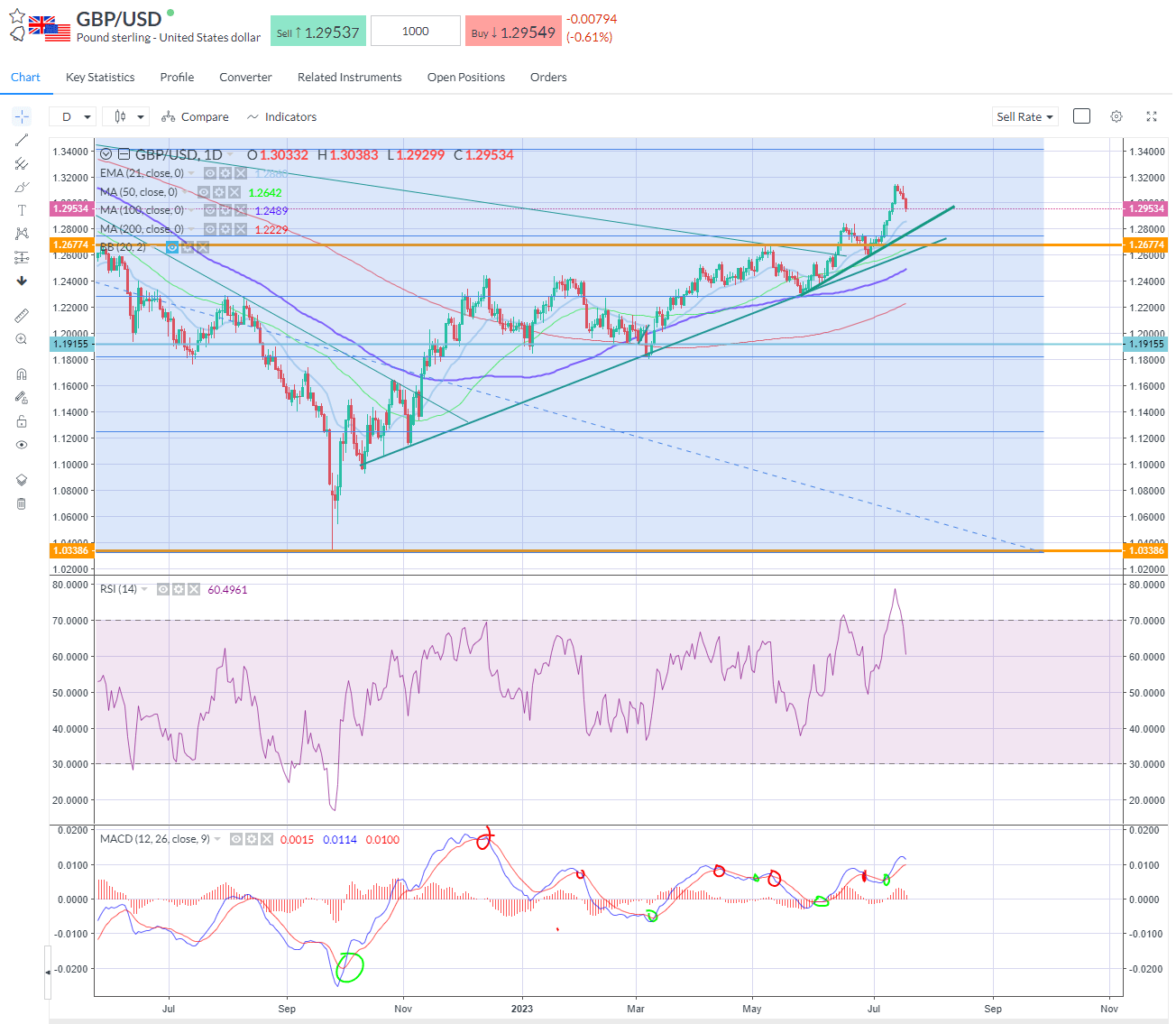

Sterling – back under 1.30 on the inflation report – another bull flag, or have the bulls had their chips? Multi-year range springs to mind.

