星期五 Feb 14 2025 02:01

5 最小

In December 2024, Switzerland’s Consumer Price Index (CPI) declined by 0.1% month-over-month, marking the third consecutive monthly decrease. This decline was driven by lower prices in sectors such as international package holidays, medicines, and certain vegetables.

For the upcoming data release, the CPI is expected to remain at -0.1% m/m, reflecting subdued consumer demand, ongoing price corrections in key sectors, and the dampening effect of a strong Swiss franc on imported goods. Additionally, the Swiss National Bank’s (SNB) accommodative monetary policy, including recent interest rate cuts, has yet to generate significant upward inflationary pressures.

(USD/CHF Daily Chart, Source: Trading View)

From a technical analysis perspective, the overall trend of the USD/CHF currency pair remains bullish, characterised by higher highs and higher lows within an ascending channel. Recently, the pair was rejected from the resistance zone, triggering bearish momentum and pushing the price downward. It is essential to monitor whether the price action breaks through the resistance or support zone first, as the trend might be highly possible to follow the direction of the breakout.

In November 2024, the UK's Gross Domestic Product (GDP) experienced a modest month-on-month growth of 0.1%, following a 0.1% contraction in October. This slight uptick was primarily driven by the services sector, which also grew by 0.1% during the same period. However, the production sector saw a decline of 0.4%, while construction output increased by 0.4%.

Looking ahead, the Bank of England projects a 0.1% GDP growth for the first quarter of 2025, a downward revision from earlier estimates of 0.4%. This tempered outlook reflects ongoing economic challenges, including subdued business activity and persistent inflationary pressures. In response, the Bank has implemented interest rate cuts to 4.5% to stimulate economic activity.

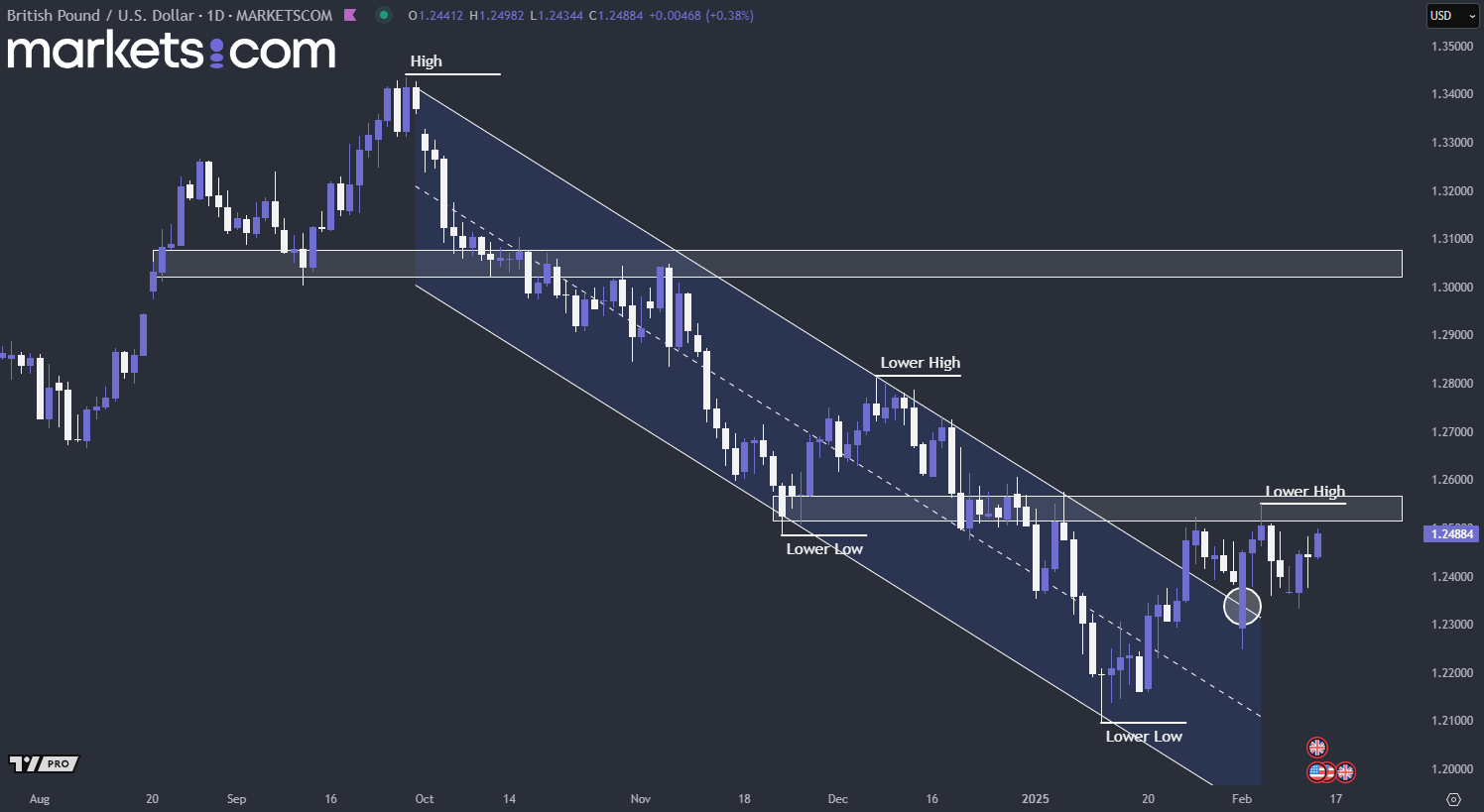

(GBP/USD Daily Chart, Source: Trading View)

From a technical analysis perspective, the overall trend of the GBP/USD currency pair has remained bearish since late September, characterised by lower highs and lower lows. However, the price action recently broke above the descending channel, retested it, found support, and began surging upward. If the price manages to break above the resistance zone, bullish momentum might take control, pushing the price higher.

