星期三 Feb 19 2025 03:25

5 最小

The Reserve Bank of Australia lowered cash rates by 25 basis points to 4.1%. This is the first cash rate cut since November 2020, when the pandemic led to a record low of 0.1%. This is the RBA's first cut in more than four years, yet it coincides with the rate-cutting trend started by other major central banks last year.

The Board acknowledged the progress made in reducing inflation but maintained a cautious stance on the potential for further policy easing. Australia's cooldown in inflation, at 2.4% for the last quarter, is comfortably within the RBA's target of 2-3%. While easing inflation supports one of the RBA's objectives, strong labour market conditions and persistent wage inflation reduce the urgency for the central bank to take aggressive action.

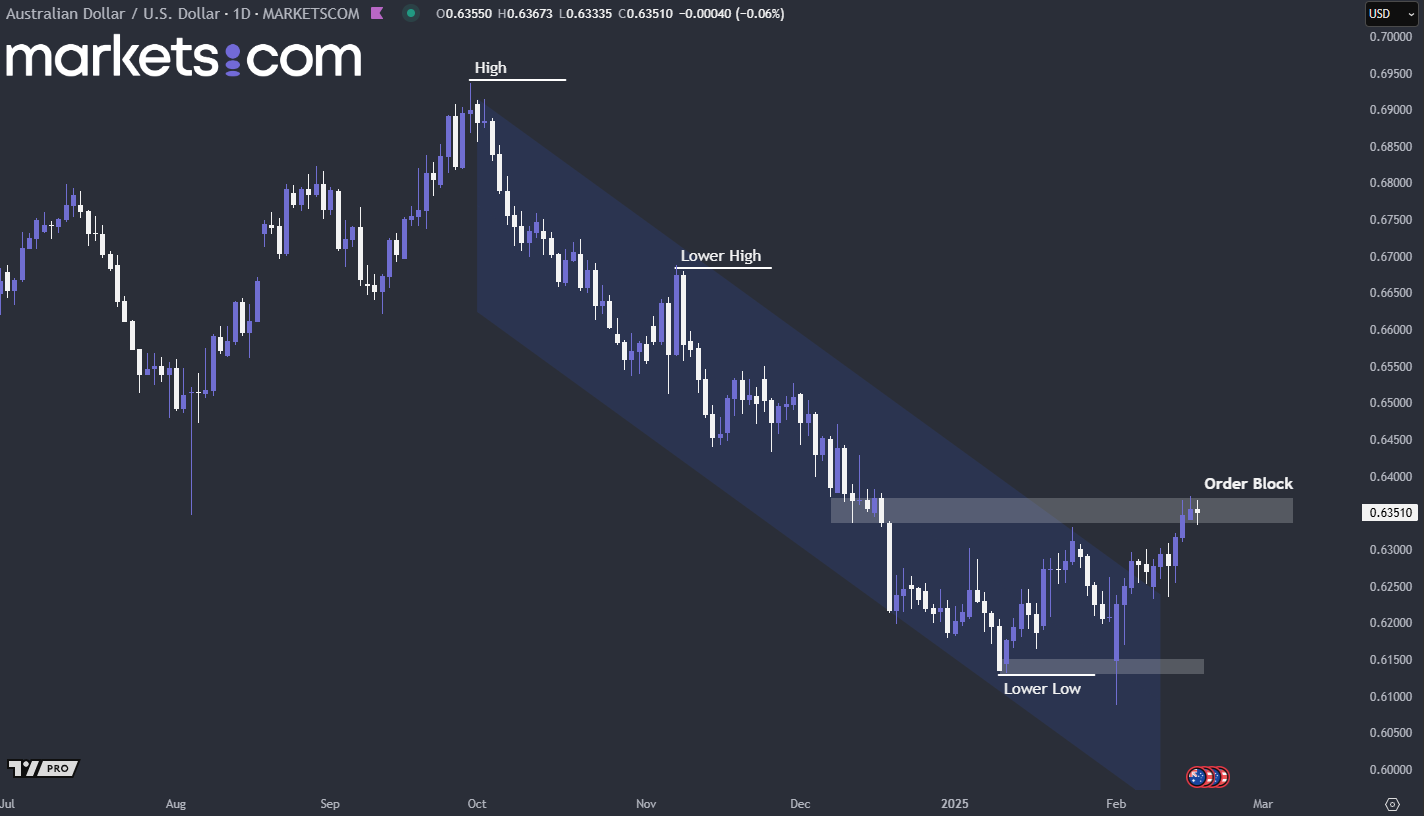

(AUD/USD Daily Chart, Source: Trading View)

From a technical analysis perspective, the overall trend of the AUD/USD currency pair has remained bearish since the end of September, as indicated by the lower highs and lower lows. The price formed a double-bottom candlestick pattern with a significant liquidity sweep in January, suggesting that bullish forces have regained control, pushing the price upwards. Currently, the price is retesting a key order block. If the price manages to break above this order block, bullish momentum could dominate, driving the price higher.

As of December 2024, Canada's Consumer Price Index (CPI) has seen a decline of 0.4% month-over-month, following a flat reading in November. This decrease was largely attributed to temporarily suspending the Goods and Services Tax (GST) and Harmonised Sales Tax (HST) on certain goods and services, which began on December 14, 2024. Nearly 10% of the CPI basket was impacted by this tax exemption, including sharp price decreases for goods such as restaurant meals, alcoholic drinks, toys, and children's clothing.

Looking ahead, Canada's inflation is expected to increase 0.1% month-over-month in January, mainly driven by seasonal price adjustments post-holiday and persistent housing and rental cost pressures. However, weak consumer demand and a slowing economy may limit the increase, keeping the rise modest.

(USD/CAD Daily Chart, Source: Trading View)

From a technical analysis perspective, the price action has recently broken below the oscillation zone, with significant bearish momentum pushing the price downwards. It is now moving between the oscillation zone and the support zone below. If the price fails to close within the oscillation zone in the near term, the bearish momentum may dominate, pushing the price downward to retest the support zone below.

On Monday, Bank of England Governor Andrew Bailey stated that inflation was slowing, and the anticipated increase in price growth later in the year was unlikely to create long-term inflationary pressures in the economy. However, the central bank also projected that inflation could reach 3.7% later in the year, which is almost double its 2% target, leading policymakers to emphasize a careful approach when discussing the expected gradual reduction in borrowing costs.

He said disinflation continues to be gradual as the effects of past economic developments continue to fade. He explained that the addition of caution to the central bank’s messaging reflected the presence of risks on both sides. He also reiterated that U.S. trade tariffs could either increase or decrease inflation in the UK, depending on their broader impact on the global economy.

(GBP/USD Daily Chart, Source: Trading View)

From a technical analysis perspective, the recent price action has broken above the swap zone, indicating that bullish momentum has temporarily regained control. It is highly possible that it will retest the swap zone. If it finds support at the swap zone, then it is likely for the price to continue surging upwards, potentially reaching the resistance zone. Conversely, this could just be a fake breakout, with the price dropping down again.

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.