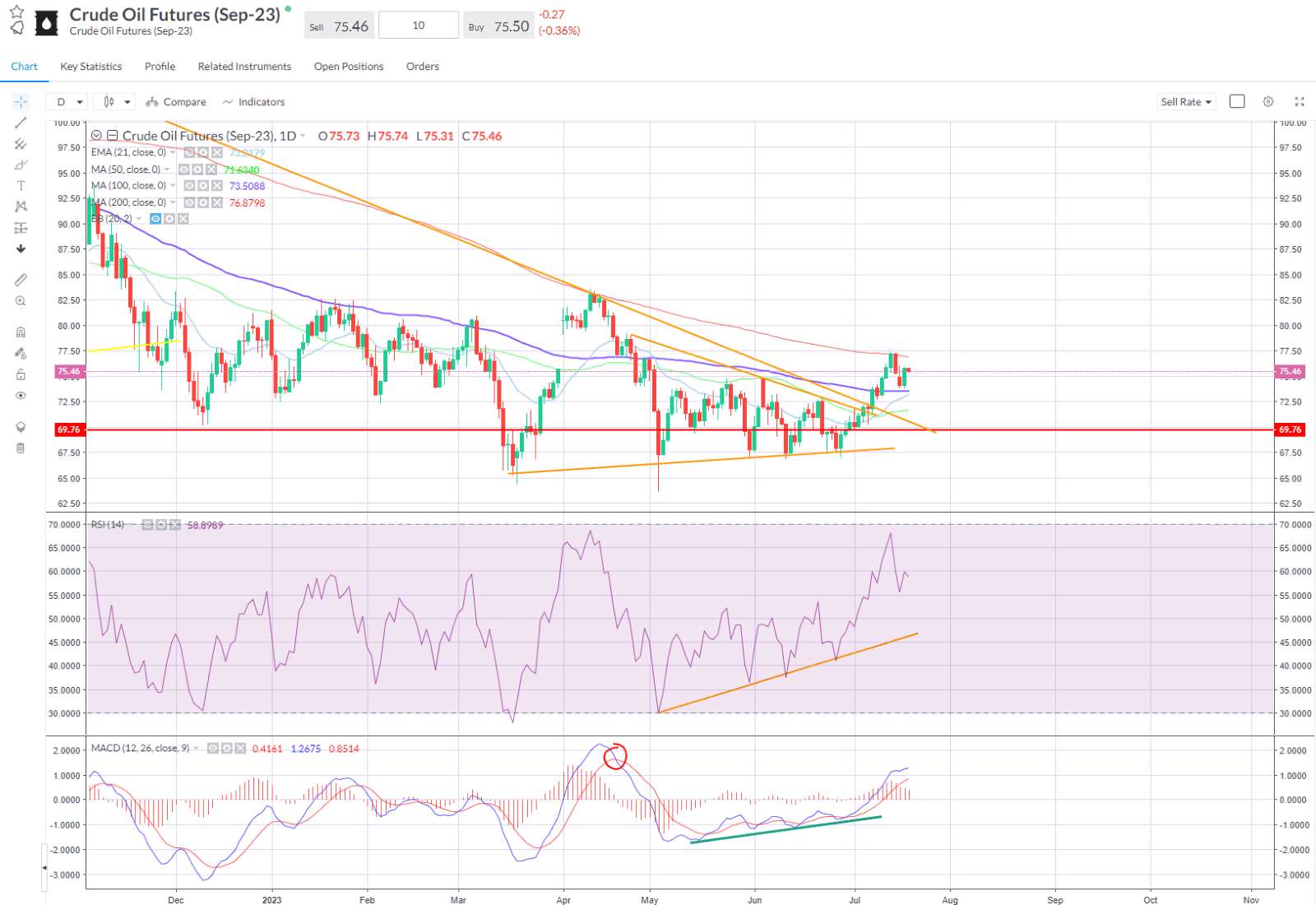

Crude oil – showing some liveliness around the 100-day line, tad lower this morning after decent pump on Tuesday as data pointed to softer Russian exports.