The PPI moved upward with an increase of 0.3% in December 2024, a drop from November's 0.4% growth. This was mostly due to a 3.5% rise in energy prices, particularly the price of gasoline, which gained about 9.7%. Meanwhile, the prices for final demand services remained unchanged.

Looking ahead, the PPI for January 2025 is expected to increase by 0.3% m/m. This forecast is consistent with the view that moderate inflation pressures would continue due to factors such as varying energy prices and potential changes in supply-chain dynamics. However, uncertainties remain with the global economy, and domestic policy changes could potentially influence producer prices in the near term.

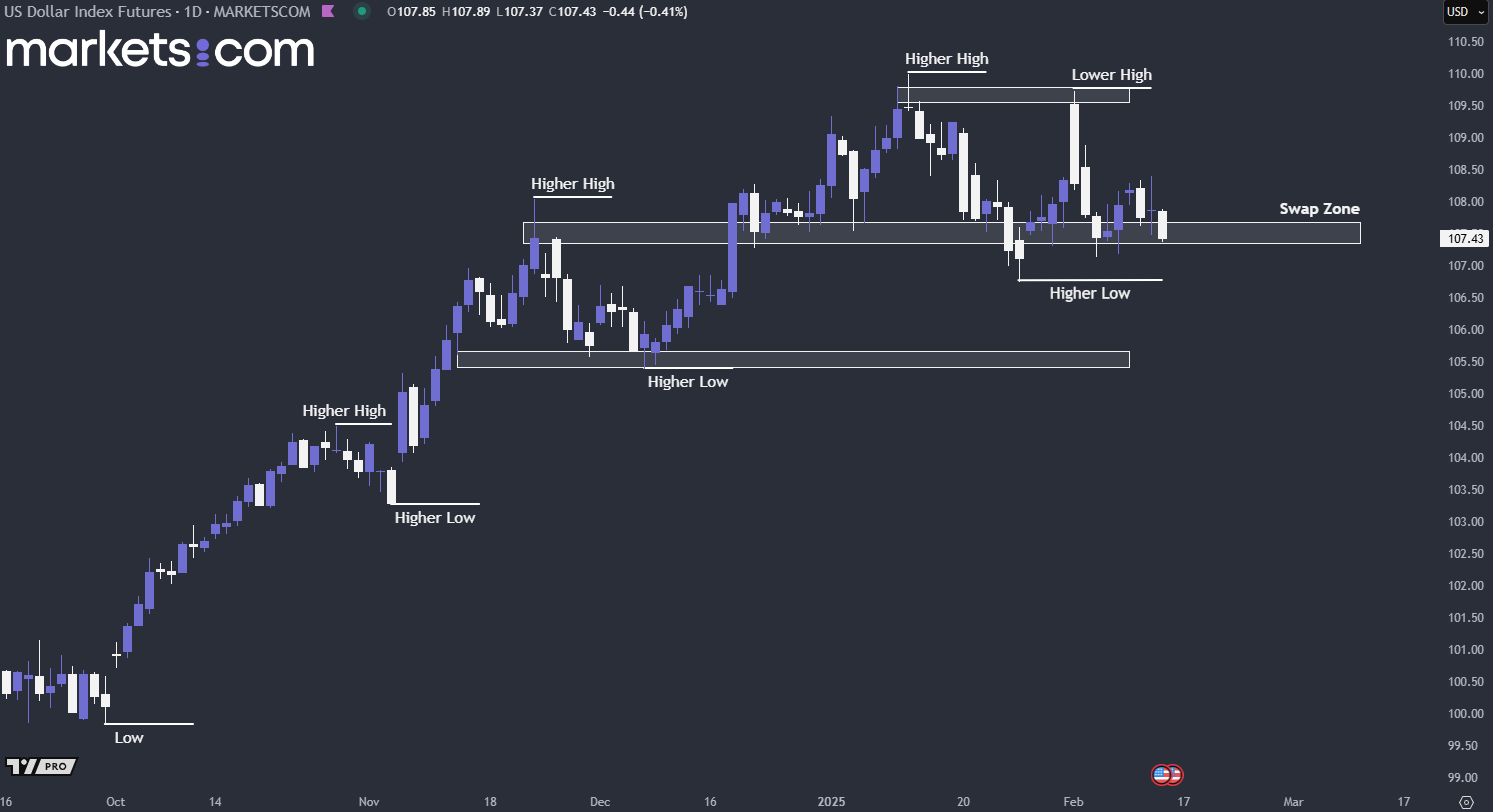

(U.S. Dollar Index Daily Chart, Source: Trading View)

From a technical analysis perspective, the overall trend of the U.S. dollar remains bullish, as indicated by the higher highs and higher lows. The price is currently moving within the swap zone. If the price fails to close above the swap zone, it is highly possible that bearish forces might take control, pushing the price downward.

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.